[ad_1]

[ad_1]

Yesterday, the Nasdaq listed Netfin announced that it has completed its “ business combination ” with Triterras Fintech, the Singapore-based company that owns the Kratos blockchain trade and finance platform. As part of what Triterras is actually listing as a unicorn, some revenue and other financial details have been shared.

Netfin was a special purpose acquisition company (SPAC) with more than $ 250 million on its balance sheet. In June, when the deal was first revealed, the announcement said Triterras’ pre-money stock value would be approximately $ 670 million and post-money $ 939 million.

With a current price of $ 12.15 and 83.196 million shares, the merged company is worth just over $ 1 billion.

Founded in 2018, Triterras developed the Kratos platform using Ethereum’s blockchain technology and focuses on the digitization of trade and trade finance processes. The aim is to reduce the inefficiencies and discrepancies that arise from the card exchange process. At the same time, blockchain can help prevent fraud by making it more difficult to forge documents and speed up the trade finance process.

By drawing on alternative financing sources

The Singapore-based company focuses on commodity trading and especially small businesses. Jim Groh, EVP at Triterras, told Ledger Insights: “It is for the PMI trader who earns $ 300- $ 500 million annually with four to fifteen people and would benefit from outsourcing a technology solution and solution. that we bring in terms of alternative loan sources “.

In particular, the company claims that trade finance does not come from banks but from specialized companies. This year he hired ten lenders, including specialist commercial finance companies and general credit funds. They combined $ 17 billion in assets under management against a projection of $ 2.5 billion in commercial funding for Kratos this financial year. The company also points out that because the credit is short-term, the resources actually needed are likely closer to $ 1.5 billion.

“What we are seeing is really a deluge of banking capacity leaving the market,” said John Galani, COO of Triterras, in a recent presentation to investors. “So there are very, very large banks that have pulled out. The other banks that presumably remained in that market have all moved up to MNC levels – multinational corporations with large balance sheets. “His view is that for SMEs and transactions under $ 10 million, not worth it for banks.

An alternative perspective was conveyed in the comments to a Financial Times article. The person noted that the numerous commercial finance platforms “group banks into groups of 4 and 5” and feared that they “contribute to the future of the sector by promoting fragmentation”.

Another point of view could be that commercial finance is becoming increasingly commodified.

Impressive figures

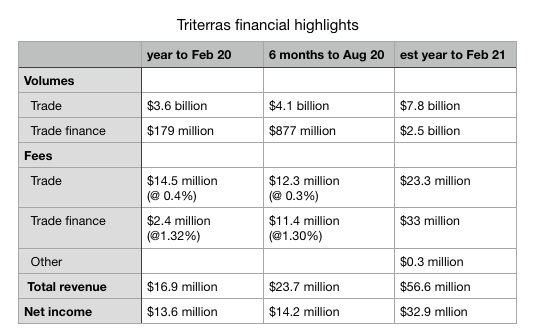

Meanwhile, some of the figures Triterras shared during investor introductions were quite impressive. Kratos charges 0.3% of the commercial value for using the digitization platform and another 1.3% if the commercial finance is financed through the network. It was noted that Kratos’ commissions had already dropped for trade from 0.4% to 0.3%. The explanation given was that 0.4% was a premium when users were using the platform only for commerce and doing the financing elsewhere because Kratos had not yet launched its financing solution.

In the year through February 2020, trading volumes were $ 3.6 billion and in the six months through August, it processed $ 4.1 billion. Trade finance is a relatively new add-on, and the figures for the past six months are $ 877 million processed. Revenues earned by Triterras were $ 23.7 million during the six months with a net profit of $ 14.2 million.

But the industry is becoming increasingly competitive. Singapore has another platform, dltledgers, which has processed over $ 2 billion in transactions to date. The commodity trade finance platform komgo also passed the billion mark. Then there are the main banking platforms we.trade, Marco Polo and Contour, not to mention numerous others. But aside from some of the big Chinese platforms, Triterras is doing pretty well. Plus, it now has deep pockets.

To update: The original article incorrectly included Cargill, Louis Dreyfus Company, Glencore & Gunvor as clients based on an investor presentation. This was intended to establish the industry not Triterras’ customers. Even the original said that 90% of the lenders were not banks, but it is 100%.