[ad_1]

[ad_1]

Ripple's XRP continues to expand as a cryptocurrency for all types of users, demonstrating that it can be beneficial for players beyond traditional customers within the financial system. In a strategic decision, Travala, one of the leading hotel reservation platforms in the cryptographic ecosystem, has added official support for XRP as a payment option.

The platform, known to many as crypto's Expedia or Airbnb, has recently expanded its catalog of offers to more than 550,000 properties available for booking in over 210 cities worldwide:

Travala will add 400,000 properties in December

This will be the first of a series of posts that will deepen the features and updates of the new version. #travel #hotels #blockchain $ neo $ AVAhttps://t.co/afi1YsORkW

– Travala.com ✈️ 🏨 (@travalacom) November 26, 2018

Travala: using Crypto to create a successful business

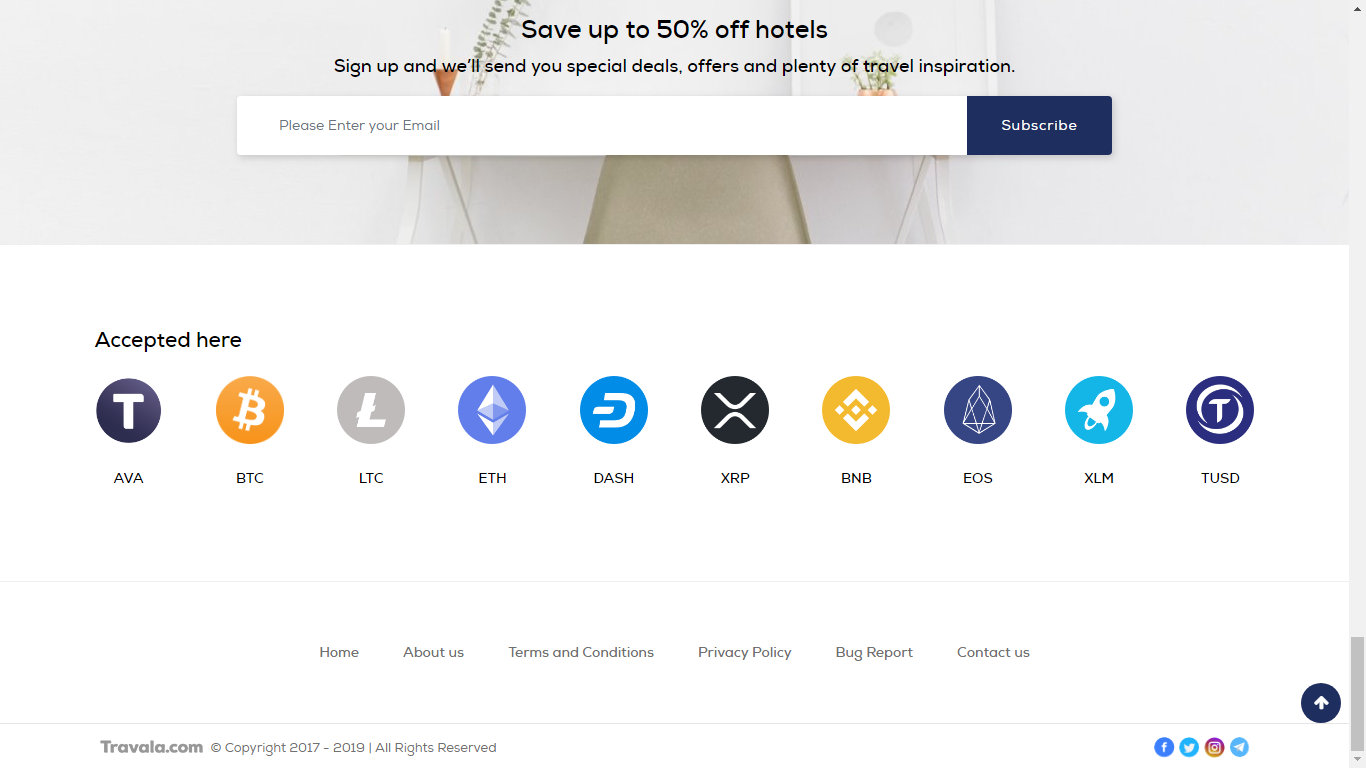

With this announcement, XRP becomes the last cryptocurrency to be listed by the platform, combining other options such as BTC, LTC, ETH, DASH, BNB, EOS, ELM, TUSD and Travala's native AVA token, which has had a streak bullish during the last week, rising from 1743 to more than 3800 sats in the last 30 days, according to data from coinmarketcap.com

The cryptographic platform marketplace came into operation in July, thanks to the blockchain NEO platform. So far no details have been provided on the number of financial transactions carried out on each token.

Furthermore, it is important to note that the AVA token of Travala, was quoted by KuCoin on December 11 with BTC and ETH and couples. The Travala team explains that AVA increases the transparency of this platform:

As a new generation online travel agency (NOTE), it changes radically the relationship between the consumer of the future and his travel purchases.

So far, the Ripple team has not provided any significant statements in this regard, however, given the effort and expansive vision of its team of developers, it is understandable that the popular blockchain is used daily.

XRP is currently in an area of relative stability, successfully testing the strong support around 888 Satoshis. According to the coinmarketcap data, the RSI could be interesting for potential new buyers; however, the 4-hour MACD does not yet show signs of a reversal of the bearish trend of the last days.

Why did ripple succeed in such bearish times?

In a recent interview for the Tech PCMag portal, Asheesh Birla, Ripple's Senior Vice President of Product Management, talked about his perspectives on the current situation of cryptomarkets and why the price of a token is not as important as many think .

For Mr. Birla, this is just one of many phases and the bear market will be healthy for the ecosystem because it will help to get rid of useless projects:

This is my third accident now in the crypto-market, and I do not have the chance. The downside is that sometimes you happen to crash and eliminate all those who are not focused on solving real problems and real use cases. And I think you'll see some really interesting companies coming out of this next recession.

Birla believes that one of the reasons for the success of Ripple and the rise of XRP as the most important altcoin is the team's pragmatism. Ripple believes that an anti-fiat approach does not work right now:

We have decided to work with financial institutions and I think it has paid off, but we must also think about all the financial requirements and regulations. In 2013, there was the maximum Bitcoin of "we do not need any of this, we no longer need government, banks or companies, only Bitcoin". This approach does not work. Working with financial institutions and regulatory authorities is a longer way, but it's the right one.

[ad_2]Source link