[ad_1]

[ad_1]

- Bitcoin Holds Over $ 12,800 After Rejection At $ 13,200; a turnaround seems imminent.

- Ethereum touches $ 420 for the first time since the beginning of September, but fails to sustain the uptrend.

- Ripple is ready for a withdrawal at $ 0.25; from here, buyers will plan a strategy for taking off at $ 0.3.

The cryptocurrency market has done very well this week, especially for major cryptocurrencies like Bitcoin and Ethereum. Several altcoins have also erupted, including Chainlink, VeChain, Stellar, Litecoin, and Waves.

The massive bullish action was reflected in the significant increase in total market capitalization. A monthly high of $ 400 billion was reached on Thursday. The 24-hour volume also increased, reaching levels above $ 100 billion.

Bitcoin takes a break before massive price action

Bitcoin rose to new annual highs, as reported on October 22. However, a reversal occurred, sending the flagship cryptocurrency below $ 13,000. The immense support has kept the selling pressure in check as the bulls aim for the maximum increase at $ 14,000.

The bullish outlook will likely be validated by a break above $ 13,000. The 50 Simple Moving Average (SMA) on an hourly basis is the initial and critical support. Other key areas to keep in mind include the $ 12,200 and the 200 SMA slightly above $ 11,800.

1 hour BTC / USD chart

(52)-637390382601034392.png)

IntoTheBlock’s IOMAP pattern reveals the absence of substantial direct resistance at $ 14,000. This lends credence to the bullish narrative and Bitcoin’s potential bull run to an all-time high as long as the immediate barrier between $ 12,977 and $ 13,363 is overcome. Here, around 102,000 addresses have previously bought around 65,000 BTC.

On the downside, the pattern is seeing increasing support. On the other hand, the robust buyer congestion zone ranging from $ 11,413 to $ 11,799 will absorb most of the selling pressure. Here about 1.8 million addresses previously purchased about 1.1 million BTC.

Bitcoin IOMAP chart

-637390383120203352.png)

According to Santiment, Bitcoin saw an age consumed spike on Friday. Age consumed is a metric that measures the number of tokens moved relative to the time they were inactive. A spike in this on-chain metric usually results in high volatility and significant price action. Therefore, BTC is likely to make a significant move during the weekend session.

Bitcoin age consumed chart

The reversal of Ethereum in sight

Ethereum broke out of $ 400 and hit $ 420. However, buyers lost strength and were unable to support the bullish outlook. Instead, Ether is trading at $ 414 amid an increasing bearish hold, as shown by the Relative Strength Index (RSI).

The smart contract token is also traded within a rapidly growing parallel channel. It is doubtful, the cryptocurrency will support intense price action, and therefore a reversal towards $ 400 is likely to occur. In case of prolonged declines, support at 50 SMA, 100 SMA and $ 360 is expected.

ETH / USD 2-hour chart

- 2020-10-23T102423.996-637390384014516679.png)

A slump in new addresses created on the network in recent days is a bearish indicator. IntoTheBlock’s “Daily Active Addresses” metric shows a significant drop from approximately 313,900 addresses created on October 18 to nearly 147,000 on October 22.

If the downtrend continues, it will be difficult for ETH to sustain the uptrend above $ 400. A downward trend in network growth negatively affects the inflow and outflow of tokens, as well as the liquidity of the platform; therefore, traders be aware.

Ethereum new addresses chart

-637390384357461073.png)

According to the Santiment holders distribution metric, Ethereum whales are currently dumping tokens, possibly to take profit after peaking at $ 420. For example, addresses holding between 100,000 and 1 million ETH dropped from 166 on 14 October to 163 on October 23.

The decrease may seem minor, but the volume that whales move is colossal. Therefore, the selling pressure is doomed to intensity, forcing ETH / USD to correct. In other words, the bearish pressure is validated.

Ethereum holder distribution chart

holder distri-637390384668899773.png)

Ripple on the verge of dumping at $ 0.25

The bullish price action of XRP this week pierced the resistance at $ 0.26 but failed to sustain the momentum to complete the remainder of the trip at $ 0.3. An ongoing reversal sees levels below $ 0.25, where the 100 SMA provides support over 2 hours.

The RSI strengthens the bearish outlook as it slips towards the midline from the overbought area. If the critical time comes and the dips continue in the near term, the 200 SMA and the $ 0.24 level will work to absorb the selling pressure.

XRP / USD 4-hour chart

-637390385296355144.png)

The Santiment chain data adds credit to the bearish outlook following an increase in both volume and social media mentions. Initially, a gradual increase in these two parameters points to a potential rally. However, once they peak, they signal a possible price reversal. In this case, the spikes indicate increasing bearish pressure.

