[ad_1]

[ad_1]

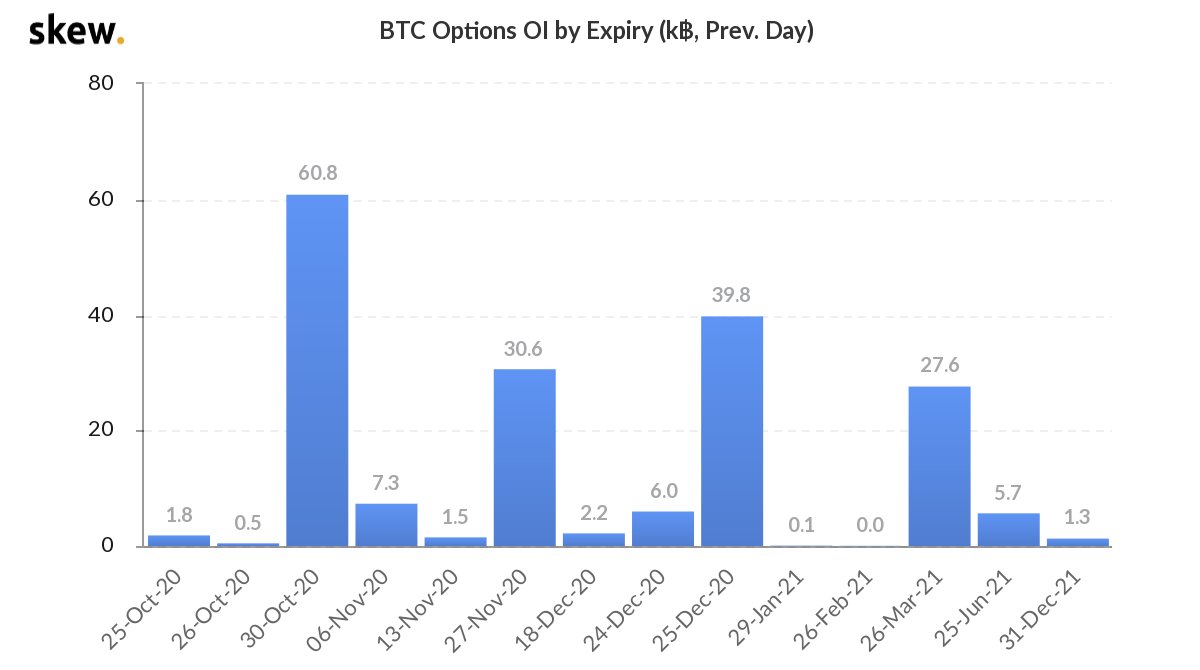

While cryptocurrency traders have been exuberant about the price hike, a number of analysts have focused on the big expirations of the bitcoin and ethereum options that are expected to end before Halloween. Data from Skew.com shows that $ 750 million in Bitcoin options are about to expire and prices could become volatile.

The price of bitcoin (BTC) hit an all-time high of 2020 at $ 13,490 on Tuesday in global exchanges. The price rose when news leaked about Southeast Asia’s largest bank, DBS, which launched a digital asset exchange.

Despite this month’s major price hike, the bitcoin and ethereum markets are expected to be volatile by the end of the week, as a large number of options expire on October 30. Professional data and analytics company Skew.com discussed the situation on Twitter on Oct.25.

“60k [in] bitcoin options expire this week, $ 750m + notional “, Skew tweeted. The main deadline not only coincided with the price increase, but the 12th anniversary of the Bitcoin white paper will also be celebrated the next day. In addition to Skew statistics, Deribit, the exchange that holds the largest number of options contracts on bitcoin and ethereum, has published an article on “trading uncertainty” related to the expiry on October 30th.

