[ad_1]

[ad_1]

introduction

Before starting, let's talk about some hypotheses. I assume that you, the reader, are interested in the bitcoin (BTC-USD) (COIN) (OTCQX: GBTC) and understand the risk. This is a new technology and everything could happen (very good or very bad). If you have decided to invest in bitcoins and are looking for an entry point, then you want to make the best decision possible. This is where I come from.

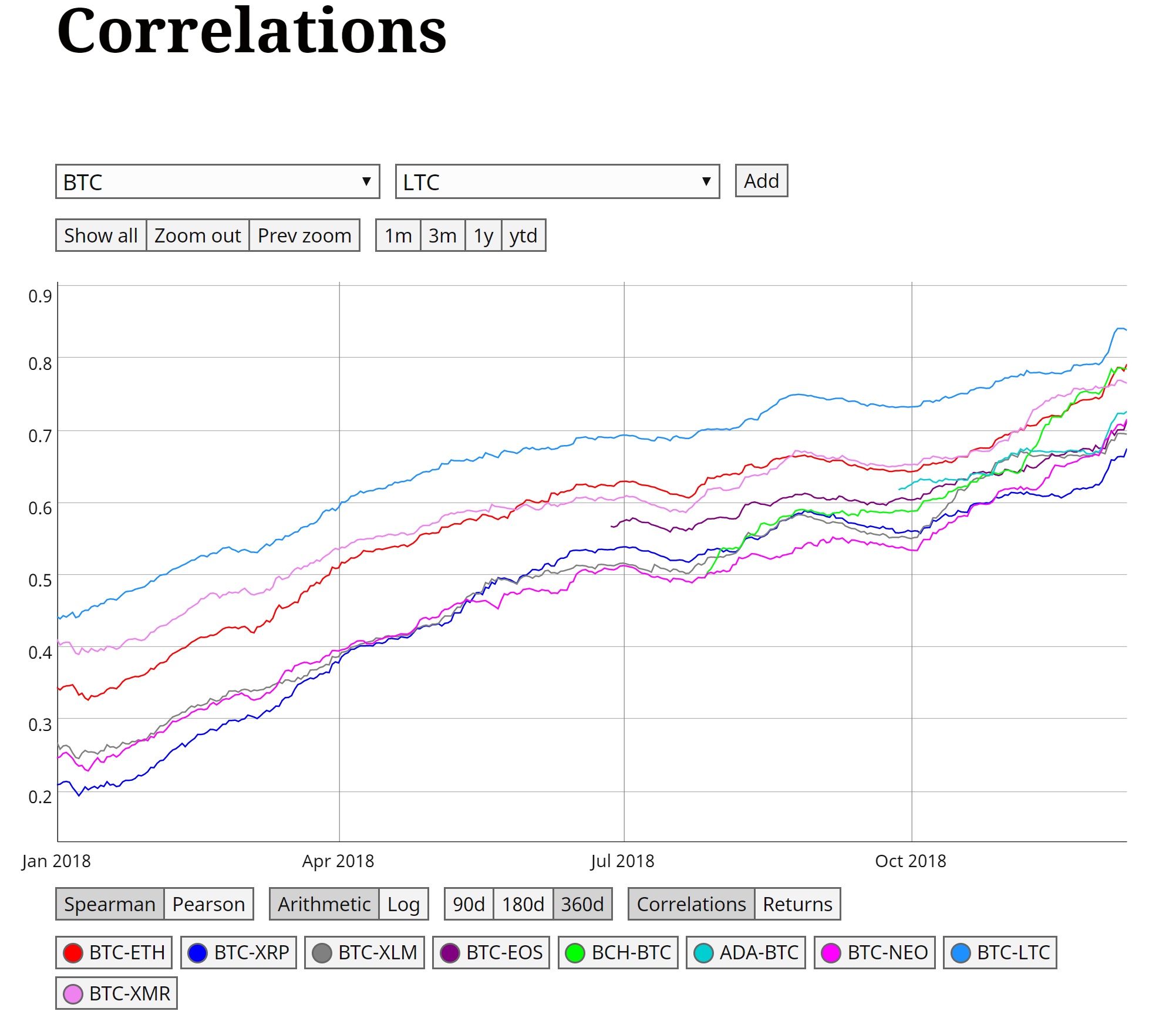

If you're investing in cryptoassets, you need to be aware of what's going on with bitcoins. This is because Bitcoin is the largest cryptoasset at this time, and we have seen high levels of correlation in the cryptoassets markets (particularly among the most important cryptocurrencies). This year these levels have increased with the winter encrypted, like the animals that are huddled together for the heat in winter.

