[ad_1]

[ad_1]

Opinion: XRP enthusiasts have been waiting for a currency bullrun as soon as it was announced that the Ripple product that used it, known as XRP, was in production. This is due to the general idea that the use of the product will result in an increase in the price of the asset, which has led to a general sense of suspense in the community.

As the end of the year approaches, it becomes clear that some theories, such as "XRP $ 589 EOY", will not come to fruition. Also in this example, an excursion to $ 589 would require an increase in the current price of 168185% in the next month. While such theories are clear not to occur, there is one thing that XRP HODLers can expect at the end of the year.

In an interview given at the beginning of the year, Brad Garlinghouse, CEO of Ripple, said that at least one of the major banks will use xRapid as a liquidity instrument by the end of this year. He has declared:

"By the end of this year, I trust the major banks will use xRapid as a liquidity instrument, this solar year, and by the end of next year, I really hope we can see them in the order of magnitude of dozens."

While an order of magnitude of dozens of banks using the network would lead to the healthy use of xRapid as a liquidity tool, this would mean more for enthusiasts and investors in the XRP platform. Given that the current market is within the bear's reach, it seems that XRP still has an ace up its sleeve to counteract the current market.

Although Garlinghouse has declared that a "bank" would use the product, at the moment there are no banks that have publicly announced that they are using xRapid. However, there are 4 customers who have subscribed xRapid, as they are all non-bank financial institutions focused on the provision of cross-border payments.

Those that have been confirmed by Ripple to use the platform are Viamericas, Cuallix, IDT and MercuryFX. Of these, according to Garlinghouse, there will be one that will use xRapid for settlements by the end of this year. In fact, all of them spoke positively about the product, with Nicolas Palacios, Cuallix CFO stating:

"With Ripple, we can provide liquidity through XRP and complete cross-border payments in seconds."

Paul Dwyer, CEO and founder of Viamericas, said:

"We believe digital assets such as XRP will play a key role in the future of cross-border payments, helping to securely address some of the structural inefficiencies of legacy settlement infrastructures".

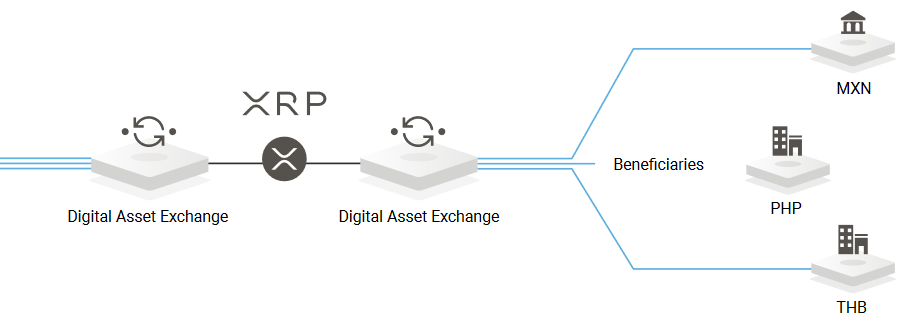

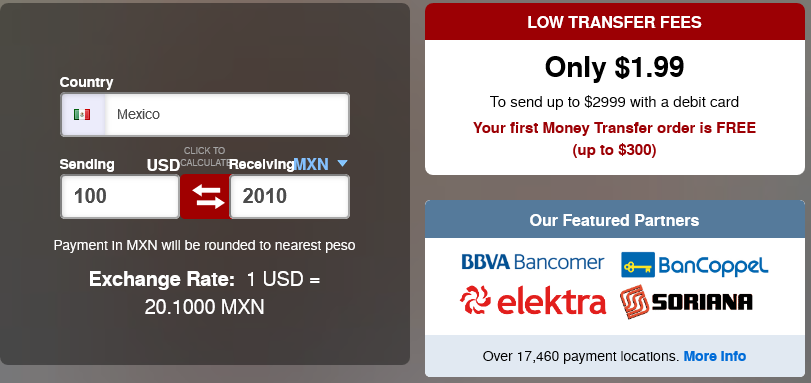

All other partners have equally appreciated Ripple's technologies, with the same Ripples claiming that their product has a 40-70% lower commission and settles in less than 10 minutes. Now, the question remains on which xRapid can be used or it seems that it is already being used. It should also be noted that there are 4 exchanges currently associated with Ripple to provide liquidity pools for xRapid, which are Bittrex for USD, Bitso for Mexican Dollars, Coins.ph for Philippine Peso and SBI Virtual Currencies for JPY.