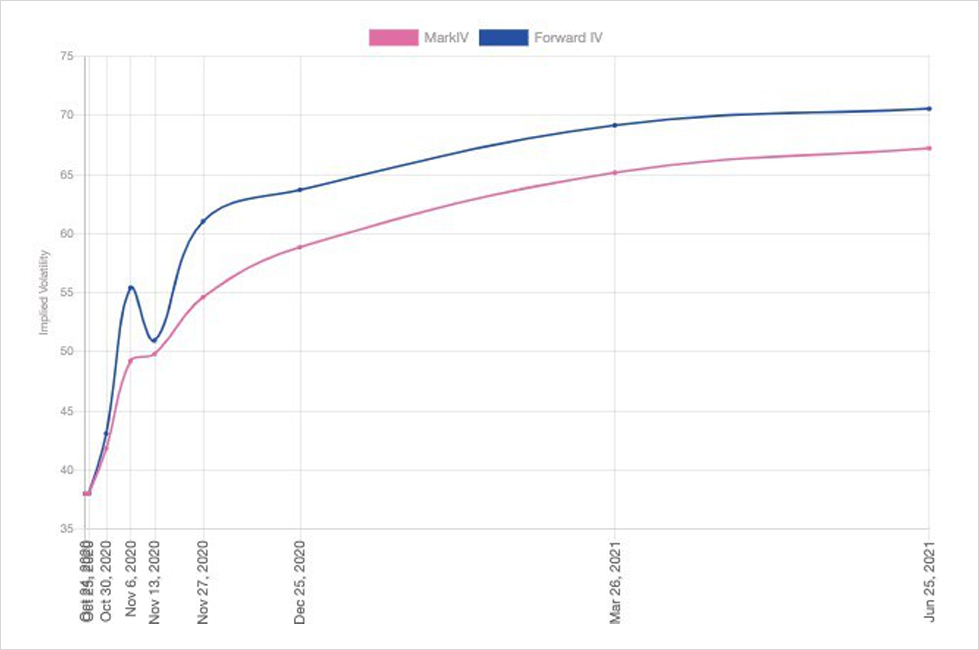

Deribit has published a chart showing the current term structure of Deribit BTC options. “Due to the time value of options, the term structure tends to be skewed upward,” notes the Deribit report.

“However, the humps show a sharp price movement expected over a given period of time. Similar to traditional markets, the BTC market priced into potential volatility in the election week of October 30 through November 6. The increase in volatility is expected to continue at least until the end of the fourth quarter, “added the cryptocurrency exchange.

According to Deribit’s crypto derivatives channel on Telegram, a recent signal from October 26, 2020 explained that there are currently 61k BTC options that expire on October 30, including 40k in Deribit. Additionally, 190,000 ETH options ($ 76 million) will expire on the same day of which 164,000 will be held in Deribit.

Deribit’s cryptocurrency derivatives signal channel further poses the question:

This month we saw a significant reversal of the file [one] mismatch of the month and Bitcoin test on annual highs. The deadline of October 30, ’20 comes just days before the eagerly followed US elections. With more than 7% of maturing open interest set on the 13,000 strike, could the first unexpected news of US elections or movements in the partially correlated stock market cause Bitcoin to go through the strike and trigger a rush to volatility?

On Tuesday, Skew tweeted about Deribit’s October deadline and said that retailers are likely long. “On Deribit for the October deadline, 12k, 12.5k, 13k and 14k calls are all open for 2k + bitcoin options,” the researchers tweeted. The biggest strike is the 9k put with more than 5k options open. Judging from where the October volume is marked, below 40, retailers are likely to have long been against overwriters. “

Obviously, speculators have given a lot of weight to cryptocurrency futures and options markets and many times these secondary markets do nothing. For example, traders and analysts often talk about CME gaps that never fill up and big expirations of extremely boring options. For example, cryptocurrency traders were expecting a lot of volatility after speculating on over 87,000 bitcoin options that expired on September 25th.

Similar to the impending expiration of the pre-Halloween bitcoin and ethereum options, data from Deribit showed that the exchange held a value of 67k (77%) of the 87k contracts on 25 September. On that day, BTC’s historical price statistics show that bitcoin opened on the 25th at $ 10,248 and closed at a high of $ 10,771 later in the afternoon. Option markets had no effect on spot market prices going forward. The bitcoin markets did not end up being turbulent after the big deadline and have since risen by 24.4%.

What do you think of the $ 750M + bitcoin options expiring on October 30th? Let us know what you think about this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Skew.com, Deribit, Twitter,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, nor a recommendation or endorsement of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use or reliance on any content, goods or services mentioned in this article.

[ad_2]Source link