[ad_1]

[ad_1]

Hive Blockchain Technologies (OTCPK: HVBTF) was known as Leeta Gold Corp., a Canadian gold mining company. During the 2017 encryption boom, they decided to skip the ship and completely change their sector. As a partner, they found Genesis Mining, directed by Marco Streng.

Source: Seeking Alpha

Source: Seeking Alpha

Genesis Mining?

Genesis Mining is the oldest surviving cloud mining provider for cryptocurrencies like Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC), Ethereum (ETH-USD) and others. They operate plants in Iceland, China and elsewhere in Europe (although they maintain the exact position in close relationship).

You can see some of these structures below:

Complete disclosure here, I was a Genesis Mining customer and this article should NOT be considered an endorsement of their services.

Cloud Mining?

Cloud mining is the cryptocurrency mining process that uses someone else's hardware and hosting at a fixed price in certain terms. For example, if you wanted to start extracting Bitcoin, but did not want to set up your farm; one thing you could do is buy a cloud contract for a fixed amount of hash power if you thought the ROI would be positive.

Cloud contracts vary greatly due to the particular extraction of cryptocurrency, the type of contract and, in particular, the company that sells these contracts. Genesis mining was the first big company in this space that was not a real scam; and they are still operating until today. However, there are numerous scams in cloud mining; they range from structures that simply do not exist, to get out of scams, to Ponzi schemes and more; buyer, be careful.

Hive Software

The hive software was originally created by Genesis Mining to be used in their server farms. The idea was to create an easy way to manage a large number of machines in an easy-to-use interface for large-scale mining operations.

Here you can see an explanation of this process, taken before Hive was sold to HVBTF:

HVBTF today

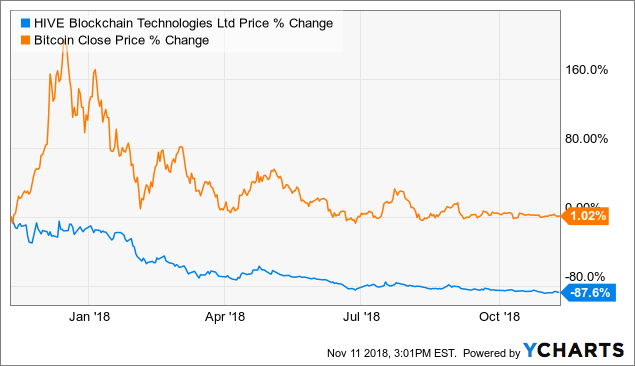

HVBTF is traded on the OTCPK markets, with a market capitalization of approximately $ 113 million. The price of shares has, predictably, been punished this year.

However, an increase in the number of outstanding shares from € 47 million to € 310 million resulted in a further downward pressure on the price. Most of this increase comes from relationships with Genesis Mining and others in their acquisition process.

Hive is led by CEO Harry Pokrandt, who according to his LinkedIn profile has recently retired.

Balance

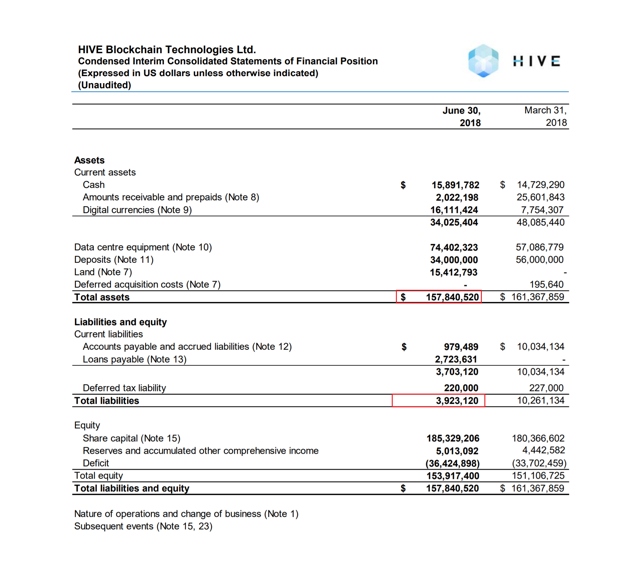

The budget looks good, maybe too good.

Source: Hive – 10Q Archiving

Source: Hive – 10Q Archiving

Look at the relationship between assets and liabilities, it is over 40/1. The company is also sitting on a lot of money, which is useful given the state of the cryptocurrency market.

I am a little skeptical about the value of data center equipment, due to the rapid depreciation of equipment at this time. But, even if this is overrated, losses that suffer depreciation will protect them from taxes when the market turns. Moreover, the value of the earth alone dwarfs of all liabilities should push come to push.

