[ad_1]

[ad_1]

Opinion: The European Central Bank [ECB] has recently announced that they will launch a system for faster payments in the Eurozone. This system is known as the Target Instant Payments System and aims to offer a settlement of instant payments in euros, with users who can access it at any time of the day and on any day of the year. At first glance, this could be the beginning of the end for the actual use of crypto-assets. However, a digital resource could benefit more from this move than many might think.

The system requires payment service providers to set aside part of the liquidity in their central bank, which will then act as a system for settling immediate payments. The system does not even promise a minimum wait during the process and the settlement of transactions 24 hours a day. All this is done with an end-to-end processing time of 10 seconds or less, with measures put in place for ensure that the system can be scaled effectively to meet the needs of users. It also provides companies with another product to sell their consumers, as instant payments are slowly becoming the new norm.

Benoît Cœuré, a member of the executive committee of the ECB, said in a speech at the beginning of this year:

"In fact, in the euro area, where different legal frameworks and customer habits prevail, there is always the risk of a new fragmentation deriving from the development of national or closed-circuit solutions that are not interoperable. To counter this risk, the European payment industry is launching a truly pan-European instant payment system. "

The launch of this platform seems that the dragon has finally defended his gold supply from the decentralized knight in shining armor, that is cryptocurrencies. With central banks effectively rejecting them as a way to conduct cross-border transactions, the technology seems to have died in the dust as the vultures choose its remains to adopt blockchain in their various initiatives.

However, this is not necessarily true, because Ripple, the FinTech company that aspires to solve the cross-border payment ecosystem, seems to have secured its place in the future of evolving payments. They achieved this goal through two main moves, with the main being their partnership with TAS Group.

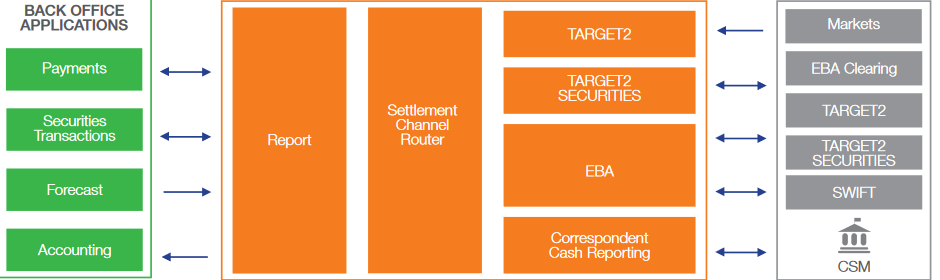

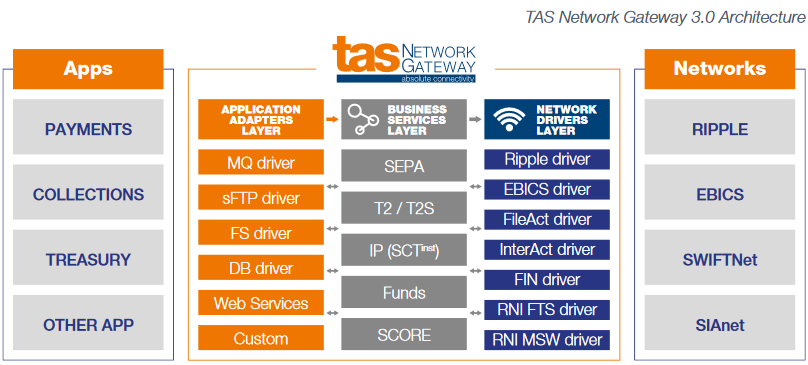

TAS Group is a company that focuses on corporate innovation in the financial sector and has released a series of software to be used with banks. They aim to provide "e-money, payment systems, capital markets and extended enterprise" solutions to payment service providers, with one of their products as the latest version of the bank's liquidity management platform. This makes it possible to forecast liquidity situations for the banks that have implemented the system.

Source: TAS group

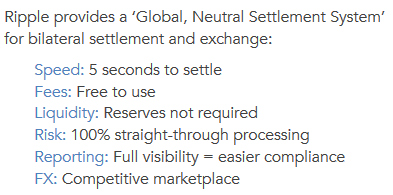

The most interesting thing is that it offers maximum interoperability with the newly announced TIPS payment standard and aims to allow a seamless transition between existing systems. TAS Group has been in partnership with Ripple for about 3 years at this point, with a document published in 2015 that illustrates in detail the benefits of Ripple compared to the real-time regulation existing in Lire [RTGS] systems.

The launch of TIPS is scheduled for the end of this month, with TAS Group ready to take control of the emerging market. Those who are up to date with Ripple developments may also know that the company promises the added interoperability between their widely adopted xCurrent product and their xRapid XRP-powered product.

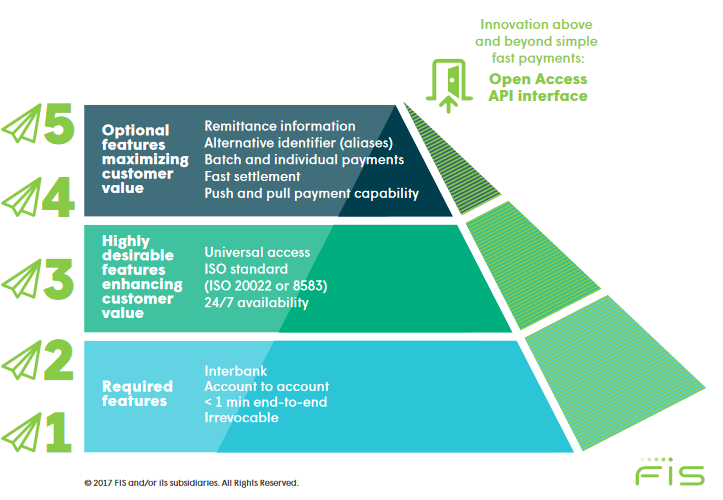

It was also a document issued by Fidelity National Information Services [FIS] which reveals the second method used by Ripple to continue to be a market leader in frictionless payments. This is done through the implementation of an open API for integration on Ripple networks, a technology that is being propagated as the future by the FIS in their relationship.

Source: FIS

As seen from their infographic, Ripple's third product, xVia, stands out many of the boxes needed to be a disruptive force even in the space of the bees. This was also touched by Benoît Cœuré in his speech, in which he stated:

"Cross-border interoperability is just one area where progress can be made. Extending access to our RTGS system to regulated non-bank payment service providers is another way that promises to make our current systems suitable for the future. "

This shows that it is very likely that systems such as Ripple's take control of cross-border payments. Short-term capital flow through Ripple networks could also lead to liquidity from xRapid partners operating in the euro area. The effect of the launch is now awaited with bated breath.

Subscribe to the AMBCrypto newsletter