[ad_1]

[ad_1]

Three trends defined Ethereum DeFi in the third quarter of 2020:

1) The Rise of Automated Market Maker (AMMs)

2) Governance tokens and agricultural yield

3) Forks, derivatives and network effects

4) and “strange DeFi”.

The Rise of Automated Market Maker (AMMs)

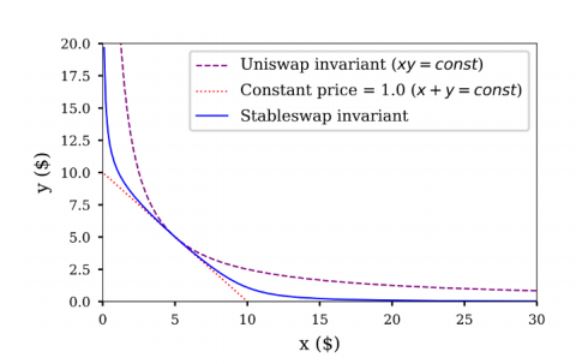

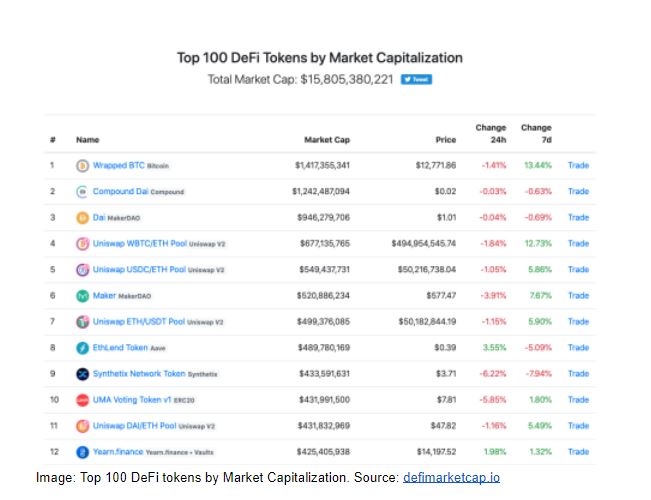

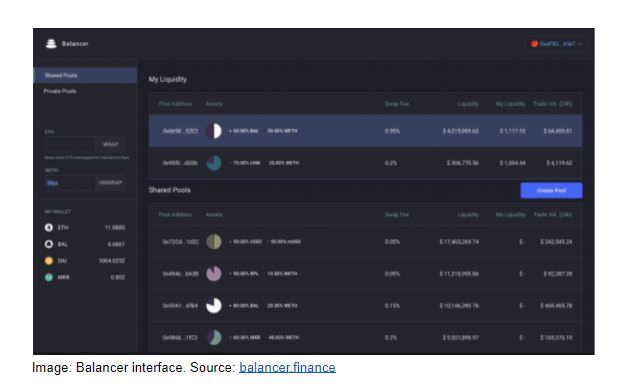

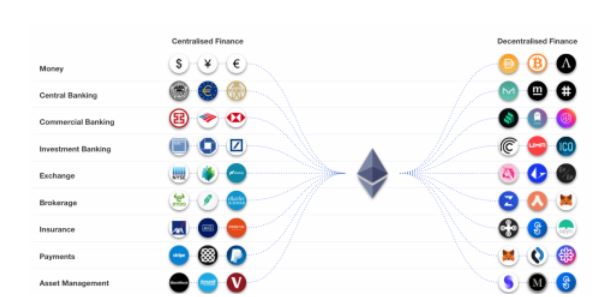

Fashion: While stablecoins and lending platforms have long been the hubs of the DeFi ecosystem, the third quarter created a number of compelling new decentralized exchange (DEX) business models. Since Ethereum’s inception, there have been a number of ways to trade tokens, from more traditional order book methods to token-based models. It is clear that there are some security and price advantages that DEXs have over their centralized counterparts. However, it wasn’t until the third quarter of 2020 that decentralized exchanges could really be said to have arrived. In September, Uniswap’s trading volume was $ 15.4 billion, nearly $ 2 billion more than Coinbase in the same month. DEXs using automated market maker (AMM) software now account for 93% of the decentralized exchange market. While Uniswap, Curve and Balancer remain some of the largest AMMs, a whole new crop of DeFi companies has sprung up in the last quarter. The third quarter saw some of these new companies try different approaches to create optimal prices for the token exchange and avoid temporary losses.

