[ad_1]

[ad_1]

The cryptocurrency ranking by market capitalization is by far the most discussed metric to evaluate success. But is there another indicator to which we should also think?

Market capitalization is a lie.

Buy support tells the true story.

Buy support evaluation separates investments from games. "From now on ALL should stop using CoinMarketCapDotCom and start using https://t.co/DoGlQsSv0l #Bitcoin

– Mr.Hodl🌕🍿[Jan/3🔑₿] (@MrHodl) 3 December 2018

According to Alexa's charts, the most popular crypto site is coinmarketcap.com. Today it is in the top 400 websites globally, but in the early months of 2018 it was briefly among the top 100 most viewed websites in the world.

One of the problems of using market capitalization as a parameter to determine the success of a project is that it does not take into account any potential liquidity to maintain a certain asset price.

Over the years, we have seen many new projects quickly conquer the market capitalization rankings based only on a few transactions on an obscure and low-volume exchange.

Another problem is that market capitalization has nothing to do with the amount of money invested in a project. It only shows the perceived value of the market and is an inadequate metric to assess the flow of funds within and outside of a given ecosystem.

A different approach

For these reasons, a much better metric to use is market liquidity. The coinmarketbook.cc data keeps track of this.

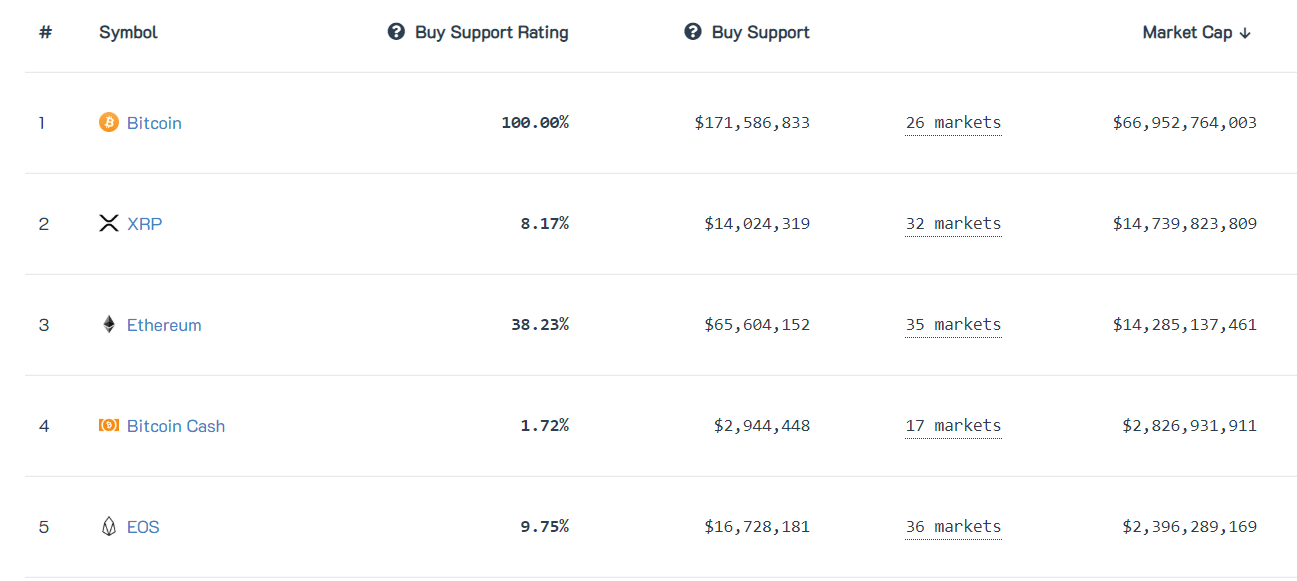

The website tracks "Buy support" for each cryptocurrency. It does so by processing the "sum of purchase orders 10% away from the highest bid price".

The website collects data from important exchanges including BitMEX, Binance, Bithumb, Bitfinex, OKEx, Huobi, Bittrex, Poloniex, Kucoin and Cryptopia. The data also take into account both spot and leverage liquidity and also make the purchase support calculation based not only on USD, but also on liquidity.

Another indicator of the novel used by the site is the "Buy Support Rating" column. This is calculated as a percentage by taking the support given in the purchase of any BTC-related altcoin.

Looking at the data

As you can see in the snapshot of the above data, even if Bitcoin dominates over 50% in terms of market capitalization (compared to all other projects), it has a much greater advantage in terms of support to the market. purchase, with over $ 170 million available buy up to 10% below the current negotiated price.

In second place, the purchase support rankings are not Ripple (XRP), but Ethereum (ETH). Ethereum has 38% of Bitcoin purchase support compared to only 8% of Ripple. In fact, even EOS has more support for purchases then XRP – a project with over six times less market capitalization!

[ad_2]Source link