[ad_1]

[ad_1]

-

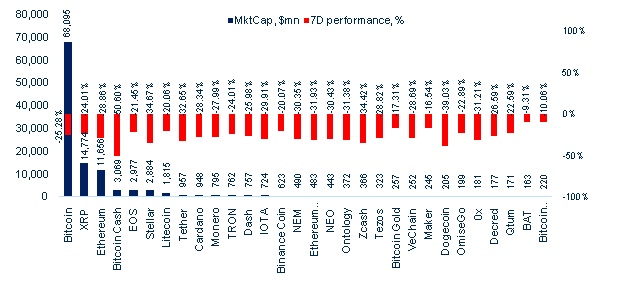

The Bitcoin concentration is reduced to 53.9% from 53.4% of a week. ThetotalCryptoMarketfell of almost 27% and the total volume increased by 32%. Bitcoinisdown by more than 25%, Ethereumlost 29%, XRP is down by 24% and EOS is down by 21%. The best results including top-40 cryptowereBitcoinDiamond (-10.4%) and Dogecoin (-16.3%).

-

United States Department of Justice's Tether investigation

-

The European Commission launches the Blockchain association

-

The United Kingdom believes that prohibiting cryptographic derivatives

-

The main OTC branches create the OTC Sport index

-

Bakkt moves the launch of futures on BTC

-

ICOs has liquidated 172,000 ETHs in the last 2 months

-

Bitcoin merchants payments down 80%

-

The auditor fully supports the USDC Stablecoinis standard

-

Acceleration of the Ethereum development plan The Singapore authority approves the exchange of digital security

Market moment

The crypto sell off continues as last week swept away almost another 34% discount on the total capital market, touching the fund to $ 115 million. Bitcoin dropped to 420-day lows at around $ 3,500, with a 36% weekly loss. Although this Monday will bring Americans away from the holidays, which helped push the price towards $ 4,200, BTC is currently back under $ 4000 and continues to fight its support. Ethereum is no different, more than 37% of mid-week losses brought the double-digit ETH to $ 99 on Sunday, and the same as BTC, the ETH is slightly recovered and currently stands at $ 114. The sell-off has no particular effect, although some may argue with the increase in the negative activity of the SEC, the delay in launching Bitcoin Cash and Bakkt, the expert operators have called sub $ 4k and BTC is most likely down to ~ $ 3k from August via historical BTC charts.

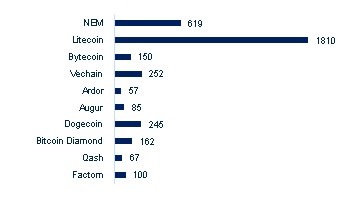

Figure 1. Performance and market capitalization of top-30 cryptocurrencies (by MktCap)

Source: Coinmarketcap.co, Starting November 26, 2018 Starting at 10:00 AMBST

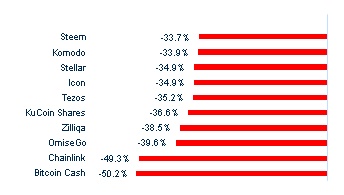

Figure 2. Worst digital resources * (7 days)

Source: Coinmarketcap.com, *) MktCap> = $ 50m

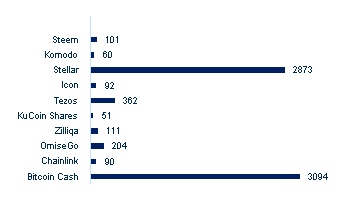

Figure 3. MktCap of the worst digital assets *

Source: Coinmarketcap.com, *) MktCap> = $ 50m

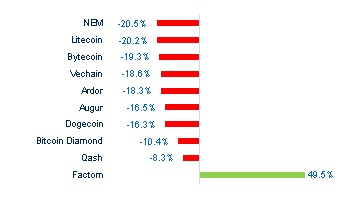

Figure 4. Digital resources with better performance (7 days)

