[ad_1]

[ad_1]

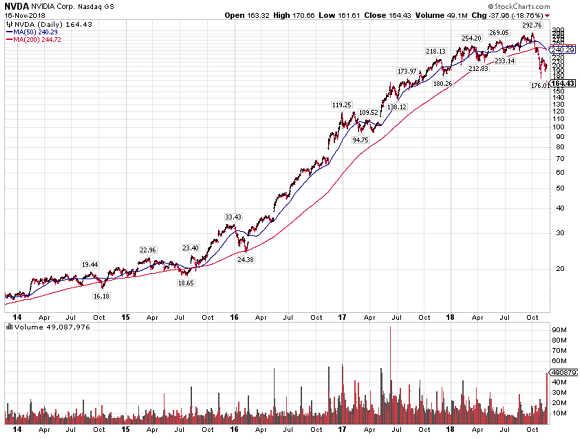

Last Thursday NVIDIA (NASDAQ: NVDA) issued a revenue guide for the current quarter of $ 2.7 billion, dropping well below analysts' consensus estimates of $ 3.4 billion. The one guilty? The bitcoin deflagrating bubble!

Some explanations on earnings and notices on revenue that you can not recover.

The craze of global cryptocurrency – not just for bitcoins but similar absurdities – has led to a strong demand for graphics processing units (GPUs), of which NVIDIA is a leader, since they are used to perform the necessary calculations to "extract" cryptocurrencies. While the air quickly left the global crypt, the extraction of those useless lines of code has become less profitable and therefore the demand for GPU has rapidly decreased!

The graphs are for illustrative and discussion purposes only. Please read the important information at the end of this comment.

Of course, NVIDIA chips are not just about bitcoin mining, but are vital for a range of other applications focused on the global phenomenon of artificial intelligence (AI). As a manufacturer of some of the most advanced chips on the market, NVIDIA will survive the disappearance of bitcoins and other similar absurdities. To observe in real time how cryptocurrency craze is imploding, you can visit coinmarketcap.com. (For more information, see Marketwatch, December 14, 2017 "Because bitcoin is now the biggest bubble in history, in a chart.")

As I have explained several times before in this column, the term "market capitalization" when used to describe a cryptocurrency is absurd. Market capitalization is the abbreviation of "market capitalization" or the total value of all publicly traded shares of an operating company. It is assumed that all earnings (or cash flows) are discounted for all investors in the company's shares (dubbed "the market") and can therefore evaluate the company in this way.

The way we know bitcoin, and all other encrypted ones, is a bubble, making a glaring observation that it is not able to produce any cash flow, making the term market capitalization absurd. This does not mean that blockchain as a technology can not be useful without the unnecessary passage of buying a digital token called bitcoin, which is calculated to limit the amount of bitcoins to 21 million and then increase their price as poorer insinuate in this line of code in search of wealth. (For more information on Marketwatch, December 19, 2017, "Opinion: Bitcoin perfectly traces the main phases of the bubble").

As history has shown on several occasions, most bubbles end with most investors losing huge amounts of money while holding and hoping the bubble is reflected. Unfortunately, after the bursting of bubbles, it may take decades to recover and "take out" the price of the bubble, or, in the worst case, disappear. I think bitcoin will be a situation of worst case scenario.

The graphs are for illustrative and discussion purposes only. Please read the important information at the end of this comment.

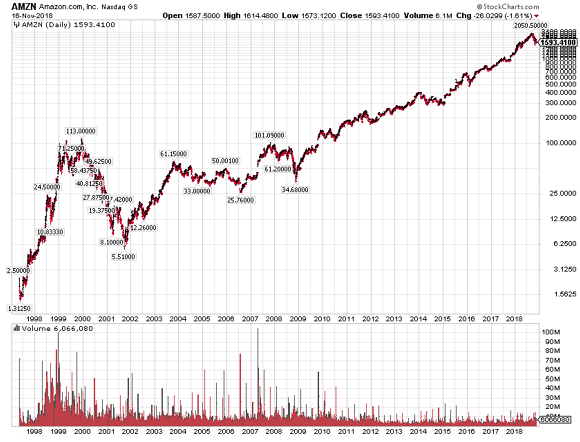

One case in particular is Amazon.com (NASDAQ: AMZN), which made its founder Jeff Bezos the richest man in the world. It was a bubble (fast-growing price without earnings). But this is no longer the case as it has increased sales and profits and is expanding into new businesses. Amazon sales were up in 1997-2000, but so were its losses. The more sales he had, the more money he lost, so the stock is overvalued in the dot.com bubble of 1999. That's why it went from $ 113 to $ 5.51 after dot.com bubble burst in 2000- 02.

Then, when Bezos turned it around, Amazon became the company that had institutional and on-board support for the longest of any big business without making money, bringing all cash flows into business growth. The stock has become parabolic without becoming a bubble. In the 2018 fiscal year, AMZN has revenues of 233.37 billion dollars, while in 2019 it is estimated that increases of 21.3% to 293.11 billion dollars, based on consensus analysts' estimates. So, AMZN will be more than half the size of Walmart (NYSE: WMT), the largest retailer in the world, but growing much faster than Walmart.

That's why Jeff Bezos is the richest man in the world and probably will become richer, if he is not decomposed by the Trump administration or by any subsequent administration for that matter, which is not the way I act cheer for a satisfied customer. After all, they did it for Standard Oil and AT & T.

(Navellier & Associates holds NVDA, AMZN but not WMT in managed accounts. Ivan Martchev and his family do not own NVDA AMZN or WMT.)

My technical point of view on Bitcoin

My job requires me to speak with many clients about the broader picture when it comes to their investments. Therefore, I am much more oriented towards the macro and I try to see through short-term market rotations. But, if one is poised for a couple of decades in the trenches of the fascinating world of finance, sooner or later one comes to know something about the use of graphs.

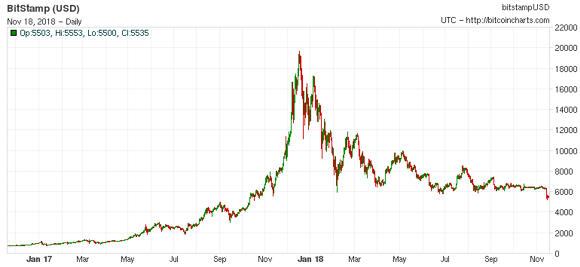

To be absolutely clear, I will never make an investment by looking at a chart alone. I have to understand what makes the "tick" chart and what makes an investment increase or decrease, as in the case of specific actions. Since there will never be profits, or cash flow for this, generated by bitcoins, never, it is conceivable that it will go to zero, nada or zero. It does not take a genius to understand it.

The graphs are for illustrative and discussion purposes only. Please read the important information at the end of this comment.

That said, let me put on the hat of my amateur technician. It seems that the bitcoin has dropped below a support level of more than 6000. The chart shows decreasing peaks and even lows that were eliminated last week at that key level. If you read that the chart is 6000, the minimum that was hit after the top was set on December 18, 2017 and 12,000 is the first major rebound below the minimum climate, then the bitcoin chart has formed a "wedge" bearish "or a" descending triangle "pointing from 12000 to 6000. The measured displacement of that break is 6000 below the breaking point (or the width of the triangle).

In other words, the Bitcoin chart suggests that it will go to zero. What about apples?

Revelation: * Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Click here for important information found in the "Information" section of the Navellier & Associates profile that accompanies this article.

[ad_2]Source link