[ad_1]

[ad_1]

Latest news from Ripple

Without a doubt, there is a renewed optimism. From critical commentators who call for funds to the planned development goals, the lights are definitely bright for cryptographic resources. Remember, it was only last year when the XRP-ETH reversal was performed.

To read: Late Ethereum Constantinople, ETH down 5%

Due to the narrow margins, the XRP market capitalization to $ 13.293 million versus ETH to $ 12.502 million, a possible flip is on the cards. The gap is about $ 700 million and an expansion of 10% of the first is sufficient to make changes in the ranking.

In other news, it is becoming increasingly clear that Ripple's goal is reachable. At the beginning it seemed impossible, but processors and banks like Exim are seeing the benefits of joining this SWIFT alternative that is fast, secure and transparent.

Read also: Bittrex has launched an over-the-counter (OTC) cryptocurrency trading desk

RippleNet remains a public ledger but the solution to the problem should be the xRapid solution, which allows instant regulation with almost no cost. More banks, more in demand. At the time of writing, 13 banks are making use of the network, compared to three at the time of the presentation of xRapid.

XRP / USD price analysis

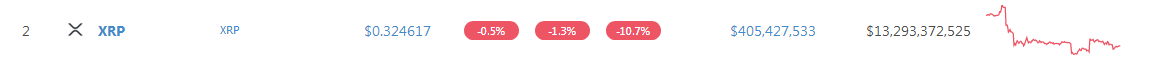

The community may be enthusiastic, but XRP still has to basically follow. At spot prices, XRP is down 1.3 percent and in line with the January 10th losses.

Nonetheless, we expect the bulls to remain and overcome. The only way it will be printed is if the drop in the sales moment leaves the bulls to join over time and reverse the losses of 10th January as a result of high volumes. Ideally, these trade volumes should exceed 83 million recorded on January 10th.

Trend and candlestick formation: bullish, accumulation

Evidently, as for the BitFinex data streams, XRP is in interval mode, moving horizontally in September 2018 at the top low. Now it's three months and as long as the sellers are trading above 25 cents or lows in 2018, the bulls have a chance. Regardless of this, even if we are optimistic, the correction is still profound in both the short and the long term.

Note that XRP prices have fallen more than 95 percent from the 2018 highs and down 78.6 percent from the December 2018 highs. The fact that prices have found support from this fundamental level of Fibonacci retracement complete a reversal model of double the bar to a few cents of 30 cents means that there is a high probability that XRP will reach around 40 cents in the short term. These projections should be highlighted as dictated by Fibonacci retracing rules.

Volumes: low, bearish

Ideally, we would like to see a surge in commercial volumes indicative of the underlying supply or demand, depending on the breakout. However, this is not the case and so far, our benchmark is 10-83 million in January versus 30 million.

If the bulls are in charge, we must see sharp reversals in prices above 38 cents and 40 cents – the Fibonacci retracement level of 61.8%. These volumes should not exceed only recent averages of 33 million, but exceed 83 million and even 123 million of those of 24 December.

All charts are provided by Trading View-BitFinex

This is not a financial / investment advice. Do your research