Ripple social media mentions / volume chart

[11.29.32, 23 Oct, 2020]-637390385826549726.png)

Daily takeaway

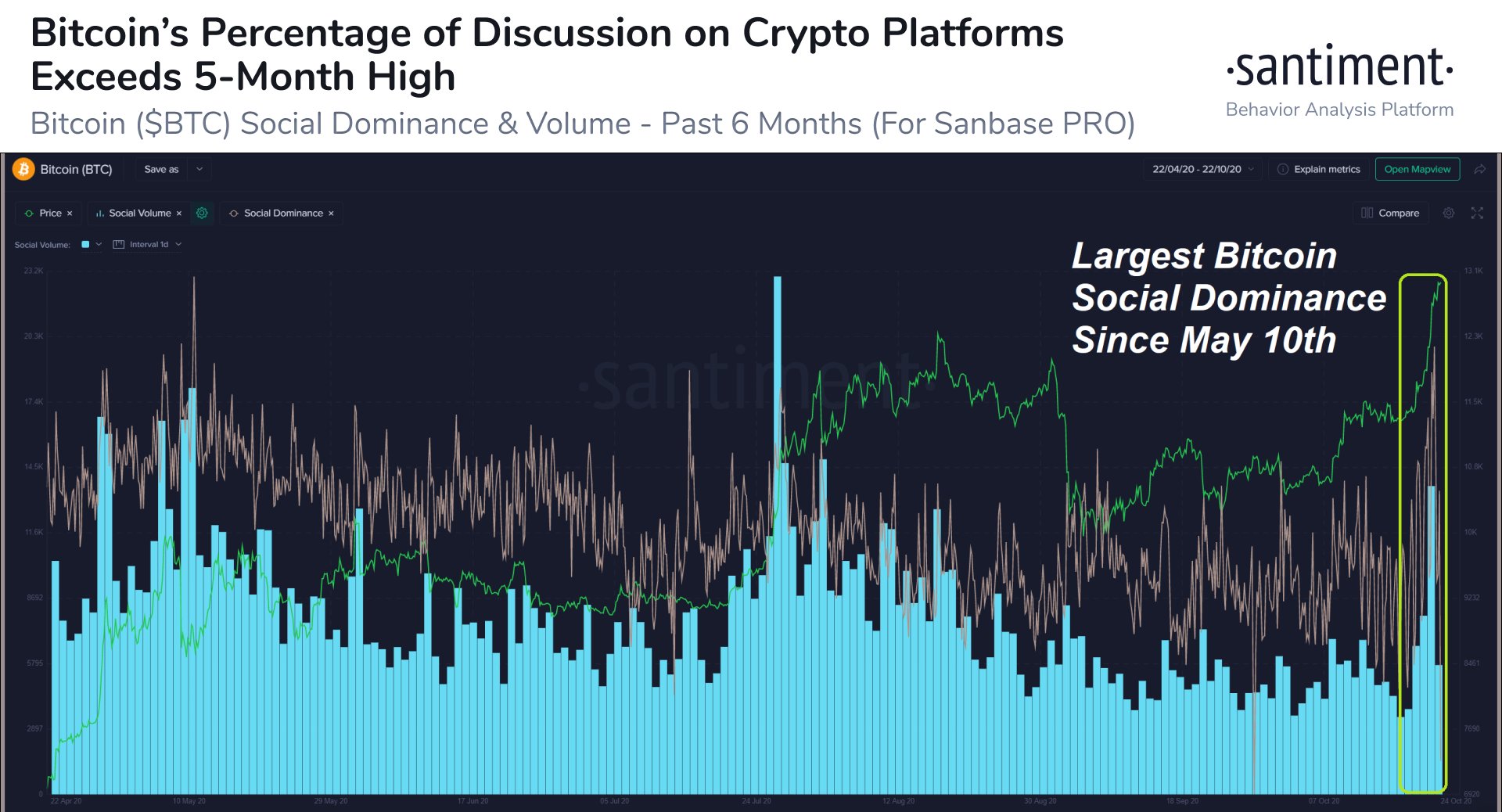

It is worth mentioning that Bitcoin’s social media mentions / volume peaked since May on Thursday. A study of this metric shows that upside comes before a price reversal.

In other words, Bitcoin will likely withdraw to the support presented by the IOMAP model before another recovery arrives. It is essential to keep in mind that the expected reversal could occur over the weekend due to the massive movement of age consumed.

Bitcoin social dominance chart

Ethereum is unable to sustain the strong uptrend after testing $ 420. The metrics on the chain suggest that the sales pressure is increasing. The ETH / USD lowest resistance path is down and may retest the support at $ 390 before a breakout hits.

Ripple is also poised to write off some of the gains it made this week after pausing slightly above $ 0.26. The support at $ 0.25 could anchor the bulls before they attempt another breakout.

.[ad_2]Source link