Source: Coinmarketcap.com, Mkt Cap> = $ 50 million

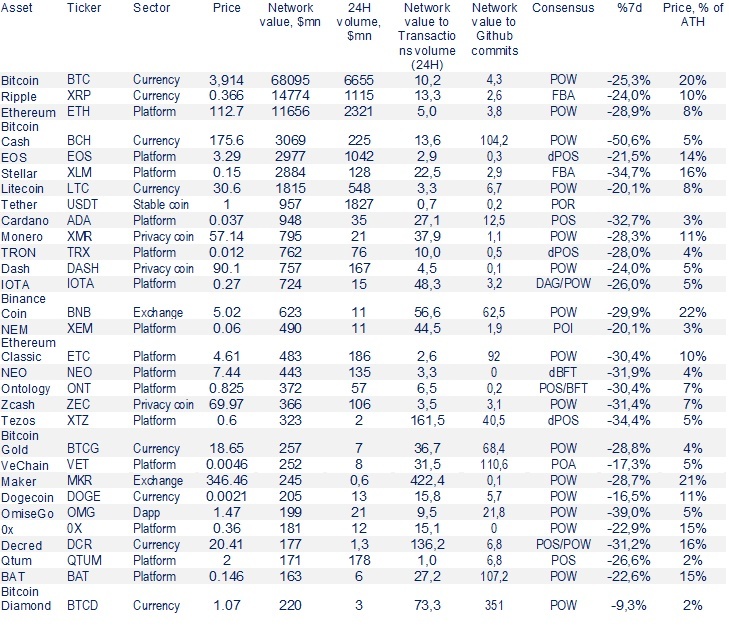

Figure 5. MktCap of the most performing digital resources

Source: Coinmarketcap.com, Mkt Cap> = $ 50 million

Figure 6. The best digital resources for MktCap evaluation

Source: Coinmarketcap.com, NKB Research * Beginning November 26th at 11:30 BST

Regulatory news

The United States Department of Justice is studying the ties of the halter with the December Rally

The United States Department of Justice has Signed up CFTC survey on Tether's ties with last year's Bitcoin rally. Tether, which is directly connected to Crypto Exchange Bitfinex, received court summons last year from the CFTC, however neither Tether nor Bitfinex have yet been accused of making a mistake. Investigators are studying specific trading strategies such as spoofing (false market orders), how cables are created, because they enter the market mainly through Bitfinex and, above all, if for each digital currency issued, it has $ 1 in the bank.

The European Commission launches the Blockchain Application Association in 2019

The international association for the safe application Blockchain (IATBA), which aims to develop guidelines, protocols and strategies for the blockchain industry in Europe, will be launched by the European Commission next year and have already signed major banks such as BBVA as members.

The United Kingdom believes that prohibiting cryptographic derivatives

Speaking at the encryption event in London, (where the head of the NKB division, Ben Sebley, was a panel member), the FCA executive Christopher Woolard, expressed FCA covers the encrypted specific derivatives sold to retail investors. "The FCA … consults a ban on the sale to retail consumers of derivatives that refer to certain types of cryptographic assets (for example, exchange tokens), including CFDs, options, futures and securities". The FCA also plans to consult on which digital resources fall under its existing regulations by the end of the year, Woolard added.

The Singapore Stock Exchange clarifies the rules for public brands issuing tokens

The Singapore exchange (SGX) has published guidelines for companies already listed on the stock exchange and considering an ICO. Each company is required to consult the issue of tokens with an SGX regulatory branch, provide a legal opinion on the nature of the tokens, the auditor's opinion on how to handle the ICO from an accounting point of view and, if the tokens are titles, they must be correctly registered and SGX RegCo expects the issuers "to be ultimately responsible for maintaining a robust system of risk management and internal controls". Finally, companies are also required to provide certain information such as risk, fund allocation and KYC / AML checks.

Blockchain Exchange of Gibraltar officially approved by regulators

The Gibraltar Financial Services Commission (GFSC) has officially licensed the Gibraltar Blockchain Exchange (GBX), a subsidiary of The Gibraltar Stock Exchange (GSX). GSX is therefore claiming to be the first stock exchange that owns a regulated blockchain bag.