Source: coinmetrics.io

Source: coinmetrics.io

So, if you want to invest in cryptoassets, it's very important to understand what's going on with bitcoins. As a general rule (yes, there are many many exceptions here), when it's a good time to buy bitcoins, it could also be a good time to buy others, like Ethereum (ETH-USD), Ripple (XRP-USD), or Litecoin (LTC-USD).

Let's begin.

Fear

Fear is a human emotion and therefore difficult to quantify for most of us. Unless you're a psychologist with the whole world connected to some advanced machines that measure their biometrics, how do we know when people are scared and to what extent?

Today I will talk about two of these ways and you should know that these are imperfect methods. However, they are not insignificant and I think they are better than not having any indication. Please use this data as a part of the decision-making process and not as a substitute for other research.

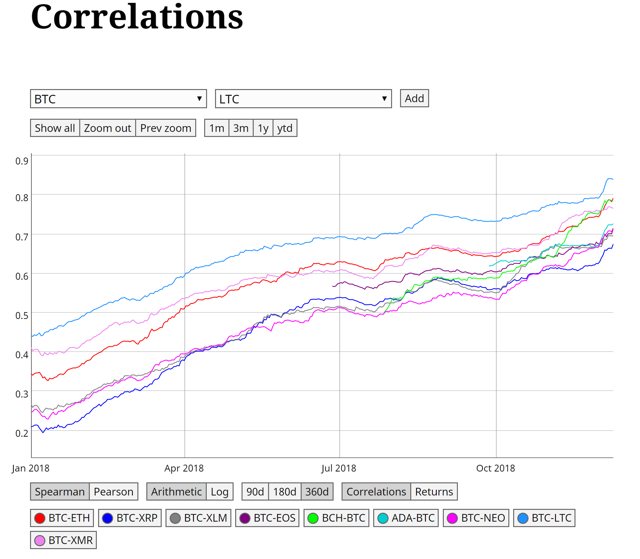

The Futures Curve

Since bitcoins now have several futures markets, we can evaluate the market sentiment from the delta between the price at this time and the price that people expect in the future. Look down:

Source: Austeritysucks.com

Source: Austeritysucks.com

What about that domain name? As you can see, expectations for the price of bitcoins in the near future are tending to decline.

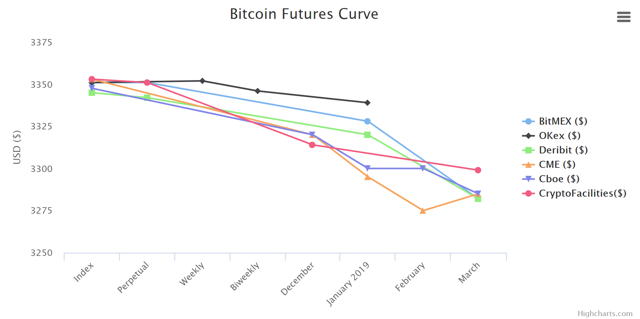

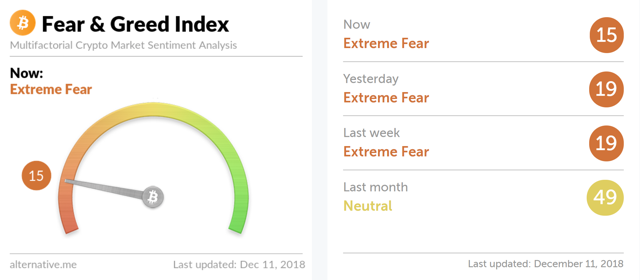

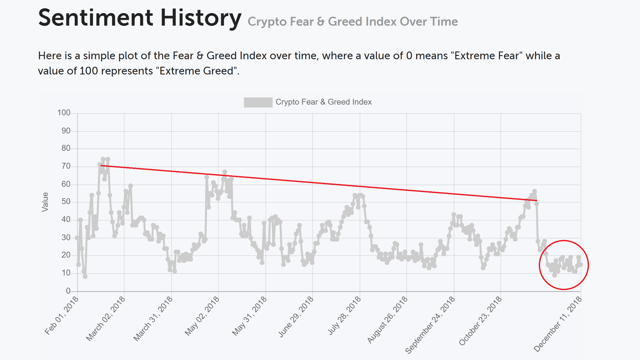

The Crypto Fear / Greed index

The Crypto Fear / Greed index accepts multiple data sources. Some of these sources are volatility, social media, surveys and more.

Source: alternative.me

Source: alternative.me

You can also view it on data projected over time.

Source: alternative.me

Source: alternative.me

The lower ratings are more scary (as described above) and higher ratings are more greedy. Notice how the trend is towards more fear, and we recently had less than 20 years for several weeks?

There seems to be some blood on the streets for me.

Value and price

I wrote a lot about the difference between the value of the bitcoin network and its price. The ability to understand this delta is the key to making money by investing in bitcoins. Buy when the price is low but the value is high, sell when the price has largely exceeded the value.

