[ad_1]

[ad_1]

Riot Blockchain (RIOT) manages the mining hardware, which is a useful service for various blockchain networks, and receives cryptocurrency in return. He can sell or hold that cryptocurrency. I took another look at this company, as I recently gained a belief that Bitcoin and the ecosystem around it could erupt and set new highs.

I am very long-term optimistic about Bitcoin and some related assets. My first article on Bitcoin’s bullish Seeking Alpha dates back to July 5, 2016, but I believed it wasn’t going anywhere for some time. Since that first I have written a total of 24 public articles on Seeking Alpha. You can find them here.

If you are a Riot Blockchain shareholder, you will be disappointed with this note. I looked at the company again and think I can find things I would rather own. After doing nothing for a long time, it is growing this year, but I just don’t think it’s justified. Other cryptocurrency-related companies are also growing, and in some of these cases, I think you’d be better off in the long run. In the short term who knows what happens.

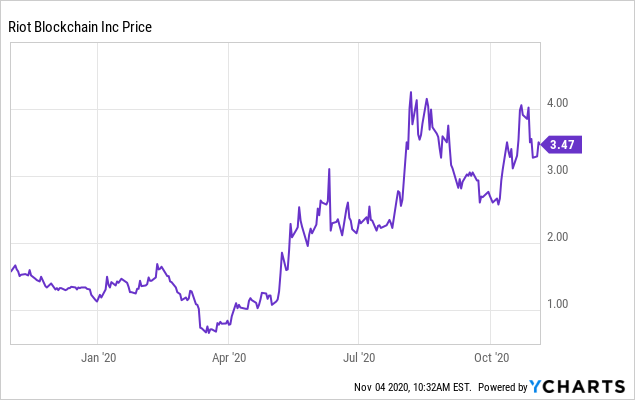

YCharts data

YCharts data

I’m certainly not going to stand in front of this train and shorten it or whatever.

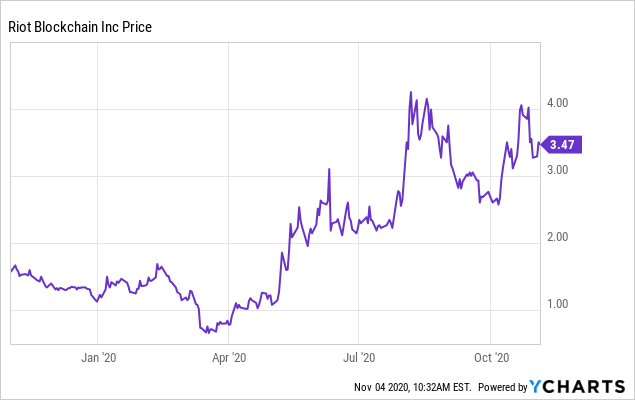

At its current price, Riot Blockchain has a market cap of $ 171 million. This means it trades at 4.6 times the book. The revenue is only $ 7 million. I understand that the company is planning to further expand capacity until 2021 with 15,000 S9 Antminer.

Gross margins are great on that revenue, but SG&A is really killing them. If Bitcoin continues to grow, I think the company could do well, but that’s true of many related investments.

This is an inefficient mining operation in the sense that it doesn’t have the size to really compete with the big ones. As the company is losing money, it recently hit the market for $ 14 million.

It has a great great structure and can do it from time to time. I want a miner to be enlarged and profitable. I don’t want to invest is then pay to get the scale. From Riot Blockchain’s recent Q-10:

As noted in Note 8, the Company has entered into a Sales Agreement with HC Wainwright & Co., LLC (“HC Wainwright”) dated May 24, 2019 (the “Sales Agreement”), pursuant to which the Company may, from time to time, sell up to $ 100.0 million of the Company’s common stock through HC Wainwright, as sales agent and / or principal of the Company, in a continuous offer to the market (“ATM Offer”) …

… The Company received proceeds from the sale of 10,181,131 ordinary shares under the sales agreement of approximately $ 14.6 million (excluding fees and expenses of $ 0.5 million) at a weighted average price of $ 1.44 during the six months ending June 30, 2020.

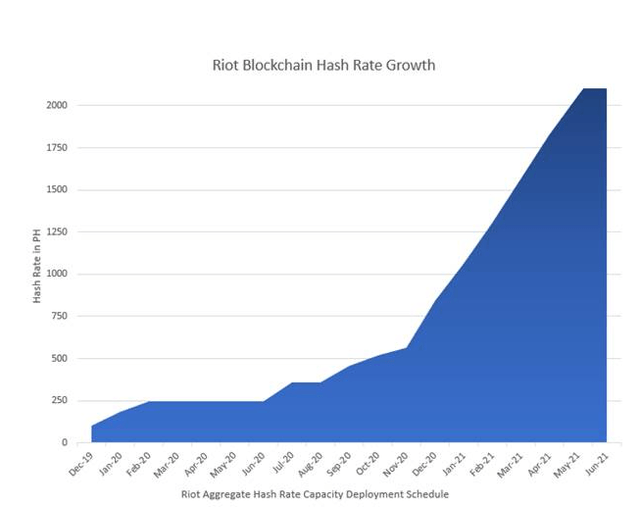

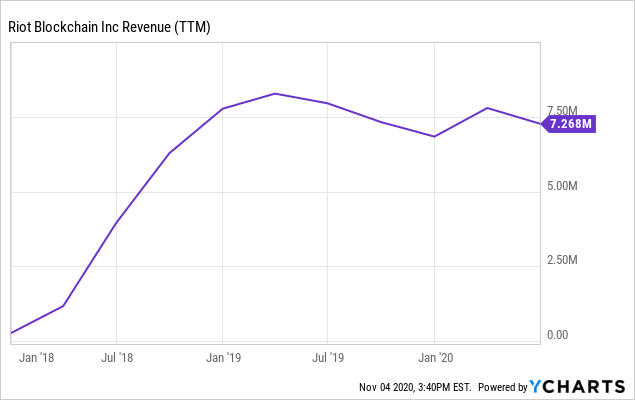

The company generates almost no revenue and is not exactly growing:

YCharts data

YCharts data

If Bitcoin increases, revenue will increase and vice versa. But that still doesn’t turn it into a healthy company. This is not a cloud business or a software business.

It is a hardware business and is highly dependent on scalability and low cost. If the price of Bitcoin doesn’t rise (which goes against my expectations), revenue will drop, and perhaps rather quickly. S19 antminers are already on the market (a newer and more efficient technology).

Hardware needs to be replaced every few years. There aren’t many manufacturers, which means the company can charge relatively high prices. Machine prices also appear to rise with Bitcoin prices (inflation is also observable in independent sectors such as precious metal mining).

I’m not thrilled with the capital allocation choices I’ve seen. Riot Blockchain burned $ 600k on Logical Brokerage Corp. in 2018, which turned out to be a total donut.

An investment in a company called Tess did not go through either. There may be some value left.

An investment in Coinsquare has neither appreciated nor depreciated. The site is still active, but I’m not sure it has gained much popularity.

Even as Bitmain charges high prices for its products, the company chooses to pay more from time to time:

Reports have been released indicating that Bitmain adjusts its miners’ prices based on bitcoin prices, so the cost of the new machines is unpredictable but could be extremely high. As a result, we can sometimes get Bitmain miners and other hardware from third parties at premium prices, insofar as they are available. For example, in November 2017, in order to facilitate the launch of our mining operations without the potential delay associated with acquiring miners directly from Bitmain, we purchased Bitmain miners at list prices substantially higher than Bitmain’s list prices.

The company disclosed many lawsuits against it in 10-K:

On April 5, 2018, Michael Jackson filed a shareholder derivatives suit on behalf of the Company in the Supreme Court of the State of New York, Nassau County, against certain officers and directors of the Company, as well as an investor (Jackson v. Riot Blockchain, Inc., et al., Case No. 604520/18). The complaint contains allegations similar to those contained in the shareholders’ class action complaints e seeks compensation for alleged breaches of fiduciary duty, unfair enrichment, waste of company assets, abuse of control and severe mismanagement.

is

On May 22, 2018, two additional claims related to shareholder derivatives were filed on behalf of the Company in the Eighth District Judicial Court of the State of Nevada and for Clark County (Kish v. O’Rourke, et al., Case No. A-18-774890-B and Gaft v. O’Rourke, et al., Case No. A-18-774896-8). The two the complaints contain identical claims, which are similar to the allegations contained in the class action complaints of shareholders. The equity derivatives plaintiffs are also seeking recovery for alleged breaches of fiduciary duty, unfair enrichment, wasting company assets, and aiding in a breach of fiduciary duty. The complaints ask for non-specific monetary damages and corporate governance changes.

And there’s more:

On September 24, 2018, the court issued an order consolidating the Gaft is Kish shares, which now has the style In re Riot BlockChain, Inc. Shareholder derivative litigation, Case No. A-18-774890-B. The plaintiffs filed a consolidated complaint on March 15, 2019. The consolidated action was temporarily suspended until the resolution of the motion to dismiss the class action on securities pending in the United District Court for the District of New Jersey.

and more:

On 9 October 2018, another complaint for shareholder derivatives on behalf of the Company was filed with the United District Court for the Eastern District of New York (Rotkowitz v. O’Rourke, et al., Case No. 2: 18-cv-05632). As with other shareholder-derived actions, the shareholder plaintiff denounces the breach of fiduciary duty, the wasting of company assets and the unfair enrichment of certain officers, directors and investors of the Company..

I’m generally not too keen on investing in companies that have lawsuits against them for alleged fiduciary duties, unfair enrichment, or wasting corporate assets. Even less, if they have made investments that have gone to zero.

Riot Blockchain has placed many of its machines in a facility managed by Coinmint. One of its owners sued for the dissolution of the company. The website should be here, but it’s down every time I check.

Bitcoin mining seems to me a perfectly reasonable business. But it is also a commodified activity that requires economies of scale. Anyone can start a mining operation – all you need is cheap energy, a data center, and IT equipment. True, there is an option due to exposure to the Bitcoin price, but it can be found much more efficiently elsewhere.

What does it mean? The company can do great if it is managed very well from now on (it seems unlikely given the track record) or if the operators are really lucky.

Bram de Haas writes the Special Situation Report. He deals with special situations such as spin-offs, share repurchases, rights offers and many merger and acquisition events. Follow me on Twitter Here or contact us by email at [email protected].

Disclosure: They are / we are BTC-USD long. I wrote this article myself and express my views. I don’t get any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]Source link