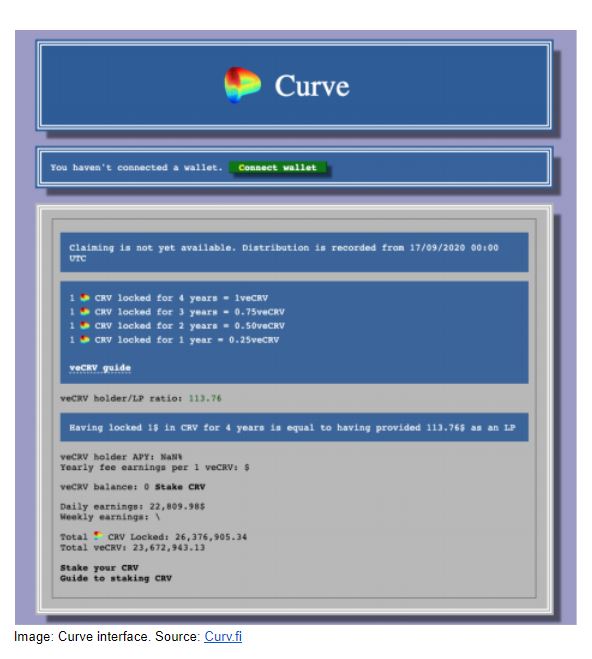

The importance: The AMM platforms were able to simultaneously achieve three results this quarter; have worked to rapidly increase liquidity for hundreds of different token pairs, provide a robust decentralized option for token trading, and benefit a wider community of individuals who add liquidity to an exchange by rewarding them with new governance tokens. These new tokens – think of them as economic participation or voting rights in some cases – are an important unique invention of Ethereum. For example, users who deposit USDC in Curve receive cUSDC in exchange, which accumulates value over time as the user collects trading fees. The success of AMMs in the third quarter proved that AMMs were ready for the mainstream, so much so that the total value of AMMs on Ethereum exceeded $ 4 billion. Instead of Wall Street market makers or centralized cryptocurrency exchanges reaping the lion’s share of trading fees, AMMs have provided yields and voting rights to anyone willing to add liquidity to a contract, whether verified or not. When did a borrower first earn a return on a debt from their lender?

Agricultural governance and production tokens

Fashion: Following the release of Compound Finance’s $ COMP token in Q2, we expected Q3 to continue the proliferation of governance token launches. We also expected these launches to be used in part to boost liquidity in DeFi protocols and to empower token holders to vote on changes to protocol designs. Yield farming, a new concept in the third quarter, can be described as a way to seek the maximum reward for putting the various resources of Ethereum to good use. Each of them used different strategies and had varying degrees of success, we saw $ BAL, $ CRV, $ UNI, $ YFI and others launched in the third quarter.

The importance: The incentive of yield farming to generate governance tokens has both instigated and exploited some of Ethereum’s most unique properties. As yield growers shifted liquidity into different pools to gain yield, a strong speculative bull market from DeFi created rapid and high demand for new types of governance tokens and pushed Ethereum gas costs to all-time highs. Likewise, governance tokens like Uniswap’s $ UNI introduced a new model for launch by giving $ UNI tokens to each Ethereum account that had previously interacted with the 400 protocol. While the summer created a frenzied rise and fall of different yield opportunities, we expect these new inventions to reward people who provide liquidity to stay. This is especially likely as the user experience improves, key management becomes more decentralized, and people providing liquidity can earn more attractive interest rates than a legacy bank account or asset.

