[ad_1]

[ad_1]

Litecoin, the sixth most valuable cryptocurrency in the global market, has risen by 30% in the past week. As LTC shows strong momentum, on-chain data points demonstrate both bearish and bullish cases.

Santiment researchers have identified various on-chain indicators that buy the case for a retreat and also for an ongoing rally. They he wrote:

“The often overlooked and overlooked #Litecoin had a rather long month, reaching an increase of almost + 70% before markets took a slight dip at the end of the weekend.”

The case of the bear

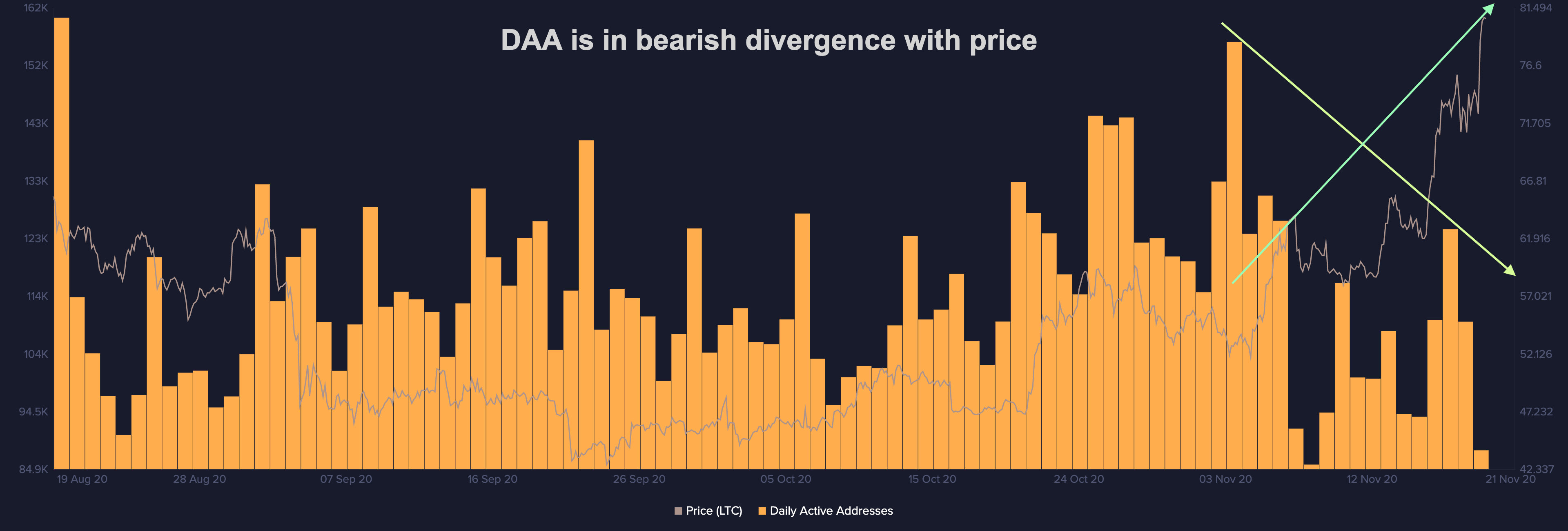

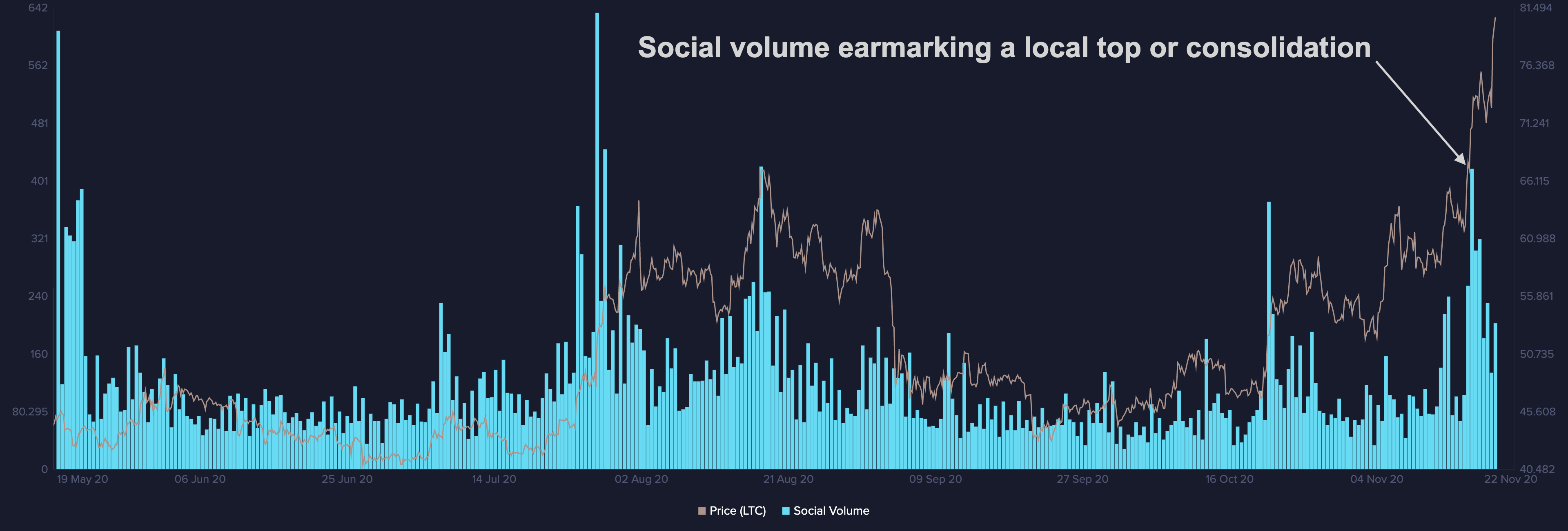

According to Santiment, three on-chain metrics indicate a local top or the possibility of consolidation.

The metrics are age consumed, daily active addresses, social volume, MVRV and average age invested in dollars.

The daily active addresses and the social volume, in particular, show an uptrend that is not supported by solid fundamentals.

When user activity of a blockchain increases in tandem with the underlying cryptocurrency, it suggests an uptrend. However, if user activity stagnates during an ongoing rally, it generally suggests that the rally may not be an organic uptrend.

