[ad_1]

[ad_1]

- The amount of ETH, LINK and REN tokens held by non-exchange addresses has increased significantly in the past few weeks.

- Most altcoins have experienced a significant drop in the past 24 hours.

Today, the cryptocurrency market has seen a noticeable decline from a market cap of $ 398.6 billion to a low of $ 386 billion in just three hours. Many altcoins have already rebounded, with Bitcoin remaining above $ 13,000.

Token accumulation chart

[22.33.16, 26 Oct, 2020]-637393461840085105.png)

This trend is not new and has been observed since May 27, 2020. REN took a huge leap from 379 million coins on non-trading addresses on October 5 to 410 million just two days later. The bullish trend continues for all three currencies, indicating that falling prices are seen as an excellent buy-in opportunity.

Ethereum had to return to $ 390 before the final rally to $ 500

In our last article, we talked about Ethereum, stating that the digital asset was ready for a small retracement towards $ 390 before resuming the uptrend. On October 22, the smart contract giant exited an ascending triangle on the daily chart.

ETH / USD daily chart

The Ethereum price then slid towards $ 390 to retest the previous resistance as a support level. Although the price went through it, it managed to bounce back by trading ETH at $ 394 currently and still aiming for $ 500 in the long term.

Chainlink must break through this crucial resistance level to reach $ 18

LINK is currently trading at $ 11.82 after a slight rejection from the upper trend line of an ascending parallel channel formed on the daily chart. The 100-SMA is acting as a strong support level for now.

LINK / USD daily chart

The MACD has been bullish since September 26 and has strengthened over the past two days. The most critical resistance level is set at $ 13, where the upper trend line is located. A breakout above this point can take LINK’s price up to $ 18.

LINK’s current refusal could push it to $ 10

On the other hand, the upper trend line of the parallel ascending channel rejected LINK’s price twice in a row on 24 and 25 October. If the 50-SMA fails to hold, the price can easily slide towards the $ 10 support level.

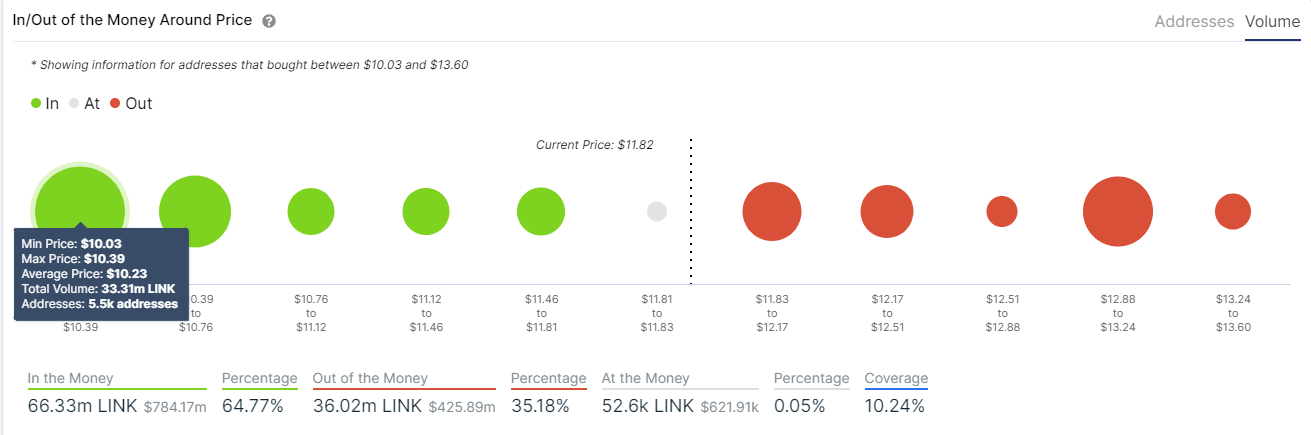

LINK IOMAP chart

The In / Out of the Money Around Price appears to confirm this theory as it shows very little downside support up to the $ 10.03 to $ 10.39 area, which has around 33.3 million LINK in volume.

The bullish breakout of the REN looks weak

On the daily chart, the REN price has established an ascending triangle. On October 11, the digital asset had a whopping 38% breakout but was not followed up. A week later, the price fell towards $ 0.33 to test the resistance level again as a support level.

REN / USD daily chart

Unfortunately, the support level did not hold and the REN price slipped below it and the lower trend line of the ascending triangle but managed to defend the 50-SMA and 100-SMA. A bearish breakout below both of these SMAs can push the price of the REN down to $ 0.17.

REN facing very little resistance to the upside

However, considering the strong buying pressure the digital asset is undergoing and how there is very little resistance to the upside, REN can easily continue with its uptrend. It needs to break through $ 0.33 in the short term.

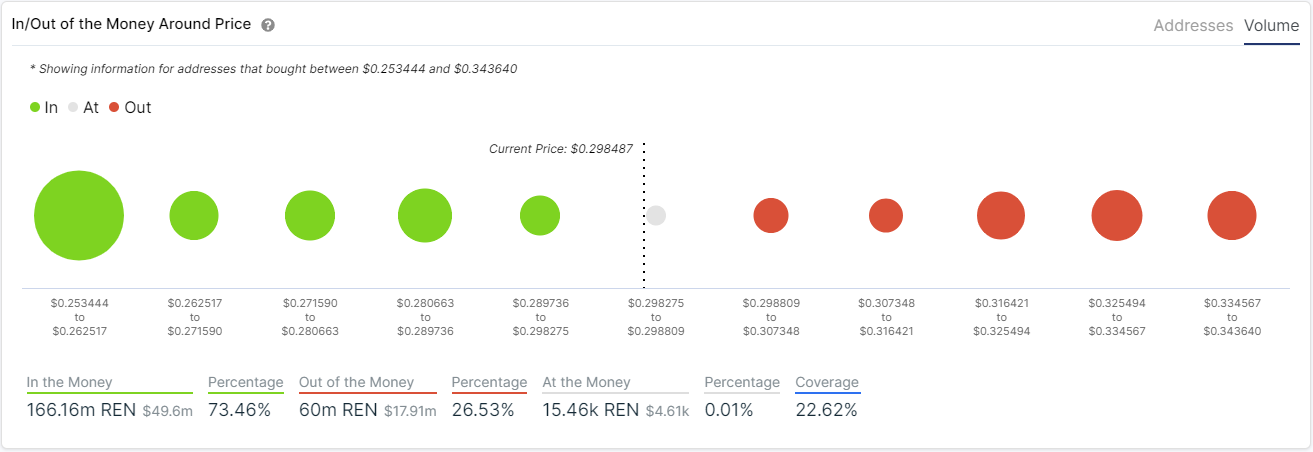

REN IOMAP chart

The In / Out of the Money Around Price chart shows no opposition up to $ 0.34, which is perhaps the most notable but still relatively weak resistance area relative to the underlying support. A breakout above $ 0.33 can push the REN to $ 0.35.

.[ad_2]Source link