[ad_1]

[ad_1]

Photo: Shutterstock

Originally founded in 2012, Ripple developed its own digital currency called XRP, which is now one of the oldest cryptocurrencies within the cryptographic space. It has managed to become the third cryptocurrency in the world after bitcoin and ethereum (as of October 2018), sometimes even replacing ethereum as the second most valuable currency. However, despite the incredible performance and the expansion of adoption, it is still difficult for ordinary people to understand how the whole system works.

So, so what exactly is XRP? Why has the currency become so popular that even giants like Santander and SWIFT have been interested in the company? Why does the ever-increasing number of institutions choose to join RippleNet with more and more companies adopting technologies developed by Ripple?

Before going further, and finding the answers to all these questions, we clarify the terms because they are often used incorrectly. In general, "Ripple" refers to three things:

- Ripple – the company that operates the Ripple platform

- XRP – the virtual currency developed to facilitate payments on Ripple

- RippleNet – a global settlement system that connects banks, exchanges and other financial companies through the distributed ledger

Now, when everything is more or less clear, let's move on to the fascinating world of innovations and technological advances led by the company.

Content

-

- Ripple vs XRP

- Who invented the ripple?

- Ripple ecosystem

- XRP Register

- XRP structure

- What is the consent algorithm of the ripple protocol?

- XRP for developers

- What are the advantages of XRP?

- How to buy ripple?

- Where to keep the ripple?

- Is Ripple a good investment?

- Ripple drives the pressure group

- XPring

- Ripple forever

- Most popular by google search

Ripple vs XRP

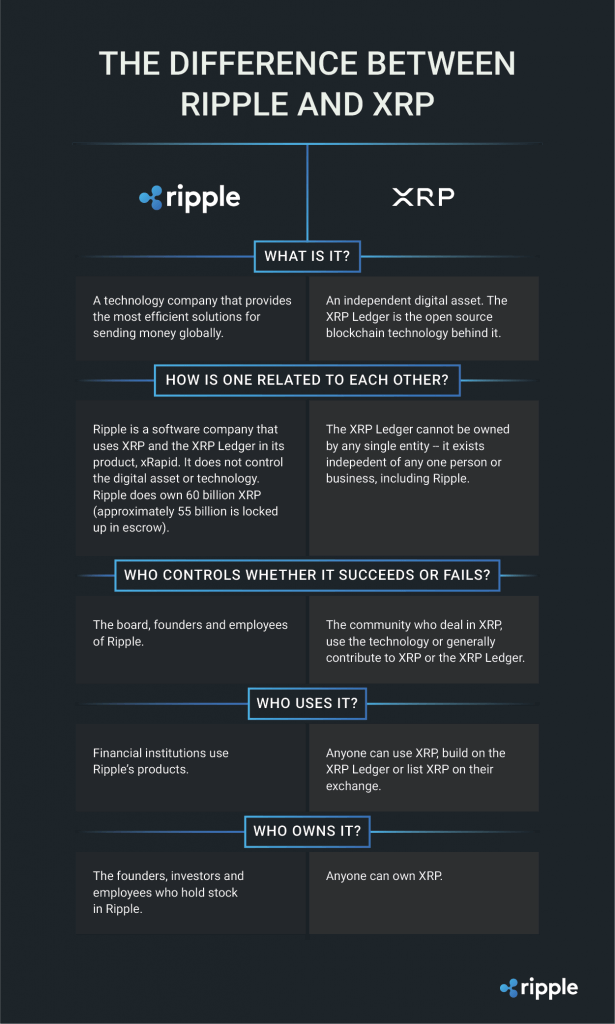

To eliminate the ambiguity related to these two terms, the project team decided to clarify the distinction between them. As the founders say, the XRP and Ripple coins are completely different notions.

In short, Ripple is a software company, while XRP is an independent virtual currency based on the distributed accounting system dubbed "XRP Ledger". The digital currency, together with XRP Ledger, is used by xRapid, a Ripple financial solution for transfer regulation.