The sudden increase in social volume also suggests euphoric levels of market sentiment, which have historically marked local peaks.

The bullish case for Litecoin and fundamental factors

The bullish argument for Litecoin in the short and medium term is mainly based on fundamental factors.

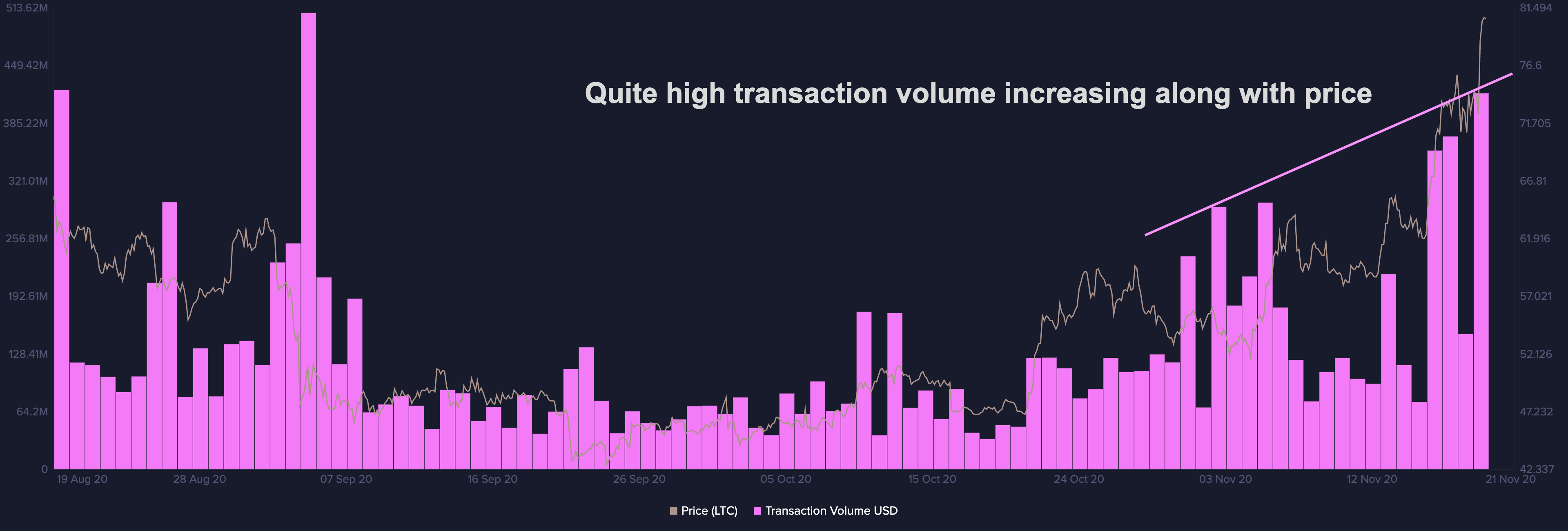

Litecoin’s transaction volume has been steadily increasing since the beginning of November. It shows that users are apparently sending and receiving multiple transactions on-chain, which could mean two things.

First, it might show that more users are accumulating LTC and possibly sending it from exchanges to personal wallets. This means that an accumulation trend could be in the works, as the alternative cryptocurrency (altcoin) market recovers as a whole.

Second, there may be more users engaged in LTC transactions as a result of various fundamental developments.

On October 6, the Litecoin blockchain open source developer community released a testnet for Mimblewimble.

Mimblewimble is a privacy solution designed for the Bitcoin blockchain. Since Litecoin and Bitcoin share similarities in structure, the solution can be implemented on the Litecoin blockchain.

