[ad_1]

[ad_1]

Latest news from Ripple

The Financial Intelligence Center (FIC), the Financial Sector Conduct Authority (VCA), the National Treasury (NT), the South African Revenue Service (SARS) and the South African Reserve Bank (SARB) have presented the first in-depth consultation the paper asks public participation before policy makers develop the first cryptographic regulation of this kind in South Africa.

To read: Plus One For Crypto: Mastercard fined $ 650m for inflating expenses

Like most countries, cryptocurrency in Africa's most developed economy remains unregulated. However, the country's tax collector not only warns investors against the risk of trading or investing in risky assets, but has imposed levies on encrypted capital gains.

However, the global nature of these resources makes it very difficult for lawmakers to implement appropriate policies without hindering innovation. It is for this reason that public participation is important. While highlighting what local investors are willing to reap from favorable policy, a standout will be the way the crypt remains a censorship-resistant resource whose prices remain immune to localized political or economic events.

Read also: Coinbase opens bank transfers, OTC trading and custody services for selected customers in Asia and Europe

Ripple, as a network that focuses on creating adaptation solutions for banks and financial institutions, will benefit immensely from favorable regulations not only in SA, but if others will follow the example. From the reports, James Preston, responsible for a project that followed the development of cryptography in South Africa, said:

"Having carefully read the SARB consultation document on the regulation of cryptographic resources in South Africa, it is clear to me that they want to be as progressive as possible without hindering and violating the security of South African central banks."

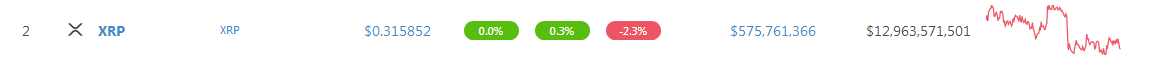

XRP / USD price analysis

The bears seem to recover yesterday's gains, but the bulls have the upper hand. As we have pointed out, the XRP / USD trajectory is increasing and, after deep corrections of the 2018 highs, it is natural for prices to come back and realign with our anchor bar. But, considering the laxity around the momentum, we are neutral but net bullish. The only time for commercial execution is when the XRP rally leads to prices above 34 cents, triggering the risk of purchases and 40 cents.

Trend agreements and candlesticks: positive, bullish

As already mentioned, the general trend is bullish. But in the short term, sellers are in charge, suppressing prices below 34 cents of minor resistance. Nevertheless, as long as XRP trends exceed 30 cents, there is a real possibility that the recent accumulation is the impetus for net earnings above 40 cents. After all, we are trading in a bullish breakout model. With immediate support at the Fibonacci retracement level of 78.6 percent in December 2018 high low or at 30 cents, we are confident of the trendy shoot.

Volumes: thin, bearish

Candelabra indicate bulls, but prices are consolidating with an average attendance of 18 million for yesterday's closing. This is nothing compared to the Jan 10 bar which records 83 million. Ideally, huge volumes – over 18 million and even 83 million, should push the main bar to trigger a 30-cent price reversal.

All graphics courtesy of Trading View.

This is not an investment advice. Do your research