The XRP can be used by exchanges that integrate it into their systems, while developers can use XRP Ledger to build their own projects. However, the business can not be controlled by any business, including Ripple. Although the company holds 60 billion tokens, it does not have the power to control the digital currency and its market value.

Who invented the ripple?

Although the company was officially founded in 2012, its current protocol was preceded by Ripplepay, a payment network written by Ryan Fugger in 2004 with the aim of allowing people to create their own money. The website debuted in 2005 as a platform for the security of transactions between users of Ripple.

In 2012, investor Chris Larsen joined the project and together with Britto, McCaleb and Schwartz, created the OpenCoin company to further focus on developing the Ripple protocol using Fugger's RipplePay model.

Initially called OpenCoin, the launch later returned to Ripple Labs to change its name to Ripple in 2015. With over 200 employees, Ripple operates offices in the United States, United Kingdom, India, Singapore, Australia and Luxembourg.

Key people

Jed McCaleb is a famous American businessman and a billionaire, according to Forbes. He also co-founded several startups, including eDonkey, a Mt. Gox encryption platform (sold to Mark Karpelès in 2011) and Stellar. In 2013, he left Ripple, but his current ownership of XRP is 5.3 billion coins.

David Schwartz is the current CTO of Ripple and also his main architect. He collaborated with the National Security Agency and CNN to create a series of cloud messaging and storage solutions. Following his mission to dismantle and reassemble one of the largest access gates to the planet, Mr. Schwartz pledged to stop the role of intermediary in the banking sector – SWIFT.

Chris Larsen is also an American business man and a serial investor, appointed by Forbes the richest man in the cryptic space. He also participated in the launch of several financial technology startups, such as the mortgage lender called E-loan in 1996.

Bradley Garlinghouse has been the company's CEO since 2015. Prior to Ripple, Bradley was CEO of the file-sharing platform called Hightail. In addition, he worked in Yahoo technology giant as senior vice president and was president of AOL of Consumer Applications.

Thanks to their efforts, Ripple is now a privately funded startup that has already completed five rounds of financing. His investors include big names like Andreessen Horowitz, Pantera Capital, Google Ventures and Santander InnoVentures. The company earned $ 55 million in a major round in 2016 from Accenture, Standard Chartered, CME Group, SBI Holdings and Seagate Technology, etc.

Ripple Ecosystem

![]()

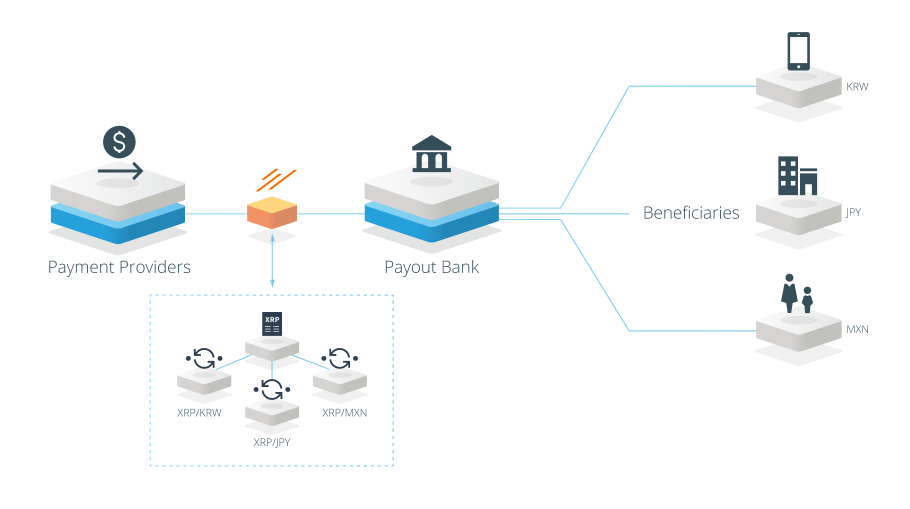

xRapid it is the Ripple settlement system aimed at accelerating cross-border transfers. Unlike xCurrent, which allows transactions in fiat currencies, this platform uses only XRP coins, which makes it perfect for organizations that want to improve the cost of liquidity.

