[ad_1]

[ad_1]

- Cryptocurrencies still seem weak.

- The slightly lower volatility hides a worsening of the technical picture.

The cryptocurrencies seem relatively stable after the recent incident on November 24th. What is the next direction?

The Confluence indicator helps us answer the question, and the bulls will not like the answer.

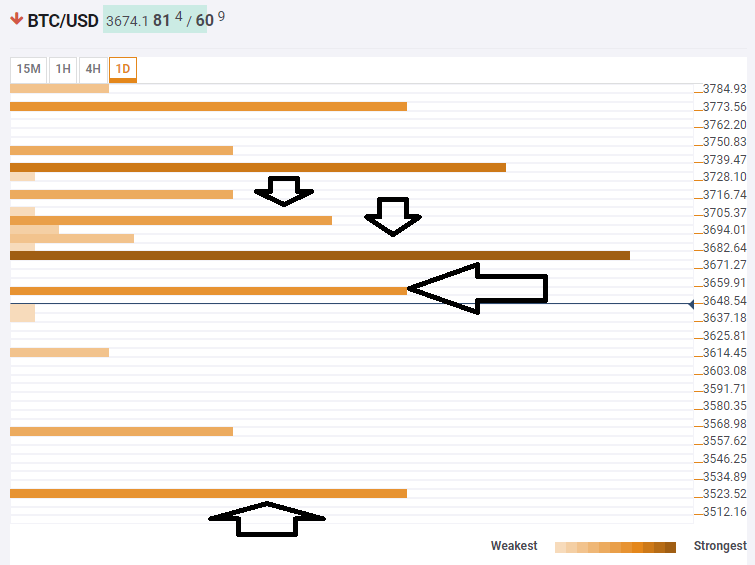

Bitcoin fell below $3,675, and this could prove fundamental. The line is the convergence of the powerful Pivot Point 1 month support 1 and the Bollinger Band 15min-Middle.

Some support awaits for $3,655 that is the Fibonacci 23.6% of a day, but if this is lost, the road is open to $3,523 that was the minimum of yesterday. The last line is the minimum of 14 months of $3,456.

Looking up, resistance waits for $3,700 where we see a cluster including the Simple Moving Average 50-15m, the previous minimum hourly, the Bollinger Band 1h-Middle and the SMA 10-1h.

See the Crypto Confluences indicator live

Ripple also lost support, albeit at higher levels. A $.3540 we find the Fibonacci 23.6% in a day, the Bollinger Band 15m-Upper, the SMA 10-1h, the SMA 50-15m and the previous high time.

Support only waits for $.3420 that is the minimum yesterday and the previous 4h high, not so strong lines.

Further down, we see the Pivot Point S1 of a day for $.3066.

In the case of returning Ripple, it will find a resistance cluster at $.3600 with the one month support Pivot Point 1, the previous 4h-high and the SMA 5-4h.

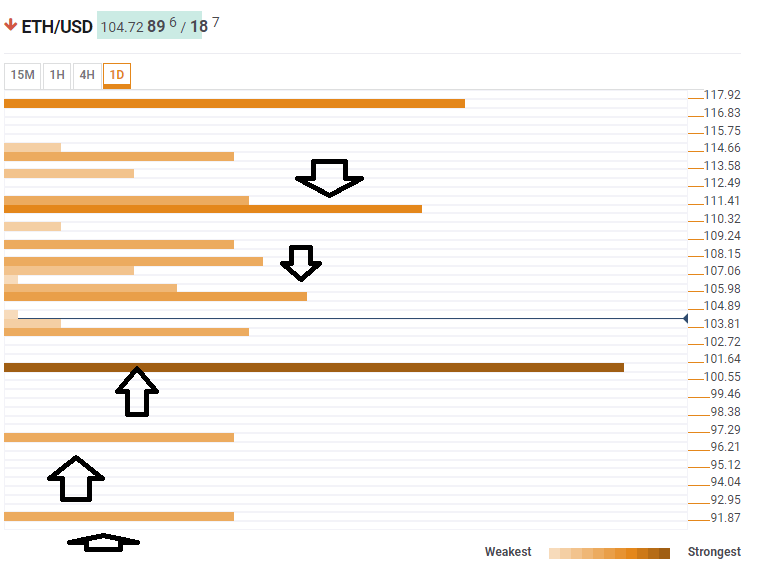

Ethereum a slightly better environment with support for $101. Here we see the confluence of the PP 1m-S1, the previous 4h low and the BB 4h-Lower.

Below, weak support waits for $96.56 that is the point Pivot S2 of a day and then to $91.87 which is the BB one-day Lower.

On the upside, resistance waits for $105.50 where we see yesterday's low, BB 15m-Middle and SMA 5-1h. Over $111 is the meeting point of 38.2% Fibonacci for a day, SMA 200-15m, SMA 50-1h and SMA 10-4h.