[ad_1]

[ad_1]

Warren Buffett, meanwhile, said that “cryptocurrencies will end badly”.

The International Compliance Association (ICA) is a professional membership and awarding body. ICA is the leading global provider of certified anti-money laundering professional qualifications; governance, risk and compliance; and prevention of financial crime. ICA members are recognized globally for their commitment to compliance best practices and a better professional reputation. To find out more, visit the ICA website.

When such valued (and profitable) investors have mixed views on cryptocurrency, it’s hard for the rest of us to tell if its influence is positive or negative. However, one thing is certain: it is here to stay.

Cryptocurrency is no longer criminals’ toy or limited to the dark corners of the web. These views are outdated excuses to avoid facing them. While no one can claim to be an expert, it is still an area we must try to understand. We shouldn’t judge ourselves too harshly, as it’s a complicated subject, but by accepting it and trying to get to grips with what it is and how it works, we will be in a better position to avoid regulatory censorship and take advantage of it.

This article will outline some of the challenges, even mysteries, of cryptocurrency and highlight the importance of everyone in compliance keeping up with everything. We’ll see what the regulators are trying to do and also give you a suggestion on where to go to learn more about this complex topic.

Where to start

As the saying goes, you can’t run before you can walk, so in this situation you need to understand the technology before you understand how it’s used. Cryptocurrency, blockchain, distributed ledger technology (DLT) – these are all terms that become more common as they gain higher levels of adoption. It can be great for compliance (for example, DLT can be used to bring greater transparency to business transactions and accelerate global trade), but it also has the potential to be an asset to criminals (anonymity provided via blockchain can create a refuge for bad actors to operate inside)

“Rapidly evolving blockchain and distributed ledger technologies have the potential to fundamentally change the financial landscape. But their speed, global reach and above all – anonymity – also attract those who want to escape the scrutiny of the authorities.”

Source: Financial Action Task Force

And for the regulator? This is not so clear-cut, as they are somewhere in between. Too much regulation stifles growth and adoption at a time when the world is clamoring for developments and improvements in the way business is done, but too slow an approach allows criminals to go wild and exploit holes in regulation.

The problem for compliance professionals, then, is how to deal with this growing technology when we start encountering it? It’s really complicated, but that’s okay: let’s find out and try to understand it all together. As with all risks, there are threats and opportunities. Clearly, we need to follow regulatory guidance, but what happens when it evolves or is updated? Likewise, what happens when new technology emerges so quickly that regulation can’t keep up? There are so many new products and new ways to transfer value globally that criminals are quick to take advantage of that regulators have a big challenge on their hands to stay ahead. So, let’s take a breath and see how regulators and authorities are attempting to do exactly that.

The point of view of the FATF

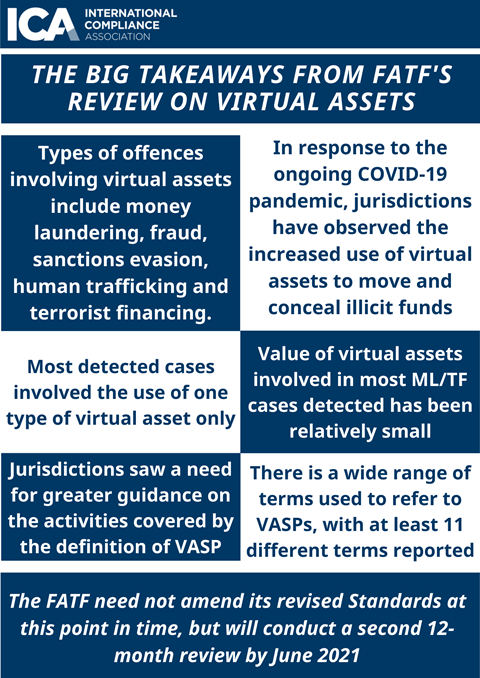

Bitcoin exploded onto the scene in 2009, immediately attracting the attention of the Financial Action Task Force (FATF). The most recent additional guidance was added to their recommendations in 2019. As part of that addition, a 12-month review was planned for June 2020 and a survey of its members and its broader global network was conducted in March 2020. Thirty-eight FATF members (37 jurisdictions and 1 regional organization) and 16 FATF-style member jurisdictions responded.