Recall that the value of the bitcoin network can be quantified in different ways. The most obvious way is to look at the performance of the network, the number of participants and the levels of activity of those participants.

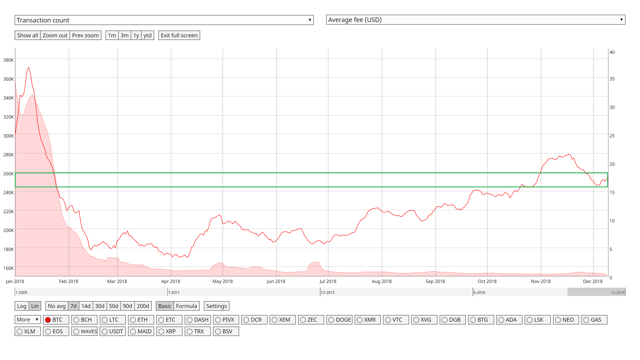

Now, at the start of this year, the bitcoin network was struggling to manage the volume of transactions. Taxes increased, and people were practically forced out of the market. But bitcoin is constantly improving. Look down:

Source: coinmetrics.io

Source: coinmetrics.io

In January 2018, the bitcoin network processed approximately 250,000 transactions in a single day. However, if you want the transaction to be included in that batch, you have had to pay a very high cost due to network congestion. In fact, the average rate then was $ 10-20. Today we process the same number of transactions for around $ 0.42. You might think, "wait, the price of the bitcoin has dropped, that's why the taxes are lower". But this is not the reason.

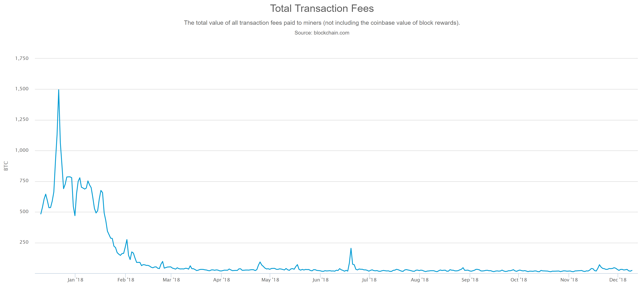

To verify this, we can examine the fees paid in terms of BTC.

Source: blockchain.com

Source: blockchain.com

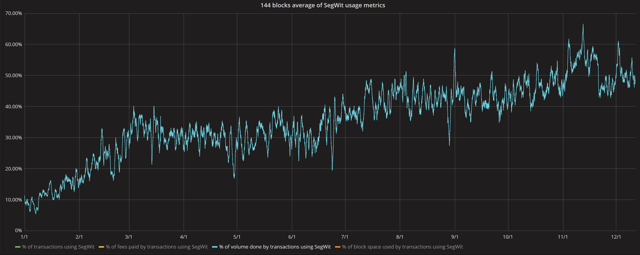

The reason why the network is proving to be much smoother is because the adoption of SegWit has increased by a factor of five since January.

Source: p2sh.info

Source: p2sh.info

When a network update is released, it takes time for the benefit to be perceived by users. This is because the updating work is about the software to support this new technology. But, given that more and more portfolios, companies, exchanges, etc. Include this new update, let's see the benefit go down to users (in the form of higher TX throughput and lower fees).

The next wave will encounter a network with higher throughput capacity and the new technology will come right behind.

Source: p2sh.info

Source: p2sh.info

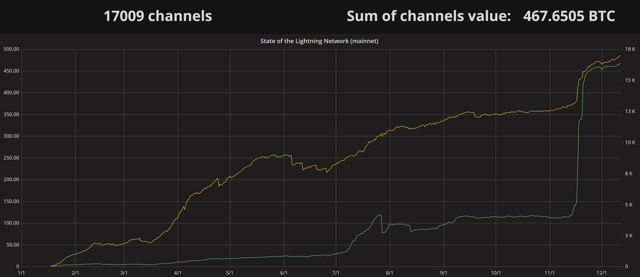

Read the Lightning network here.

Price

Of course you know that the price of all cryptoassets has been slaughtered this year. But that's exactly the thing you're looking for, is not it? Increased performance at a huge discount.

High quality indicators

There are numerous bitcoin price signals and indicators. I reviewed many of these and found some rough diamonds. Today I want to talk only about three of these. I think it's interesting that using a completely different methodology, they're practically singing the same melody.

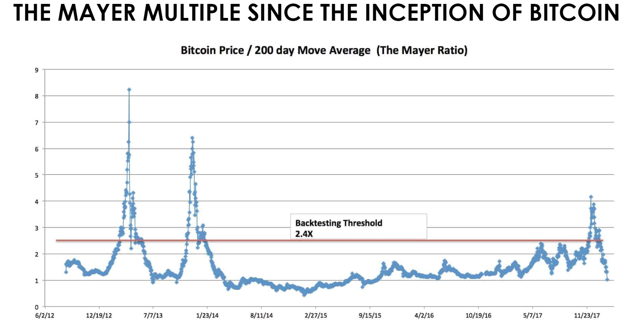

Mayer's multiple

The Mayer Multiple is the simplest indicator; an old man but a treasure. The price of the bitcoin is divided by the 200 DMA, and you're done.