![]()

XVI bis allows payment service providers to transfer money through different networks using standardized interfaces. It has a simple API that does not require users to install software, thus simplifying the transfer of funds. In addition, xVia users can add heavy data, such as invoices, to the contents of the payment.

XRP Ledger

XRP is based on an open source cryptographic registry (the XRP register) that is powered by a trusted network of P2P server. The system is designed to allow users to send money in fiat or digital currency in a couple of seconds from any country.

The platform uses the native virtual currency – XRP. Unlike Bitcoin or Ethereum, it acts primarily as a real-time source for liquidity data and serves as a bridge currency, allowing for transfers between the two unrelated currencies.

The project has been tested by leading financial operators and is already supported by over a hundred organizations worldwide, including Santander, Bank of America, American Express and others.

In addition to supporting XRP transfers, the ledger includes a number of features that allow you to develop applications that can run in any environment, but not just as intelligent contracts within the Ripple network.

These features are:

- Distributed exchange: allows trading obligations and XRP currency;

- Payment channels: allow asynchronous XRP payments;

- Invariant control: offers an independent level of protection against bugs;

- Commitment: allows users to block XRP coins until they expire;

- DepositAuth: allows users to control who can transfer money to them;

- Changes: allows users to introduce changes to the ledger without causing interruptions.

XRP structure

Ripple has a limited stock of coins limited to 100 billion XRP (all tokens are initially extracted and already exist). Coins can be destroyed after each transfer to pay the transaction costs.

Interesting fact: Given today's destruction rate, it would take about 70,000 years to destroy all the coins.

The coins were launched on the market when Ripple was developed (XRP) and it is not possible to issue more, according to the rules of the company. In the meantime, given that the current outstanding offering makes 40 billion apps, most of the released XRP is not yet in circulation. The company holds nearly 60 billion coins, 55 of which are held in escrow accounts for further distribution. Each month, one billion XRPs are made available for sale, which could significantly increase the overall supply over the next few years.

Instead of using Proof of Work (PoW) and Proof of Stake (PoS) algorithms, like bitcoins and other currencies, XRP uses the consensus method known as Proof of Burn (PoB).

Whenever someone transfers XRP to another account, a transaction fee is paid, while the XRPs used to pay for such commissions are burned. After these coins have been destroyed, they are removed permanently and can no longer be used. The default transaction fee is lower than that of Bitcoin and amounts to 0.00001 XRP.

With Proof of Burn, the cost of XRP will increase steadily, as more coins are burned every day. The main function of XRP burning is to protect the network from being attacked or spammed.

What is the consent algorithm of the ripple protocol?

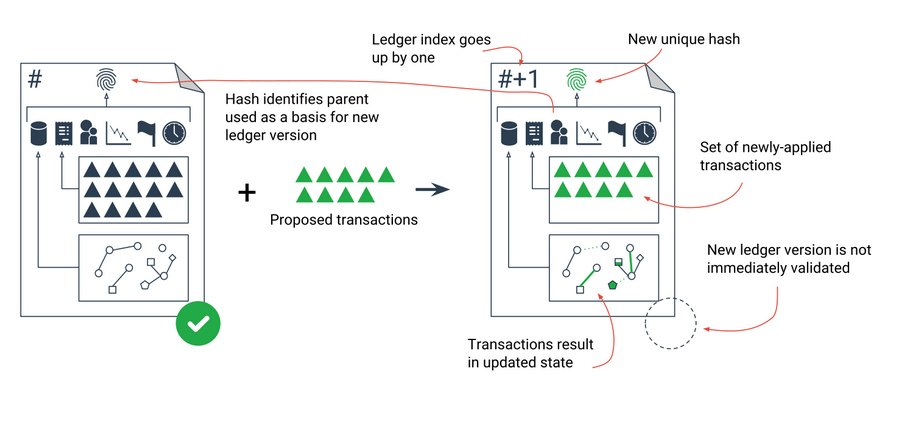

One thing that makes the system different from other cryptocurrencies is that it does not use a real blockchain. In contrast, XRP Ledger uses its own technology, called the Ripple protocol consent algorithm.

