[ad_1]

[ad_1]

In early August, I proposed that Riot Blockchain (RIOT) would likely appreciate in reaction to the apparent breakdown of Bitcoin (BTC-USD). Since then, both Bitcoin and Riot have been beating the market. I continue to anticipate frenzied demand for both of us in 2021, just like in 2017. Even though Riot has grown by around 30% in recent months, the opportunity is still quite significant and Riot may be cheaper now than it was in August. , compared to the price of Bitcoin.

Bitcoin continues to outperform in 2020 for numerous reasons. Bitcoin’s facility halved production earlier this year, drastically reducing the supply flow of new coins available, while increasing the costs associated with mining. This “ halving ” of the Bitcoin blocking subsidy occurs every four years and was in play when Bitcoin erupted in 2017.

Another obvious factor is that the The COVID-19 pandemic is causing global action by governments and has challenged many previous income streams. This concern is likely the driving factor behind the rise in gold and silver prices. This is likely contributing to Bitcoin’s appreciation as well, and in a way that wasn’t a factor in 2017.

As is the case with gold miners, Bitcoin miners are likely to have leveraged the moves for any significant change in underlying commodity prices. There is a limited supply of Bitcoin miners or related stocks that have a clear advantage from the possibly significant price appreciation Bitcoin may experience in 2021. There are few publicly traded Bitcoin miners and there are no large cap ones, or even those with mid cap.

Why Riot?

If there are large-cap Bitcoin miners in the future, Riot Blockchain (RIOT) has the potential to become the nation’s first large-cap Bitcoin miner. Riot Blockchain specializes in cryptocurrency mining, with a focus on Bitcoin. Riot also has investments in some private blockchain technology companies. Over the past year, Riot has significantly increased its mining capacity by purchasing more miners.

Riot also recently entered into a colocation deal with Coinmint to move its mining operations from Oklahoma City to Massena, NY. The company plans to improve margins by reducing energy costs. Coinmint is a digital currency data center in a former Alcoa aluminum smelter plant in Massena, near the Canadian border. The transition probably caused several one-off expenses, but is likely to provide both better margins and a higher ESG score.

In the first half of 2020, Riot announced that it would receive delivery of an additional 3,040 Antminers in the second half of 2020. On July 16, Riot announced that it had received the first 1,000 of those miners and would deploy them at the Massena facility that week. . . Since August, however, the company has significantly increased its miner acquisition rate.

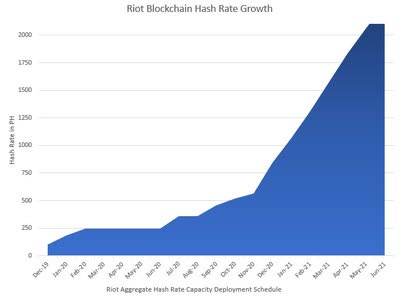

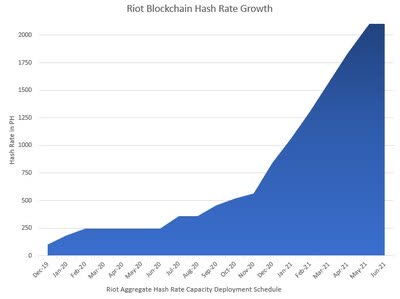

In August and October, the company purchased thousands more S19 miners for delivery in 2020 and the first half of 2021. According to Riot’s latest update, when fully implemented, Riot expects to reach 2.3 EH / s of capacity of total hash rate, using 73 megawatts of energy.

Riot Predicted Hash Growth Rate: (Source: Riot Blockchain)

Plus, Riot still doesn’t hold any long-term debt. Riot indicated that all of their new mining purchases are being funded with available working capital. If Bitcoin’s recent rise stops or reverses here, Riot’s big bet on increasing capacity next year is a huge mistake, but if Bitcoin continues to appreciate throughout 2021 in a way comparable to what happened in 2017 , Riot is securing a leveraged response to that appreciation.

Bitcoin is breaking out

Bitcoin is doing another breakout. Bitcoin last peaked in 2017. Many thought the speculative asset would die as a result of that bubble burst, but Bitcoin held out. Now, once again, Bitcoin is in a strong uptrend that is following a halving. Moreover, this time the precious metals and their miners are also erupting.

When Bitcoin breaks out, Riot should too. If Bitcoin continues its current move, Riot likely will too. Riot is underperforming Bitcoin on this recent rally, but if Bitcoin can continue to appreciate, or even maintain its current range, Riot should inevitably follow and exit this recent range.

I believe the current Bitcoin price is enough for Riot to appreciate above $ 4 and break out of its current range. Riot is likely to be in a new range that will find $ 4 as support as long as Bitcoin doesn’t decline. From there, if Bitcoin continues to rise, Riot should follow and the move should be leveraged.

Risk

Bitcoin is a speculative asset and any company focused on accumulating a speculative asset is itself a mere derivative of that speculation. While Bitcoin is full of spectacular potential, there is also the possibility that it will be a spectacular failure. Any fatal flaw on Bitcoin will be terminal for bitcoin miners like Riot.

(Source: Riot Blockchain)

The cryptocurrency industry is likely to receive ongoing regulatory scrutiny and there are likely bad actors out there. I think Riot is one of the strongest names from this perspective, at least moving forward. Riot was already the subject of a SEC investigation, but Riot reported that it was shut down earlier this year. That investigation was supposed to prepare Riot for future scrutiny.

Riot also chose to drastically increase its capacity in the first half of 2021, which is a big leap of faith here. Riot is clearly predicting a similar rise in Bitcoin’s price over the next twelve months, but we can be wrong. This move will likely only make sense if Bitcoin can continue this recent trend. I think it will continue.

Conclusion

Riot is highly speculative and I wouldn’t invest more in Riot than I was comfortable losing. It is a leveraged bet on Bitcoin that is made in the hope that the current upward movement continues and reaches new highs. Riot is one of the few publicly traded bitcoin miners and all of them are quite small. Riot looks comparable to investing in a junior gold miner, which may well be a good investment in the next year, but Riot will be sensitive to Bitcoin.

There is an incredible shortage of publicly traded Bitcoin miners, and Riot is arguably the best-known name to retail investors. It is also domestic. If Bitcoin can continue up and out of here, I believe Riot will have a relative increase with leverage. I believe Riot shares are good short-term speculation at current levels. I also believe long term options (“LEAPS”) could work exceptionally well from here.

Disclosure: They are / we are long RIOT, BTC-USD. I wrote this article myself and express my views. I don’t get any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]Source link