This means that xRapid settlements can only occur through these corridors, with SBIVC also outside the framework due to a general lack of clarity regarding the exchange. This leaves the settlements between the United States, the Philippines and Mexico.

Cuallix works between the Mexico corridor for settlements, without any publicly available information on their rates and settlement times. Likewise, MercuryFX works with B2B transactions or private transactions worth over GBP 5000, which leaves us with no public information available.

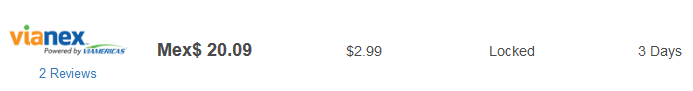

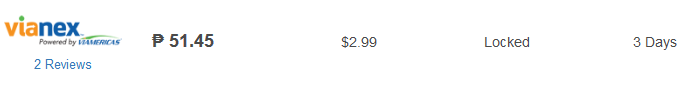

Viamericas offers a service known as Vianex that allows users to send money all over the world via the Viamericas network. It is not surprising that they support the transfer of funds between the aforementioned corridors. This leaves us with competitive prices for both corridors, with a 3-day settlement time.

This means that the company is not yet using xRapid for these agreements, but is ready to start doing so at any time because of the infrastructure established between these corridors.

The last customer for xRapid is IDT, which is a telecommunications operator. They are using xRapid for the launch of their "BOSS Revolution" product aimed at helping under-populations. As stated by them:

"IDT Telecom's flagship retail service is BOSS Revolution: BOSS Revolution helps immigrants and the under-counter to communicate cost-effectively and share resources worldwide." BOSS Revolution is a collection of communication and payment services. "

This also fits the statement made at the start of their partnership with Ripple, where Alfredo O & # 39; Hagan, Senior Vice President of IDT's Consumer Payments Division, said:

"Our international money transfer business of BOSS Revolution usually uses digital assets to generate liquidity in legal currencies for our payment agents as part of our transaction settlement process."

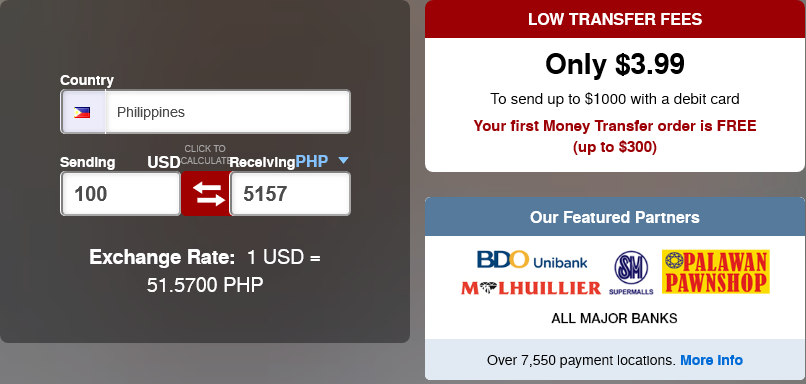

They also offer money transfer services in Mexico and the Philippines, with the latter costing $ 4 for the transfer and the former $ 2. This also indicates the disuse of xRapid within IDT, as the rates would be reduced. in case of use for liquidity.

Overall, Ripple seems to have reserved efforts this year to increase the reach of RippleNet with multiple xCurrent partners. That said, there is still time for them to announce another partner or existing partner to easily start using the product. It is left to see and is likely to reflect the price of cryptocurrency n. 2.

Subscribe to the AMBCrypto newsletter