The goal of the mechanism is to enable and adjust transfers in a distributed database. The ledger has a network of trusted validators that decides whether the transactions are compliant with the protocol requirements. Once a transaction is verified by the majority of validators, it is written on the ledger. While it takes hours to approve the transfer on the bitcoin network, a transaction on the Ripple network is confirmed in only 4-5 seconds.

Unlike miners, validators are not paid for ordering and transaction validation. They are managed by individuals, digital asset trading platforms and other institutions and are located all over the world. The main objective of this process is to prevent double spending. Therefore, if the same number of digital currency is spent for two separate transactions, it will not be approved by most nodes.

Sometimes, a validator can go against consent. In this case, the validator who does not agree on a transaction must digitally sign it and inform the other validators, who in turn will decide whether it should be removed or not. This mechanism helps to maintain system security and eliminates delays caused by validators.

Apparently, the algorithm can be better explained by David Schwartz:

XRP for developers

XRP Ledger is open-source and its API can be used by developers for a variety of purposes. Ripple offers a wide range of tools needed to manage the technology independently and incorporate the system into third-party platforms.

Regarding the use cases of the technology, Ripple says that it is mainly integrated by exchanges to allow deposits in XRP. Developers and companies based on Ledger can install a rippled Validator and thus support network decentralization. In addition, users are invited to improve the functionality of the rippled Validator, a P2P server that manages the XRP register, contributing with the code or reporting a bug detected on the platform.

To power the use of its currency, the company launched an initiative called Xpring, the project that aims to attract and urge companies to implement on Ripple's Ledger by providing them with investment support. .

What are the XRP benefits?

These are the key features that allow XRP to be rightly ranked among the best.

- Access

- Transaction speed

- Greater certainty of payments

- Low payment costs

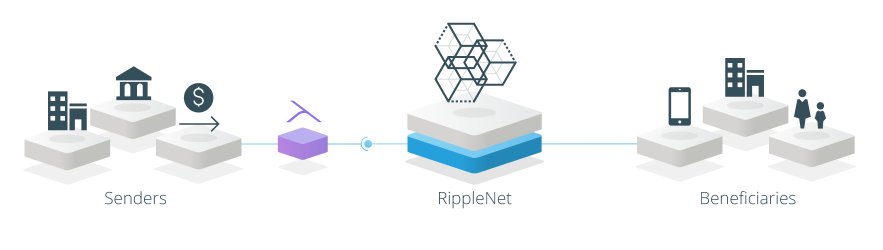

Existing payment systems are often obsolete, which makes it difficult and expensive for users to make transactions with new partners. RippleNet, in turn, offers a single point of access to a global network of institutions through standard rules, formats and governance.

While Bitcoin can only adjust seven transactions per second, XRP can constantly handle 1,500 transactions per second, with the goal of climbing to the point where it would be able to compete with Visa.