Forks, derivatives and a growing network

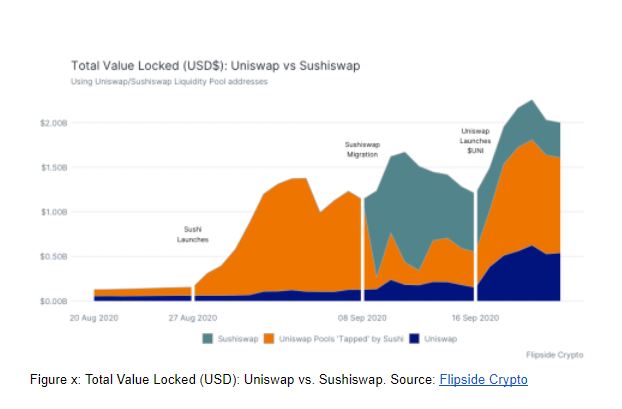

Fashion: This quarter was also not without a myriad of forks, imitations and (most importantly) meme-based tokens that attempted to capitalize on the popularity of AMMs and produce agriculture. SushiSwap and CREAM launched as a fork of Uniswap and Compound. The details and data surrounding these forks have brought to light how network effects, community popularity, and even the very nature of open source software are unique to DeFi.

The importance: The potential ability of anyone to fork and duplicate open source code has long been a concern and the subject of game theoretical analysis in the Ethereum and DeFi communities. The argument against the perceived disadvantages of public code has been the resilience of network effects, which theoretically serve as protection against a protocol that suddenly loses all of its users to an identical competitor. SushiSwap was launched as a fork of Uniswap and CREAM was launched as a fork of Compound. In some cases, these forks have provided new mathematical models for protecting against temporary losses and slips on trading pairs. Their varying degrees of success, however, highlighted the negative side effects that left some creators and network participants burned. This opens up a critical discussion and raises questions about the legitimacy of anonymous token founders and, more generally, questions the ethics of using the imitative code for personal gain.

Strange DeFi

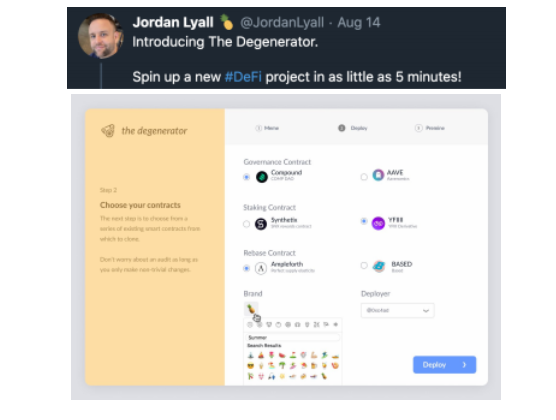

Fashion: In addition to creating financial protocols, DeFi has begun to incorporate the memetic culture of the Internet into the lexicon. Speculation resulting from interest rate maximization (i.e., agricultural production) has been largely driven by conversations on social media and chat channels like Twitter, Telegram, and Discord. It’s impossible to overstate the dizzying pace of DeFi activity in the third quarter and the role of these social channels in driving much of it. Of particular note is the concept of “Weird Twitter”: a subset of social media filled with absurd humor and the Internet subculture. This approach has extended to DeFi, as projects like Based.Money and Meme Protocol (“Don’t Buy $ MEME”) have become popular with crypto influencers. The same speculators began to call themselves “degenerate” investors, taking high-risk bets on new forks and anonymous protocols and exposing themselves to 1000% returns, as well as scams and big losses, or “carpet shots”.

Jordan Lyall of ConsenSys posted a picture of the DeFi project generator on Twitter as a joke and inadvertently initiated the Meme protocol which has a market cap of over $ 5 million less than 3 months later.

The importance: While the trend may seem absurd, we note that Internet culture and crypto assets have long been linked, both in terms of economic philosophy and community distribution. As investors began to see financial activity as a game, the result created protocols that combined money with visual imagery and self-referential humor. This in turn led to the creation of projects that used financial mechanisms such as asset collateral for a

synthetic return in order to earn collectible social assets, such as images, cards and other non-fungible tokens. As a result, cryptocurrency tokens known as non-fungible tokens or NFTs (ERC-721, ERC-1155) began to grow significantly and to be linked to protocols with large financial volumes. Cryptocurrency and collectible markets such as Rarible and OpenSea saw the volume of purchases increase in the third quarter. Personal and social tokens have also flourished through projects like Roll and Async Art.

To read the full DeFi Q3 report: https://consensys.net/insights/q3-defi-report/