Source: theinvestorspodcast.com

Source: theinvestorspodcast.com

The idea is to buy bitcoins when this ratio is low. This indicates a divergence from the tendency to the low side. The same is true for identifying the bubbles but on the contrary. When the relationship is high, the price has far exceeded the trend of 200 DMA and we could find ourselves in a dangerous territory.

The Mayer multiple is low, but perhaps not yet low.

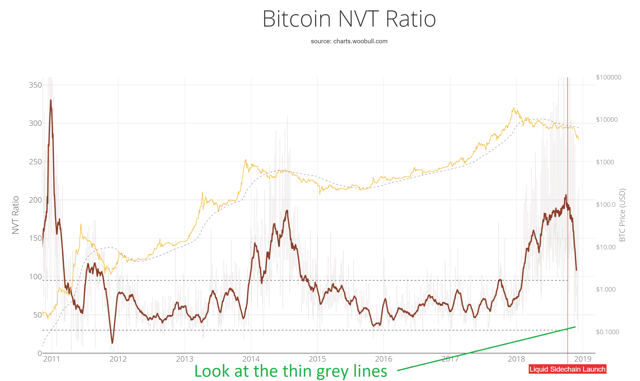

NVT report

I reviewed the NVT report in a previous article. My only problem was that it tended to delay the market up and down. However, there are more data that we can extract from this approach.

The NVT ratio is just the limit of the bitcoin market divided by the volume of daily trade in US dollars (on the chain, not on the volume of trade). Let's have a look.

Source: charts.woobull.com

Source: charts.woobull.com

In the past, I focused on the thick red line, which is the actual ratio determined by a moving average. However, thin gray lines are the daily values that make up the moving average. See how low they are recently.

Notice how the thick red line has been swooping in the last few weeks? The idea behind NVT is to buy between the two dotted lines, generally as low as possible. Large peaks above those dotted lines are a warning sign that you may be in a bubble.

The recent NVT actions suggest that we are rapidly entering the buying zone, but we may still have downward pressure in the short term.

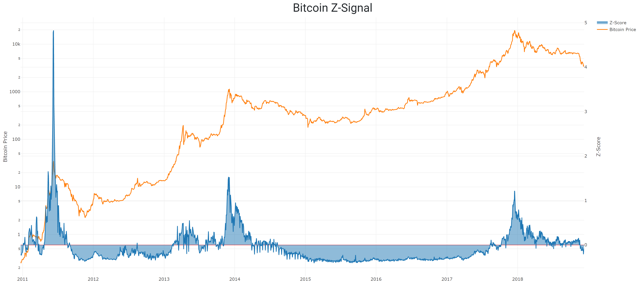

The Bitcoin Z-Signal

Bitcoin Z-Signal is my last bitcoin price modeling experiment. I take into account the daily transactions, the total count of all transactions (the subtotal) and the number of unique addresses in use. I transform them into a log scale and perform multiple regression with respect to the price, even in the log scale. You can read more here and here, or follow me on Twitter (TWTR) for updates every day.

Source: blockchain.com and the author's graphs

Source: blockchain.com and the author's graphs

On the left the y axis is the price of the bitcoin. On the right the y axis is the standardized output of the price / expected from the model. This is the Z score. The floor is a Z score of about -0.5 and the ceiling is theoretically infinite. See that little blue beep sticking its head below zero?

Looking at the Bitcoin Z-Signal, we have been in winter crypt mode since the end of 2017. However, only very recently have we started to record values below the forecast. The best time to buy is when the price is far below the forecast, and the best time to sell is when the price is far from forecast.

The Z-Signal seems to indicate that we are entering an optimal purchasing territory, even if we are not yet at the absolute bottom of the market.

Conclusion

I've shown that people are scared now. In addition, the network is able to handle a much larger volume at a lower cost, indicating that it is now possible to meet an increase in demand. Furthermore, three popular pricing models show that the ideal buying moment is fast approaching, although we have probably not yet seen the absolute price of this market cycle.

By the way, for me bitcoin and cryptoasset do not just make money investing in a scheme to "get rich quick". I see a future that will be based on decentralized cryptographic systems to protect our fundamental human rights. If you want to know more, read here for a discussion that goes beyond investment.

Greetings,

Hans

This article was published for the first time in Crypto Blue Chips, my community of private investors.

Revelation: We are / are long-term BTC-USD, ETH-USD, LTC. I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link