[ad_1]

[ad_1]

Latest news from Ripple

The just concluded Impact Fintech 2018 it was still another platform for Ripple officials to reiterate their company's mission statement-vision: to provide simple, economic and effective transnational settlement solutions. To accomplish this goal, the company has implemented xVia, xRapid and xCurrent. The latter received an update but against expectations, the uptake was slow with a handful of banks updating but failing to adopt xRapid, the solution that leverages XRP as an on-demand liquidity tool. By incorporating XRP into their transactions, banks can free up funds that could otherwise be used to provide liquidity.

To read: Winklevoss Twins Unfazed In the middle of Crypto Winter, launches Gemini Mobile

During the conference, Ross D & # 39; Arcy, director of sales at Ripple, said the company is actively using its options to solve real user cases and is not in a Proof of Concept (POC) phase or in experiments. scientific. He went ahead and said that centralized banks are not trustworthy institutions because they are opaque in their operations and full of restrictions that must be met before a transaction is settled.

On the other hand, Ripple funds can be sent instantly without the need to hold the target fiat currency. With each bank connecting to the network, Ripple's business model is reached and their goal of creating this valuable Internet is slowly becoming a reality.

XRP / USD price analysis

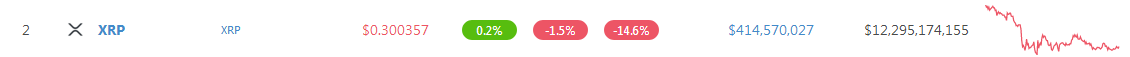

With every implementation and partnership, Ripple's fundamentals look positive. However, we need more banks to use xRapid in their operations. This will undoubtedly help raise prices from current levels. The XRP is down 1.5 percent at the time of printing, but stable in shorter periods of time. While bears have control, sellers still have to press down and reverse the 2018 earnings, and this is bullish.

Trend: bearish, remote

Aside from the series of higher trend highs that define September, XRP / USD has recorded a lower trend in the last two months. This has caused the XRP to drop by 90% compared to the Sep highs and the last two weeks, there is the risk of further falls, if prices can not expand beyond 40 cents – our previous resistance line support .

Volumes: bullish

It is not possible to make comparisons between the volumes of the last weeks and those of September. There is a great disparity in the sense that market activity becomes thinner while investors, traders and participants feel the sting. Nevertheless, in the last few days there was a tenth, 2300HRs bull bar-23 million against an average of 9 million. Note that the price action of the last three days is still within its high minimum. Its 4-cent trade range must define our triggering factors and since we are on the upside, we expect earnings above 33 cents. This will turn on buyers who point at 40 cents and more by the end of the year.

Candlestick training: Bear Breakout, Re-test phase

The losses on December 6 indicate that the XRP / USD is traded within a bear breakout model. For the bulls to reign, there must be earnings above 33 cents. Otherwise, the refusal of higher highs of over 33 cents – our minor settlement line, could see prices collapse in a retesting phase below 29 cents. This in turn could trigger another wave of sales that bring XRP prices to 25 cents or less.

Conclusion

Too much, we keep a bullish overview because the bears still have to reverse the Sep peaks. Therefore, our XRP / USD price analysis will be as follows:

Buy: 33 cents

Stop: 31 cents

First goal: 40 cents

All graphics courtesy of Trading View.

This is not an investment tip. You have the research.