[ad_1]

[ad_1]

Bitcoin was brought back into the spotlight thanks to its recent rally and renewed interest from Wall Street and the big traders of the day.

The price of bitcoin, which topped $ 12,000 per bitcoin on late Sunday evening, has added 30% in the past month, although some smaller cryptocurrencies have made much larger gains.

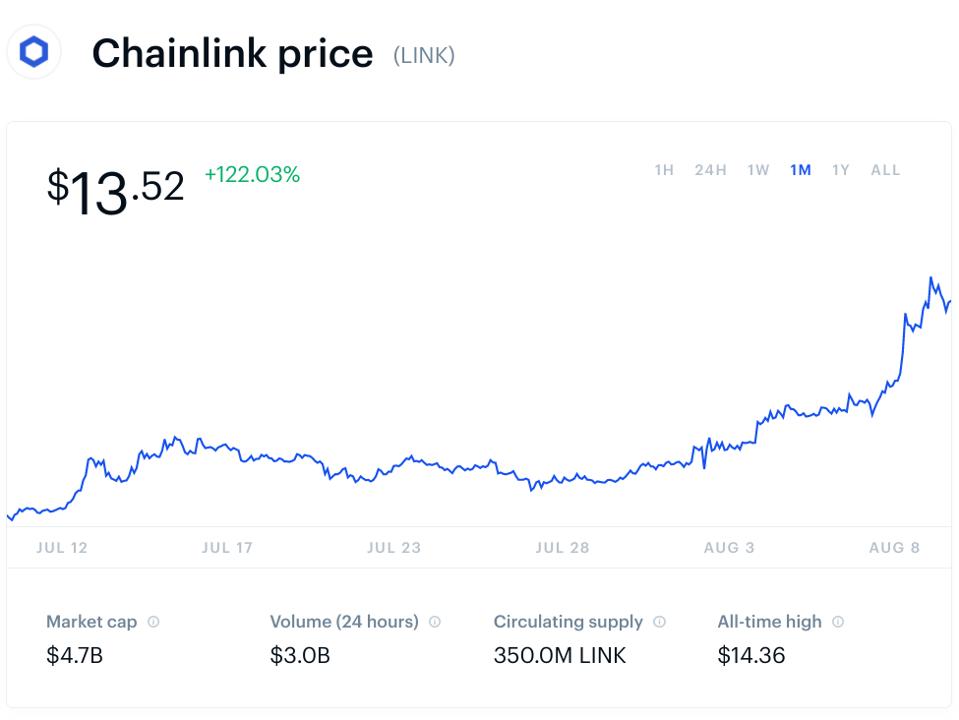

Chainlink’s link token has now added 120% to its price over the past month, climbing to over $ 13 per token and building gains of around 500% over the past year, with some investors saying the link is still “wildly underrated”.

Traders have sent Chainlink’s Link Token price sharply higher in recent months, making it paler … [+]

BLOOMBERG NEWS

“Chainlink is on track to function as [the decentralized web3’s] de facto level of security for all transactions of significant value, “Michael Anderson, co-founder of Framework Ventures, the largest private holder of link tokens outside the core team and bitcoin exchanges, said in an email and cryptocurrencies.

“We believe the value of the link will follow the value of the smart contract platform it is securing, which means that the long-term market cap of the link will eventually be greater than ethereum’s current market cap.”

Chainlink, an Ethereum-based token that powers a decentralized network designed to link smart contracts to external data sources, currently has a market capitalization of just under $ 5 billion compared to Ethereum’s $ 45 billion.

Chainlink, up 65% in the last week alone, has been spurred in recent months by an increase in interest in decentralized finance (DeFi), the idea that blockchain entrepreneurs can use bitcoin and crypto technology to recreate tools. traditional financials such as loans and insurance.

“At present, blockchains are unable to reliably talk to real-world data, which means they require some sort of blockchain abstraction layer that sits between the blockchain and the outside world,” Anderson said. , adding that Chainlink’s importance has become more evident as billions of dollars have been locked into DeFi products dependent on smart contracts. “

Since the beginning of June, the total value locked in the DeFi protocols has gone from about $ 1 billion to nearly $ 5 billion, according to DiFi Pulse data.

Meanwhile, the cryptocurrency token of a competitor of Chainlink, band, Band Protocol’s native token, has also soared in recent weeks. Band, ranked 43rd in CoinMarketCap’s Most Valuable Cryptocurrency List compared to Link’s 6th, has added nearly 5,000% since the start of its rally in early April.

Over the weekend, Chainlink’s link token trading increased, dropping bitcoin from the top spot on the largest bitcoin and cryptocurrency exchange in the United States, Coinbase, to become the most traded cryptocurrency on the popular platform over a period of 24 hours.

Link’s 24-hour trading volume on Coinbase Pro jumped to $ 163 million, about 70% higher than bitcoin’s $ 96 million trading volume, according to data from bitcoin analytics and cryptography firm Messari.

However, worldwide, 24-hour link trading volume of just over $ 3 billion is still only a fraction of bitcoin’s $ 17 billion.

Chainlink’s link token price has more than doubled in value in the past month, by far … [+]

Coinbase

Despite the huge link rally and hints that the link price could be a rising bubble about to burst, Anderson is confident that the link price will continue to rise, indicating Chainlink’s ambitions to work with “smart contracts” for any transaction that requires real-world data, events and payments “and involves so-called staking, which means that” users will be able to stake their link as collateral with Chainlink nodes, allowing them to earn a stream of income passive when said nodes complete the work by providing useful data to smart contracts “.

“A correction is possible in the short term, but even if the price of the link were to double tomorrow, we would still think it is wildly undervalued in light of the long-term view,” Anderson added.

“If they manage to achieve even a fraction of what they set out to do, the implications for businesses, banks, derivatives, insurance companies and more will be enormous.”

Link’s surge over the past week has been attributed to a massive downturn in the futures market, according to reports, leading some to warn that his rally may not hold up.

“Chainlink can be a very sizzling asset and it looks very sizzling now,” cautioned Timothy Peterson, alternative investment analyst and manager of Cane Island Alternative Advisors, via Twitter.

.[ad_2]Source link