Very often, when new legislation is enacted, or guidance is provided on a specific topic, it is tempting to feel that its contents are sufficient to cover the need and the issue resolved. However, it’s rarely that simple. The regulations are complicated and the guide below may take multiple iterations to correct. This is especially true in such fast-paced areas like new technologies, virtual assets, and cryptocurrency.

While the recommendations are being implemented, there is still a long way to go for full adoption and full regulation. The FATF aims to bring consistency across its virtual asset service provider frameworks, recommendations, and review.

The EU is taking its first steps

In addition to the FATF recommendations, other jurisdictions are coming to terms on how to regulate cryptocurrency. The European Union has found that it is difficult to establish clear and strict rules given the opaque nature of the Internet (anonymity provided by IP addresses, data that is moved quickly, places disguised via a virtual network, etc.). It is proving almost impossible to enforce sanctions in the cyber world in the same way as against arms traffickers or nuclear proliferation activities.

However, in November 2020, the European Union imposed its first cyber sanctions regime against Russian, North Korean and Chinese actors held responsible for cyber attacks against EU member states. Likewise, the United States has also pursued sanctions and charges against Russian, North Korean and Chinese actors. However, the attribution of blame and blame in the cyber sphere often lacks what would otherwise be considered essential evidence, either because governments do not have access to incontrovertible evidence or because they are unwilling to provide it.

Furthermore, since IP addresses can be altered or hidden, the location of an author’s address is neither adequate nor necessarily correct proof of their true location. The easily blurred and untraceable nature of cyberspace will therefore make it difficult to identify complete networks of individuals. As a result, cyber sanctions may not result in significant asset freezes or have a severe impact on the financial networks supporting illicit cyber actors. Therefore, it is not surprising that the authorities take some time to deal with all of this.

What are the nation states doing?

The United States has yet to formulate a consistent legal approach to cryptocurrencies, with laws varying from state to state. Federal authorities also differ in the definition of the term: the Financial Crimes Enforcement Network (FinCEN) does not yet consider cryptocurrencies to be legal tender; on the contrary, the Internal Revenue Service (IRS) treats cryptocurrencies as property. Using different terms for the same thing is just another example of how complicated this area is.

The situation in China is different. The cryptocurrency was initially handled very cautiously there, but has more recently received support. In 2017, the People’s Bank of China banned initial coin offerings and cryptocurrency exchanges and attempted to root out the industry by making token sales illegal. The largest exchanges have thus ceased to operate. That all changed in 2019 when a Chinese court ruled that Bitcoin was digital property. There has been a shift in cryptocurrency adoption since then, with Chinese President Xi Jinping calling for an increase in blockchain development efforts. There is still some caution, but China is certainly a country with development in mind.

What can you do? (And why should you do it?)

Why is all this important to you? Well, the adoption of virtual assets, blockchain and cryptocurrency is rapidly increasing: a recent report by Chainanalysis found that of the 154 countries analyzed, 92% had some sort of cryptocurrency activity. The way we work, bank and live for years to come may look very different from now, with some of these technologies being used to support our core businesses.

In a workplace and with a focus on compliance, it will be critical to not only monitor these changes, but also take action to ensure that you and your business remain compliant. A company that fails to evolve will lag behind, and the same goes for compliance professionals: if you don’t keep up to date, you too will be out of the loop. Learn about technology; demystify it. If you are able to understand this and know what you are dealing with, this will help you manage risk and leverage value. Remember it works both ways. If you are a FinTech, understand how technology is exposed to risk through its features and usability and find ways to control it.

There is a plethora of information available on virtual assets, cryptocurrencies, blockchains and so on, but keeping up with everything is almost a full-time job. As mentioned at the beginning, no one is an expert in this area yet, so all we can do is educate ourselves as best we can and then share that knowledge.

Cryptocurrency creates confusion – there is no point in pretending otherwise. But through education and knowledge sharing, we are all able to understand it better and adapt to its adoption and continued use. He’s here to stay, so we can also get on board and enjoy the ride.

The International Compliance Association is a subsidiary of Compliance Week. Both organizations are under the umbrella of Wilmington plc.