Income statement

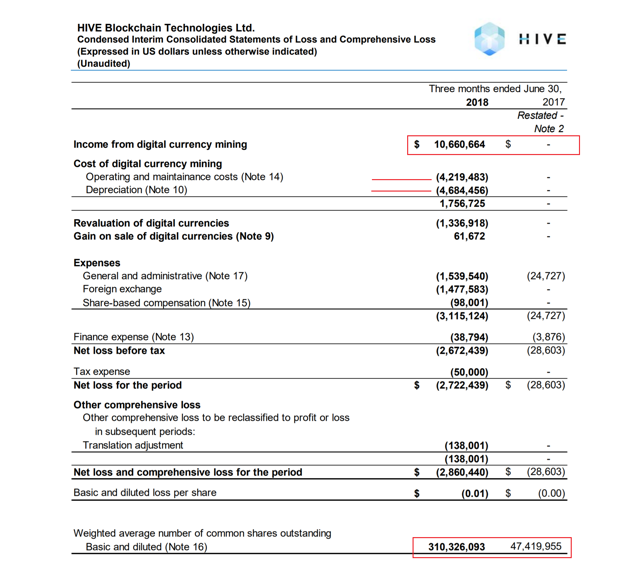

The income statement seems rather strange, since the company has recently moved operations from one sector to another. There is not much we can compare, but we do our best anyway.

Source: Hive 10Q, 30 June 2018

Source: Hive 10Q, 30 June 2018

With the extraction of digital money that brings $ 10.6 million and an operating cost of $ 4.2 million, Hive clearly has the opportunity to continue generating income during the protracted bear market. Recall that Hut 8 Mining (OTCQX: HUTMF) was able to produce similar results in their Q3 archives, and we know that Hut 8 Mining is a well oiled machine. HUTMF defined this "mining margin" and I like that term. For them, it is the market price of a Bitcoin divided by the cost of extracting the same Bitcoin (only the costs of the mining structure). For Hive, it is more than Ethereum, but the concept is essentially the same.

The depreciation seems to me a bit low, but it could be in line with a 24-month amortization schedule if we assume that the structures and equipment are divided about 50/50, where the building appreciates more than 10 years or more and the mining platforms are on the quickest program. Here is my math for napkins / best guess on how it breaks.

- $ 74.4 million / 2, half building and infrastructure, half of mining rigs

- $ 37.2 / 24 months = $ 1.55 m monthly depreciation

- $ 1.55 * 3 = $ 4.65M depreciation for the quarter, which seems to be strangely close to the income statement

There are many new actions in the city, as we have briefly mentioned before. This was due to the restructuring and acquisitions by Genesis Mining. The question that this raises for me is the amount of ordinary shares issued by the company? Investing while the market is falling is generally wise, but how much more have they planned?

concerns

I have a number of concerns here with Hive, especially with their partner Genesis Mining. First of all, Genesis Mining has developed a bad reputation with the community for a variety of reasons.

Immature behavior

While I'm sure some of the crypto-children were just wide-eyed on some of this company's antics; serious investors are less likely to be alarmed. For example, Genesis Mining paid for these placards placed in Omaha.

In addition to this, they staged fake protests at the Consensus Blockchain Conference.

All of this smells like a company with more money than sense, but where does all the money come from?

Poor customer relationship

Some of these returns came from being in the Bitcoin mining business from the early days, but some of these went to the detriment of Genesis Mining customers. See, many people who were new to cryptocurrency bought the famous "life contracts" of Genesis Mining near the peak of the Bitcoin bubble. It turns out that these contracts had a resolutive clause that put an end to their operation if the market conditions remained poor for a long period of time.

The details were all included in the fine print, so I'm not saying that Genesis Mining broke the laws here; simply that their marketing was very misleading. Some unfortunate customers bought large "lifetime mining contracts" in January 2018, which were scheduled for launch in March 2018. To their surprise, these contracts were closed in June 2018, resulting in substantial losses.

A popular YouTuber, Voskcoin made this review of Genesis Mining.

In conclusion, Genesis Mining is not a scam, it's just a terrible investment for customers who have terrible customer service. Not exactly a company I would like to work for or invest in, or have as a parent company or a partial owner (cough, beehive, cough).