Cryptic market news

Three major OTC branches create the OTC Spot index

The subsidiary of VanEck, MV Index Solutions, has launched Bitcoin OTC Spot Index (MVBTCO) in collaboration with Genesis, Cumberland and Circle, which will provide price feeds. VanEck's director of digital asset strategy, Gabor Gurbacs, said that "the index can pave the way for institutionally-oriented products, such as ETFs, as well as provide additional tools to institutional investors to execute institutional exchanges at prices transparent on the OTC markets. "

Bakkt moves the launch of BTC Futures in January 2019

The highly anticipated launch of the Intercontinental Exchange Bitcoin futures trading platform was postponed until January 24, 2019, according to the company's blog post. Originally scheduled for launch on December 12, Bakkt is waiting because of the "volume of interest" and "work needed to get all the pieces in place", as Bakkt CEO Kelly Loeffler writes.

ICOs has liquidated 172,000 ETHs in the last 2 months

Interesting research conducted by Larry Cermak, which passed through ICO Treasuries and found that combined, ICOs hold over 3.57 million ETHs (3.5% of ETH's offer), ICO liquidated 172,000 ETHs (4.6% of reserves Treasury totals) since September and aggregates, ICO has moved / liquidated 64% of all ETHs that generated. This report therefore indicates that the sell-off was not as drastic as it was generally held. Yet.

Silvergate Capital Files for IPO

Silvergate Capital Corporation, Silvergate bank's holding company with over 480 encrypted clients, has archived S-1 form for an IPO. Silvergate customers included names like Gemini, Kraken and Paxos. It is important to stress that the group of digital currencies has participated in the $ 114 million Silvergate financing round.

Giga Watt files for mine cultivation

Giga Watt, start-up of Bitcoin Cloud Mining, founded by the well-known BTC miner Dave Carlson, filed for bankruptcy judicial documents. Giga Watt, who originally planned to build a crypto mining facility in Washington state through the $ 20 million ICO facility in July 2017, has previously he has been sued for leading an offer of unregistered securities.

Bitcoin merchant payments fell 80%, 44% Hashrate

According to Chainanalysis, the use for commercial payment in Bitcoin has decreased by almost 80%. The chain of analysis examined 17 BTC and payment processors found that payments dropped from $ 427 million in December 2017 to $ 96 million in September. Wednesday, BTC hashrate (measurement of mining difficulties) fell by almost 44% compared to its ATH in August, and from Sunday the hashrate is recovering with a 38% increase from Wednesday.

The auditors state that USDC Stablecoin has complete coverage

Grant Thornton LLP chief auditor, reported that Circle, the company behind the dollar-dollar USDC, has $ 127.5 million in its bank account, which is enough to cover every issued token. The USDC has joined the "army of stable currencies" of the Gemus TrueUSDs and the previously verified PaxosStandart tokens.

Acceleration of the Ethereum development plan

Key Ethereum developers, including V.Buterin, G.Colvin, J.Lubin, D.Ryan and others, had a private meeting to discuss the acceleration of development to increase the capabilities of the platform in the short term. The minutes were published on Github by an engineer of the virtual machine Ethereum, Greg Colvin. The developers of Ethereum are under pressure to change the public roadmap. The changes discussed include a system-wide upgrade or a fixed fork (scheduled for June 2019), including the replacement of the Ethereum virtual machine, storage costs for smart contracts, and some other minor updates.

Investments last week

Binanceinvest $ 3 million in the OTC Koi Trading trading desk through its venture arm, Binance Labs.

NEWS ON SECURITY TOKEN

The Monetary Authority of Singapore approves the exchange of digital security

The Monetary Authority of Singapore has approvedClearBridge Accelerator and its CapBridge fundraising platform, to manage its digital security exchange called 1exchange, in order to help companies raise funds and allow investors to buy and sell digital assets.

Overstock retail sale

Overstock shares increased 26% after Preston Byrne CEO announced who will sell the retail trade that sells furniture and home jewelry to completely shift its focus on blockchain development. Byrne's plans for the blockchain space will be realized through the subsidiary Medici Ventures of Overstock, where Byrne has invested $ 175 million. One of the most famous start-ups supported by Byrne, is the tZERO digital exchange, which has not yet been launched despite having raised more than $ 130 million in August.

Tokenestate performs the first security token transaction

The security token issuer based in Switzerland, Tokenestate, performed its first blockchain equity transaction, selling its shares in exchange for a payment in Swiss francs.

Information on digital security

Jesus Rodriguez has been very active so far in creating stimulating and stimulating content for all those interested / interested in the digital security space. His two recent blog posts clarify the mount in the world of security tokens and underlines the lack of promises liquid assets.