[ad_1]

[ad_1]

Latest news from Ripple

Ripple, the company's software solution provider, slowly sets up tracks for Convergence? From the point of view of things, that could be the ultimate goal that confirms what Jim Chauncey-Kelly, the director of Talents Acquisition of Ripple, stated in an interview as the reason why the company was reinforcing, assuming engineering in the first half of the year.

Update xCurrent 4.0

Read the number 6 pic.twitter.com/OyB8ugPaZk– Knutzi (@KATB_norge) November 20, 2018

Convergence is a solution that recovers xVia – an API solution, xRapid – a payment access that uses XRP and xCurrent: a business software solution that allows banks to immediately settle cross-border payments with end-to-end monitoring. Remember, before upgrading xCurrent to version 4, Ripple changed the layout of the home page.

Previously, Ripple joined xVia, xCurrent and xRapid – which is in use by four companies that help move funds seamlessly between Mexico, the United States and Europe – under "Global Payments" on their homepage fueling the speculations that Convergence would be a reality from the end of the year.

Despite the excitement, banks are slow to improve. American Express and Santander are the only ones but have yet to incorporate xRapid even though Brad Garlinghouse is optimistic that "big banks" will integrate with xRapid by the end of the year.

XRP / USD price analysis

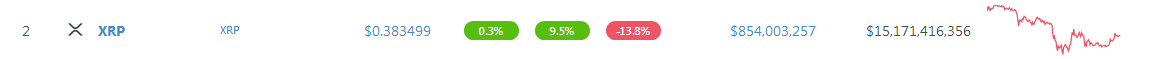

There is an increase in the market, a general recovery and various digital resources are back to the green after 14 days of slaughter. At spot prices, XRP / USD rose seven percent in the last day, but fell 14 percent in the last week. This 35 cents retreat is slowly reaffirming our previous bullish position. As long as XRP / USD is trending within the support area from 35 cents to 40 cents, we may even see prints at or above the October highs.

Trend: variable, bullish

As in previous XRP / USD business plans, we will maintain a bullish prospect as prices have not fallen below 35 cents, the lower limit of our support zone. From the arrangement of the candles, it is clear that the bulls are in charge. That not all prices range from 20 cents with resistance to 60 cents.

As long as prices vary, buyers have an advantage. For this reason, conservative traders must start positions once there is a convincing break above 60 cents or falls below 35 cents.

Volume: increasing, bullish

Regardless of the bars identified in the previous XRP / USD analysis, November 25 is new. Note that, although the market is in free fall, on November 25th it printed a pin bar directly from the main support line at 35 cents.

In addition, the volumes were above the average – to 182 million against 92 million and, curiously, prices have accumulated inside this bar and the bulls are not yet completely above the maximum of 40 cents.

Candelabra formation: bullish up bullish, bull flag

Clearly, the increases in the 2018 set led to price breaks above the multiple resistance levels. That was a clear bull's throw. Although the confirmation has not been so strong, we expect a three-month follow-up from the trend that defines the September rise.

In our case, prices are rebounding on the bull's flag basis and traders can start two positions – once above 40 cents and after 60 cents – depending on their risk appetite.

Conclusion

Technically, the XRP bulls were and continue to be responsible despite low minimum attempts. After today's awakening set with the 25-pin bar, we expect buyers to push prices above 40 cents by triggering short-term long-term goals with 60-cents.

Subsequently, assuming that there is a solid close above the highs of October-November, conservative traders can buy pullbacks in shorter times with the first target at parity and $ 1.65.

All graphics courtesy of Trading View.

This is not an investment tip. Do your research.

[ad_2]Source link