Ethereum and pole test

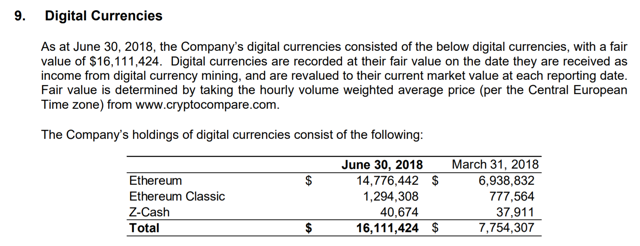

If we look at the digital holdings of Hive, we see that they consist mainly of Ethereum.

Source: Hive 10Q, 30 June 2018

Source: Hive 10Q, 30 June 2018

So, what is the problem you could ask? Well, Ethereum is the cornerstone of the GPU mining world today, and they are phasing out the mining industry.

Some of you are now heading to the comments section to say that Ethereum has "passed to the PoS" since the launch and it could take years. But the latest news we have is that the trouble bomb is coming; and the next major update of the network that moves Ethereum closer to the complete elimination of mining is scheduled for January 2019.

Also during the call, the developer Lane Rettig has shared research on the so-called "bomb of difficulty" of ethereum. The difficulty bomb is an algorithm embedded in the ethereum code that makes blocks increasingly difficult to use, and has been put in place to act as an incentive to encourage regular updates to the network.

According to Rettig, the difficulty bomb will be visible from January, leading to 30 seconds of blocking by April or May of next year. – Coindesk

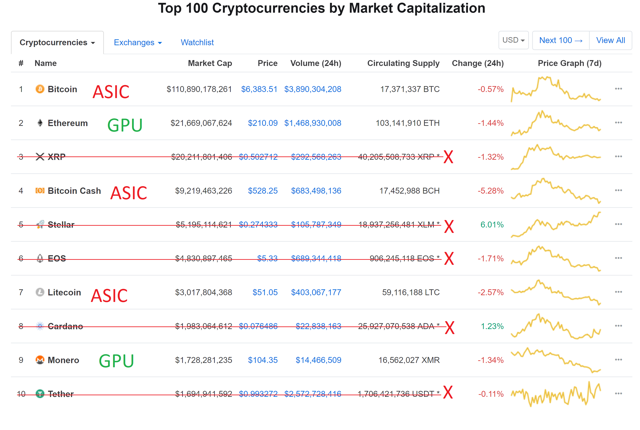

It is entirely possible that other cryptocurrencies absorb the excess of mining energy, but let us look at the state of the mining world of the GPU at this time. Among the first ten cryptocurrencies, how many do you think can be extracted with a GPU? How many can be extracted?

Source: Coinmarketcap.com

Source: Coinmarketcap.com

It turns out that five are not miniscule, three require ASIC and only two of the remaining coins can be extracted with GPUs. Look at the market capitalization of Ethereum against Monero (XMR-USD). The number of miners a currency can support is directly proportional to its market capitalization (with some variance for algorithms that do not work exactly the same way on every GPU, some have advantages in certain algos).

Ethereum is currently supporting 12.5 times more miners of the 2-digit numerical GPU coin, Monero, using this simple yardstick. So when Ethereum comes out of the mining game, where do all those GPUs go?

I hope to explain it clearly. Basically, any cryptocurrency that can be extracted with a GPU already has the correct number of miners to balance difficulties and profit (it's a free market). If the minimum GPU crypt number one leaves the stage, what will all those machines do? Certainly Monero can not be absorbed by himself, since Monero already has the right amount of hash power and only needs one twelfth of the Ethereum network to be in balance.

Sure, there are a myriad of new use cases that have been proposed, but none of them can be compared to the profits from the mining encryption, which created the market in the first place.

For me, this is a concern for a company primarily engaged in the mining industry of Ethereum. That bomb of trouble will soon arrive one day, and if it arrives in the middle of the night (during a deep bear market) it will cause a great disaster.

Conclusion

While I'm not a huge Genesis Mining fan, Hive could be a good bet in certain market conditions. Genesis Mining certainly has experience in the mining industry, after all it is an industry leader. But I'm worried about their bad business practices and exposure to Ethereum. Depending on how it all takes place, this could be a huge "big bathroom" for investors.

However, if the market turns around early, then new miniscule cryptocurrencies may appear (or suddenly become popular enough to support multiple GPU miners). In addition, the promises of artificial intelligence on the blockchain could create demand for all GPUs used in the mining sector. Other cases of use include modeling fluid dynamics and rendering CGI, but these ideas have yet to mature.

I would suggest approaching HVBTF with caution in the meantime.

This article was first published in Crypto Blue Chips.

Revelation: We are / are long-term BTC-USD, ETH-USD, HUTMF.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]Source link