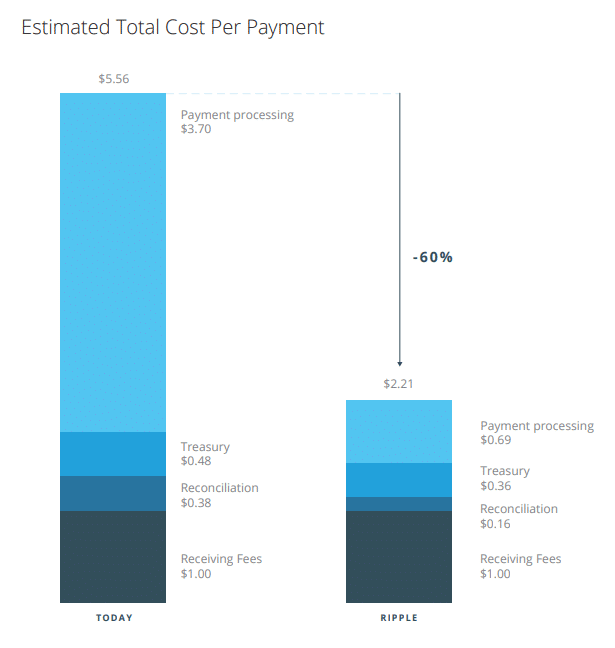

Using a messaging API, the network ensures payment certainty by allowing institutions to exchange data such as KYC requirements, exchange rates, funds delivery times and other payment details. In addition to standardized connectivity, data APIs, the platform provides on-demand access to liquidity, thus reducing payment costs.

Unlike most startups in the blockchain sphere, Ripple was founded as an official company for banks. Thus, it is not subject to multiple controls by regulatory bodies such as other digital currencies. Since the platform is not aimed at end users but aims to guide network adoption among large banking institutions, the high scalability and the ability to process high volumes of transactions are its main features.

As mentioned earlier, Ripple uses a unique Proof of Burn (PoB) mechanism, in which XRPs used for the transaction fee are destroyed and therefore the total amount of coins decreases every day. This implies that the current cost of XRPs will continue to grow over time. The minimum value of a standard transaction is 0.00001 XRP or 10 drops. The commission can increase when the load increases.

How to buy XRP?

Cryptocurrency can be acquired in many of the world's most famous cryptographic exchanges. Some platforms, such as Bitstamp, allow buyers to exchange USD or EUR for XRP, while most require users to exchange it with a different virtual currency. One of these, one of the main trade in cryptocurrencies in the world – Binance in Chinese exchange. Being one of the largest in the field, Binance boasts its cryptocurrency called Binance Coin (BNB), which can be used to pay for trading fees.

To make an investment, you will need to register a new account on the platform you have selected, add the XRP portfolio where you will transfer your coins, make a deposit using fiat or electronic currency and finally choose the amount of XRP coins you want to get.

Where to keep XRP?

There are three basic ways to keep your XRPs:

- Exchange. Probably the easiest way is to leave XRP on the platform (exchange) where you bought it. The option, however, is not perfect as any exchange is subject to the risk of an attack by a hacker.

- Software portfolio (Web app). You can also register an XRP portfolio and keep your money. Good examples of such are Exarpy and Toast Wallet. The former is non-hosted and accessible from any web browser, while the latter is also open-source and free (something everyone loves).

- Hardware portfolio. Meanwhile, the safest option today is to keep the cryptocurrency on a hardware portfolio that supports different types of coins. Today, Trezor and Ledger Nano S are the most popular thanks to their safety, ease of use and portability. The only thing you should worry about when using this device is not to lose it.

Is XRP a good investment?

No one can be 100% sure that XRP, just like any other currency, is a safe investment tool. However, it has some advantages that make it a promising advantage. The overall offer (100 billion tokens) has already been released, which means that there is no place for inflation.

While around 40% is in circulation, the remaining coins are kept by Ripple. To avoid a negative influence on value, the platform will not distribute the entire coin supply but will release it gradually every month.

The digital currency has grown a lot since the beginning of 2018 and is likely to increase due to the number of partnerships that the company has entered into. In 2017, the currency was valued at around $ 0.0066 and reached a record level of $ 3.81 in January 2018.

Ripple Leads Lobby Group

While the United States is one of the major financial markets, the government is still too slow to develop a framework for the regulation of the cryptocurrency sector. With the intent to promote the favorable legal environment for crypto developers, Ripple Labs, together with the PolySign custody service provider, the Coil financial system and the virtual investment agency Hard Yaka, has set up a lobby called "Protecting the Internet of Value Coalition America".

Led by Ripple, the new coalition aims to gain the support of the authorities to make the United States an attractive country for cryptic investors. The members also collaborated with the bipartisan lobbying company Klein / Johnson, which will receive $ 25,000 with an additional 10,000 XRP on a monthly basis.