It comes a month after CryptoSlate reported that a new Litecoin update showed the Mimblewimble rollout is on track.

Charlie Lee, the creator of Litecoin, first announced the integration of Mimblewimble in January 2019. He he wrote at the time:

“Fungibility is the only property of sound money that Bitcoin and Litecoin lack. Now that the scale debate is behind us, the next battleground will be on fungibility and privacy. Now I am focused on making Litecoin more fungible by adding confidential transactions. “

The confluence of major network developments, increased transaction volume and the start of an altcoin season have supported LTC in the past few weeks. In the short to medium term, LTC could see sustained momentum if daily active addresses start to increase and social volumes remain stable.

Litecoin, currently in sixth place by market capitalization, is on the rise 4.91% in the last 24 hours. LTC has a market cap of $ 5.66 billion with a 24-hour volume of $ 6.26 billion.

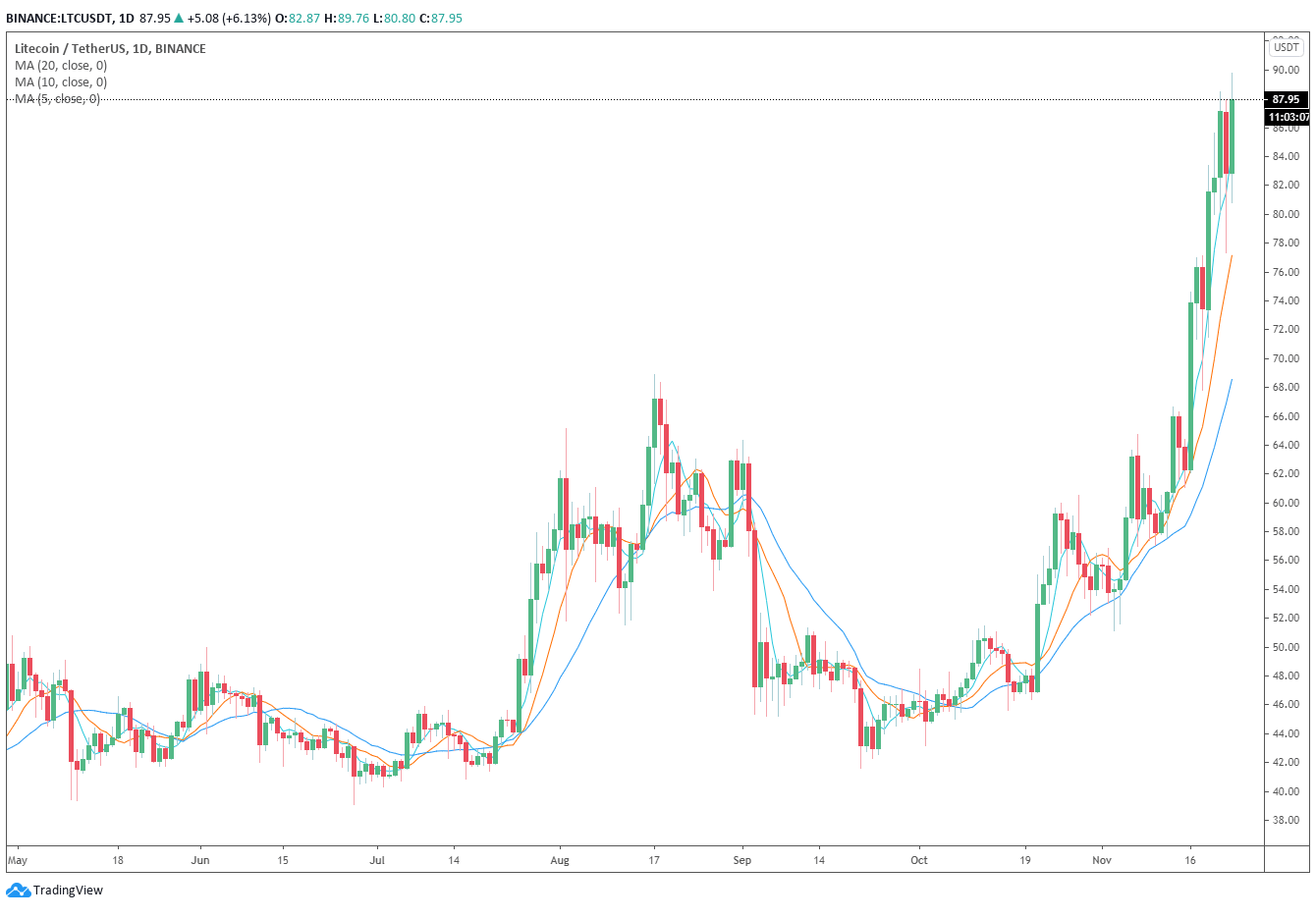

Litecoin price chart

TradingView LTCUSD chart

Do you like what you see? Sign up for daily updates.

[ad_2]Source link