[ad_1]

[ad_1]

- Cryptocurrencies are improving with Ethereum driving the charge.

- Bakkt, a futures exchange ready for launch, raised funds from Microsoft and others.

- Here are the levels to be observed according to Confluence Detector, our proprietary tool

The cryptocurrencies kick off 2019 with Ethereum extending its earnings. Constantinople update for Ether has led investors and speculators to accumulate in Vitalik & # 39; s Buterin's wits. Other digital coins are raising their heads after a few days.

Even more important for Bitcoin and the wider blockchain world, Bakkt managed to raise $ 182.5 million from Microsoft, Pantera Capital, BCG and others. Bakkt completed this round of financing to become a reliable broker or gateway for institutional traders looking to switch to digital currencies. The ICE project also aims to facilitate the use of BTC in cross-border money transfers. After several delays, fundraising promises a launch that will come soon enough. Project leader Kelly Loeffler sees an active year in criptos.

Another mainstream development, a Bitcoin ETF, is still expected and expected by the end of February. The SEC is set to approve or disapprove SolidX and Van Eck's request for this financial instrument.

With this promising start of the year, what prices should we look at?

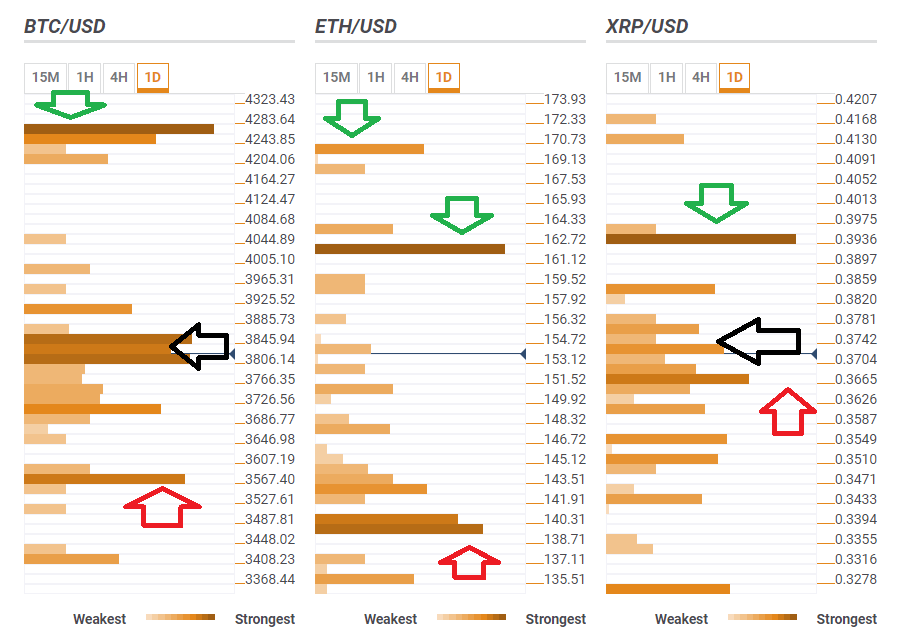

BTC / USD eyes $ 4,263

Bitcoin, the grandfather of cryptocurrencies, is struggling in a range of $3,806 and $ 3,845. The area is a dense cluster of technical levels including the Simple Moving Average 10-15m, the Fibonacci 61.8% a month, the Fibonacci 23.6% a day, the Bollinger Band 15 minutes Upper, the SMA 10 -1h, SMA 10 -1d, BB 15min-Middle, SMA 5-1h, Fibonacci 38.2% one week, SMA 5-15m, BB 1h-Middle, BB 15min-Lower, SMA 5-1d, Fibonacci 38.2% 1d and SMA 50-15m.

If it breaks higher, the next level to look at is $4,363 where we see the Resistance of a month in PP 1, last month's maximum, the PP 1w-R1 and the SMA 50-1d.

Looking down, $ 3, 567 it is a significant support where we see the PP 1m-S1, the Fibonacci 38.2% at one month and the PP 1d-S2.

The ETH / USD has its sights set on $ 170 as a second goal

Ethereum drives cryptographic charts with its increase and continues to move higher. Remarkable resistance waits for $162 that is the meeting point of the last month's maximum and last week's high.

Higher, $170 is the confluence of a month's Pivot Point R1 and a 100-one-day SMA.

Some support awaits for $142 that is the convergence of the Fibonacci 23.6% of a month, the Fibonacci of 38.2% of a week and the Fibonacci of 23.6% of a day.

Lower, $139 it is a crucial support line that includes BB 4h-Middle, SMA 5-one-day and SMA 100-1h.

The XRP / USD is equal to $ 0.3936

Ripple is currently struggling for $.3740 which is a cluster that includes SMA 5-1d, the previous daily high, BB 15min-Middle, SMA 5-1h, SMA 5-15m, SMA 10-15m and the previous 4h-high.

Significant resistance waits for $.3936 that is 61.8% of Fibonacci at one month and the one-day resistance at Pivot Point 3.

A cushion awaits XRP / USD for $.3665 where we see the previous 4h low, the SMA 100-4h, the SMA 100-15m and the SMA 100-1h.