[ad_1]

[ad_1]

TRX / USD is considered by some to be one of the undervalued assets of the encrypted market. Since the end of its migration to its Mainnet, it has been good news for good after the other. This news will have no doubt, will support the fundamental positive prospects for TRON and will offer the opportunity to this crypto resource to take its true place in the market.

Fundamental Outlook

The latest news for TRON is its listing as a payment method on the CoinPayment platform. This made the cryptocurrency available for use with 2.2 million merchants to pay for goods and services with this encryption. This move will serve to increase the adoption of TRON going forward.

The 30 th in August, the official Tron Virtual Machine will be integrated into the TRON Mainnet, which will make it possible for developers to create decentralized applications (Dapps) on the network. These two events are positive for TRX and we could see a little of that positivity that reflects in the TRX / USD pair.

Technical Outlook

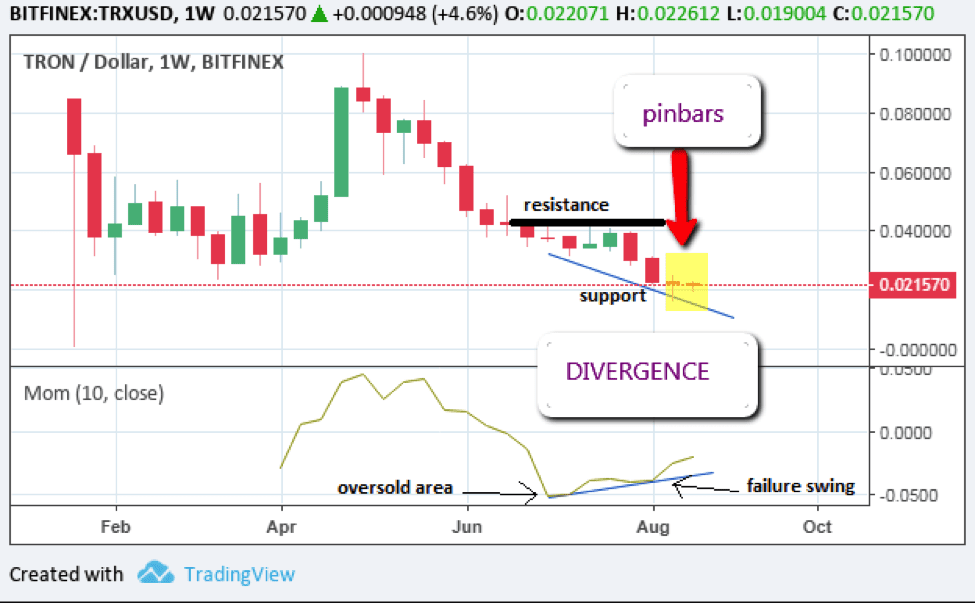

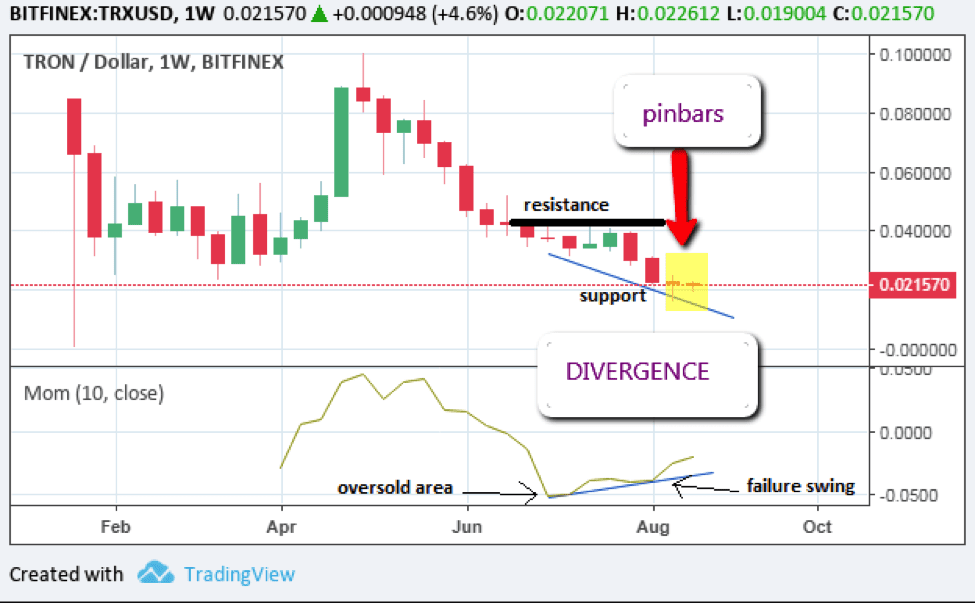

True technical analysis begins with long-term prospects for good. For TRON, we look at the weekly chart for our analysis for the week. Unlike Bitcoin and Ethereum, Tron does not have much history on the weekly chart, having been launched in 2017. Therefore, we basically have a one-year history to analyze. The TRX / USD table is shown below:

TRX / USD Weekly Chart: 29 August 2018

There are basically two key points to keep away from this chart:

- The indicator of the moment has formed two price ranges that tend towards the high. This is due to the fact that the price action has formed two price cuts that are lowering. This is a sign of divergence.

- The shaded area on the descending support line reveals the presence of two pinbars. The price level here is 0.021570. This price level also corresponds to the long-term support level (red dashed line). We can see the pinbars that rest firmly on this support line.

There are two possible scenarios on how this configuration will evolve.

Trade Scenario

By putting all these points together, we see only one possible result for the price action on TRX / USD: an upward reversal. This is based on the bullish pinbar on the support line, as well as on the back of the divergence situation.

We would also note that the momentum indicator constituted the first trough in the oversold area, while the 2 nd trough was unable to reach the oversold area. This in technical analysis is what we call the "swing failure". It is an inversion signal, and this adds credibility to the expectation that the price of the TRX / USD should reverse the trend towards the high

Any price movements [19659003] So what would be the prospect for the TRX / USD pair in the future?

A bullish reversal seems very likely. However, this is a weekly candle, so any real movement to use for commercial items needs to be done off the hourly charts. It is likely that the next weekly candle may still have some downward movement, but this candle should not close below the support trend line.

On the upside, every bullish rally will have to deal with a firm resistance that stopped its land at the 0.040000 mark. So any long trade that is taken to follow the expected bullish price hike will have to consider this area of resistance as a possible exit point. Traders with a bearish sentiment on TRX / USD will also try to use this area to sell at rallies.

Market sentiment:

The long-term, medium and short-term prospects of the TRX / USD pair are:

- Long-term – Bearish (could change soon)

- Medium-term – Bullish

- Short-term – Bullish

Disclaimer

Note: this analysis was performed on a weekly chart. It takes a whole week to form a candle, so these moves may take several weeks. Entries should be made on graphs at shorter time intervals such as the daily chart.

This piece is for educational purposes only and should not be construed as a recommendation to buy or sell ETH at any price. The cryptocurrency markets are very volatile and require the user to be well funded and have a good amount of trading experience.

[ad_2]Source link