[ad_1]

[ad_1]

- Cryptocurrencies have awakened from there to sleep at low levels and bounced.

- All three major digital currencies have important support lines and upside potential.

- Here are the levels to be observed according to Confluence Detector, our proprietary tool

After a long period of sleep at low levels, the cryptocurrencies are finally waking up and smelling the coffee. Are they going to enjoy a Santa Rally? There does not seem to be any significant trigger for the increase.

Did the whales begin to accumulate after the big landfill? While some coins are still worth half of their value before November 14, awakening is a positive development.

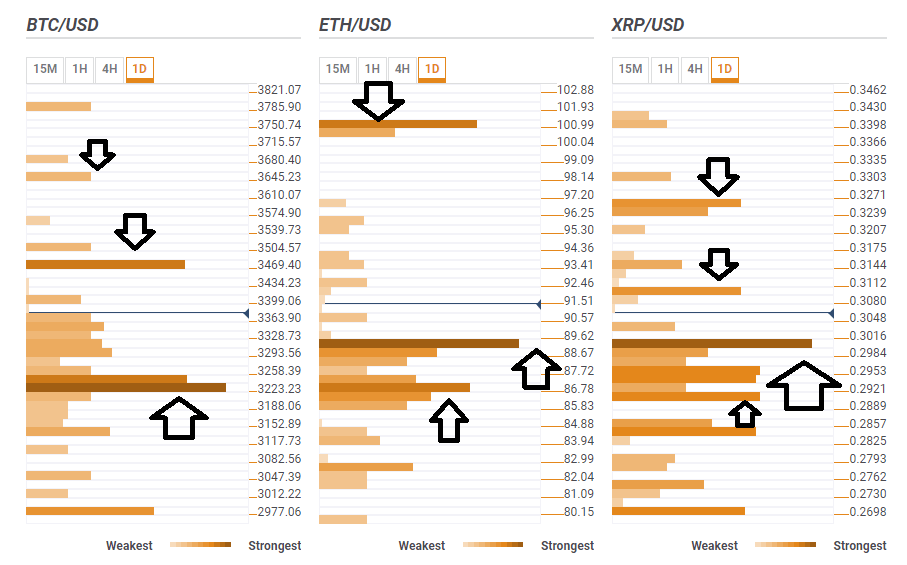

BTC / USD over support, next obstacle $ 3,469

Bitcoin rebounded above $ 3,000 and outperformed $3,223 which is a dense mass that includes the simple 50-1h moving average, the SMA 200-15 minutes, the Bollinger Band 4h-Middle, the Fibonacci 61.8% a day, the SMA 10-4h, the SMA 5-4h, the Bollinger Band 1h-Middle and more.

The next support line is a $3,133 where we see the confluence of 161.8% of Fibonacci of a day and of the support of a day of Pivot Point 2.

The upward target is $3,469 that is the meeting point of the minimum of the previous month and the Fibonacci 61.8% per week.

The next upward target is $3,645 that was the maximum of last week and also the BB of an average day.

ETH / USD observes $ 101

Also the digital currency of Vitalik Buterin has exceeded a considerable level: $ 89.20 is the convergence of SMA 10-a-day and Fibonacci of 38.2% per week.

It is supported by $ 86.78, where Fibonacci converges 23.6% per week, SMA 10-4h, BB 1h-Middle and SMA 5-4h.

Resistance for ETH / USD waits at $ 101 which is the confluence of the BB of an average day, the minimum of the previous month and the maximum of last week. It is the next upward target for Ether.

XRP / USD supported exactly at $ 0.30

Ripple made a nice move higher and passed the round number of $00:30. It turned out to be a remarkable result because the round number sees a concentration of levels: SMA 50-4h, SMA 10-one-day, Fibonacci 38.2% per week and BB 1h-Upper.

Further down, there are some pillows, with $.2911 stands out as a meeting point between SMA 50-1h, SMA 200-15m, Fibonacci 61.8% one day and BB 4h-Middle.

Some resistance waits for XRP / USD to $0,3096 where we see the cluster including the PP in a day R3, the Fibonacci 61.8% per week and the previous 15 minutes high.

The upward target is $.3250 that is the maximum of last week and the minimum of last month.