XRP was one of the few cryptocurrencies that remained unchanged over the past month despite the strength of the cryptocurrency market. However, on November 20, the bulls woke up, pushing the XRP price towards the new 2020 highs of $ 0.78, a 180% increase, outstripping many altcoins.

On November 25, along with the rest of the altcoins and Bitcoin, XRP recorded a significant correction down to $ 0.459, from which it is currently trying to recover.

XRP price crepe ascending triangle

On the 1-hour chart, XRP formed an ascending triangle with the trend line above $ 0.574, which was broken two hours ago with much following by the XRP bulls. The current price of the digital asset is $ 0.616 and continues to rise.

1 hour chart XRP / USD – TradingView

Using the height of the pattern as a reference, we can determine that the next price target will be at $ 0.68, which would be extremely close to the 2020 high.

The entire cryptocurrency market is showing signs of a potential full recovery by earning around $ 30 billion in market cap in the past 24 hours. On the 4-hour chart, the XRP price has managed to rise decisively above the 12-EMA and 26-EMA for the first time since the rally began and there is a noticeable increase in trading volume indicating that the bullish breakout is robust.

XRP / USD 4 Hour Chart – TradingView

Additionally, the MACD has crossed bullish for the first time since Nov 20 adding even more credit to the positive outlook. The next price target on the 4-hour chart is the high at $ 0.706.

From a time frame as long as the daily chart, this latest decline looks perfectly healthy after such a massive rally. XRP hasn’t lost 12-EMA like Bitcoin and others and remains significantly stronger. The MACD also remains bullish as the RSI has cooled decently.

There is basically no resistance until the 2020 high of $ 0.78, which is the long-term price target of the bulls. Most technical indicators such as moving averages remain in favor of XRP on the daily chart and on longer time frames such as weekly or monthly charts.

Over the past week, XRP’s average 24-hour trading volume has risen colossally from $ 2.3 billion to a peak of $ 34 billion and remains at around $ 15.5 billion.

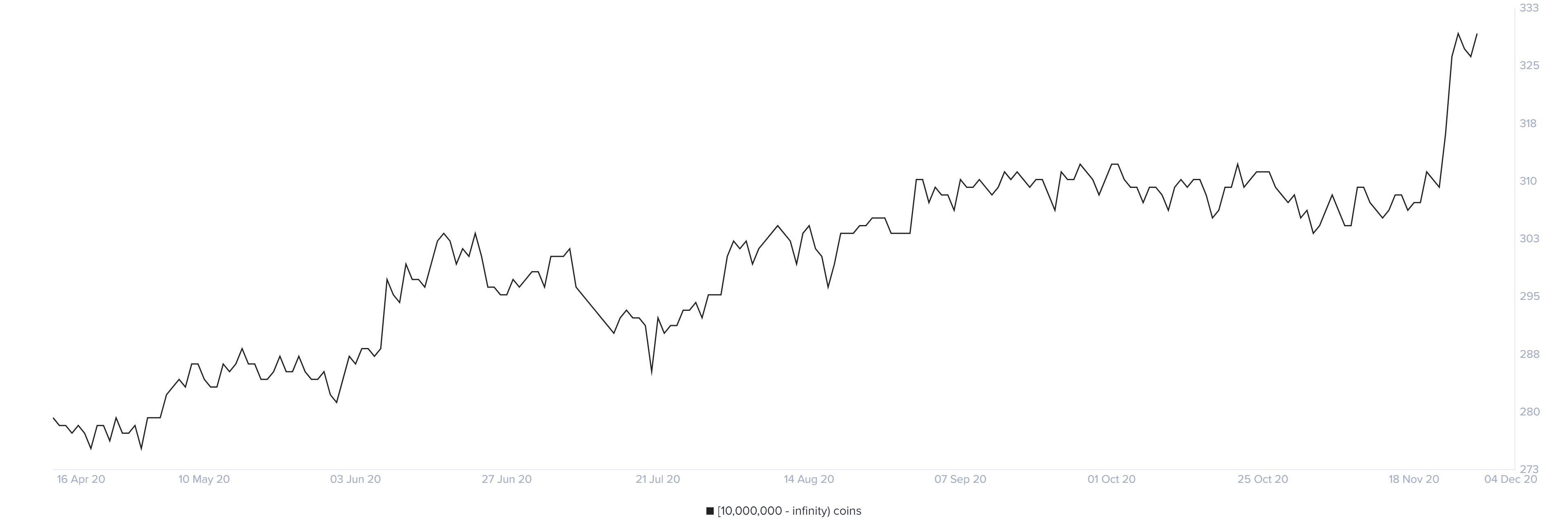

Additionally, the number of whales holding at least 10,000,000 coins ($ 6,100,000 or more) has increased significantly since April, from 276 to 330 currently. This metric shows that large investors remain strongly interested in the digital asset, despite its dormant trading period in recent months.

Be sure to join our Telegram trading group for more great tips!

This post may contain promotional links that help us fund the site. When you click on the links, we get a commission, but the prices don’t change for you! 🙂

Disclaimer: The authors of this website may have invested in cryptocurrencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in cryptocurrencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs carries a high level of risk and is therefore not suitable for security conscious investors. CFDs are complex instruments and come with a high risk of losing money quickly thanks to leverage. Keep in mind that most private investors lose money if they decide to trade CFDs. Any type of trading and speculating on financial products that can produce an unusually high return is also associated with an increased risk of losing money. Note that past earnings are no guarantee of positive results in the future.