The efforts of the alliance to be directed to Congress and other organizations related to the regulation of cryptocurrency, such as the IRS and the SEC.

XPring

Xpring is an initiative aimed at supporting companies to create their new projects using XRP Ledger and XRP cryptocurrency. Ripple will provide grants, investments and incubation to developers using Ripple technology to overcome user issues on digital media, identity, finance and other areas.

To ensure the best support to entrepreneurs, Xpring welcomed Ethan Beard, who will become Senior Vice President to manage the program. Prior to becoming a consultant for several fintech companies, Ethan worked as a manager in Facebook, where he managed relationships with developers and oversaw product marketing.

Xpring has already supported various projects, including Coil, SB Projects, Blockchain Capital and Omni.

Crossing for good

Photo: Shutterstock

Photo: ShutterstockRipple for Good is a philanthropic project launched by Ripple in September 2018. The goal of the charity project is to promote financial inclusion around the world by supporting initiatives in the field of fintech and education.

As Ripple explains, the charity aims to facilitate social change by enabling unallocated populations to access innovative financial services. The company will support real applications of cryptocurrency, blockchain and other related technologies in a wide range of industries, including science, math, engineering and technology.

Ripple is investing a total of $ 105 million to fund the program. In addition to $ 80 million in donations already received, the company is providing 25 million dollars of their own money. So far, he has dedicated $ 50 million to help the universities participating in the blockchain investigation and $ 29 million for the DonorsChoose crowdfunding website.

Come parte del progetto, Ripple ha collaborato con una fondazione senza scopo di lucro RippleWorks, che ha sostenuto 70 iniziative provenienti da 55 paesi diversi e aiutato 250 milioni di persone a migliorare la propria vita a livello globale.

Più popolare da Ricerca Google

Cerchiamo di rispondere alle domande più rilevanti (come da query di ricerca di Google) riguardanti Ripple e XRP.

Photo: Pixabay

Photo: Pixabay- Quante ripple in circolazione?

La quantità totale di XRP in uso è 39,9 miliardi.

Sul portale ufficiale di XRP, la società fornisce tutte le informazioni rilevanti sulla valuta. Qui puoi controllare il prezzo e il volume della moneta, trovare le ultime notizie e saperne di più su XRP.

- Che cosa significa XRP stand for?

Come da norme ISO, ogni valuta che non è emessa da un paese specifico deve iniziare con il codice "X". Ad esempio, l'abbreviazione di gold è XAU, mentre Bitcoin è noto come XBT. Quindi, XRP sta per la moneta Ripple.

La moneta di Ripple è chiamata XRP e serve come moneta virtuale nativa sulla rete di Ripple.

Il termine Ripple può fare riferimento a tre cose diverse: Ripple Labs (la società che gestisce la piattaforma Ripple), il protocollo di Ripple Payments e la criptovaluta nativa della rete, soprannominata XRP.

Sì, nel 2015 Ripple ufficialmente fatto il suo codice open source.

Ogni portafoglio digitale sulla piattaforma Ripple è identificato da un'unica chiave pubblica, ovvero l'indirizzo XRP a cui altre persone possono inviare i loro fondi.

Come dice la società, Ripple è decentralizzato perché gli utenti possono scegliere i validatori di cui si fidano. Tuttavia, molti sostengono che Ripple non è completamente decentralizzato, in quanto detiene una grande porzione di controllo sul sistema. La piattaforma possiede la maggior parte degli XRP, quindi ha tutti i diritti per gestire l'offerta di monete. Inoltre, utilizza un pool affidabile di validatori, con ogni convalidatore selezionato da Ripple stesso.

Il token XRP è il nome della valuta nativa di Ripple che facilita le transazioni globali tramite la sua rete di pagamento.

- Qual è la valuta Ripple?

La valuta di Ripple è denominata XRP e viene utilizzata per il regolamento dei pagamenti in tempo reale.

- Quanto tempo le transazioni Ripple prendono?

Le operazioni prendono generalmente non più di 4 secondi.