[ad_1]

[ad_1]

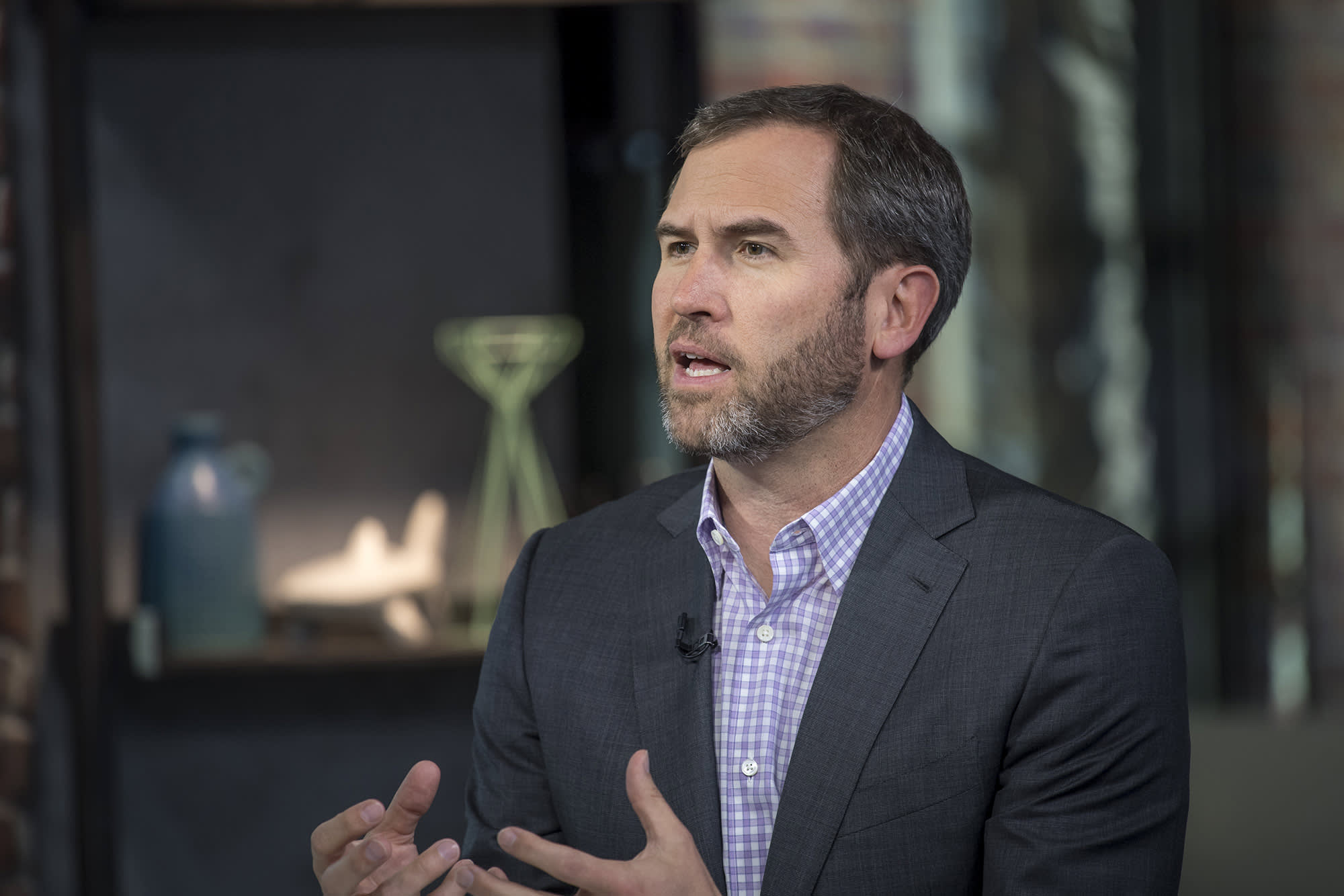

Brad Garlinghouse, CEO of Ripple Labs Inc.

David Paul Morris | Bloomberg | Getty Images

Blockchain start-up Ripple claims to have raised a $ 200 million investment round, taking its valuation to a whopping $ 10 billion.

The fundraiser was led by New York-based investment firm Tetragon, Ripple said on Friday, while Japan’s SBI Holdings and Virginia-based venture capital firm Route 66 Ventures also invested.

Founded in 2012, Ripple rose to fame in late 2017 when the value of XRP, a cryptocurrency used by the company, skyrocketed in value alongside a multitude of other virtual currencies.

The company uses XRP to facilitate cross-border transactions for its network of financial institutions, while also employing an interbank messaging system – think of it as a blockchain-based alternative to Swift – which is used by banks to send money around the world.

“We are in a strong financial position to perform against our vision,” said Brad Garlinghouse, CEO of Ripple, in a statement. “As others in the blockchain space have slowed their growth or even closed, we have accelerated our momentum and leadership in the industry throughout 2019.”

While XRP rose by over $ 3 in January 2018, the world’s third largest digital currency has retreated significantly and is currently at around 19 cents. The cryptocurrency rose more than 3% on Friday on the heels of Ripple’s funding news.

Ripple derives a significant portion of its income from the sale of its holdings in XRP. According to industry outlet The Block, Ripple has been selling cryptocurrency worth $ 260 million in the past year. The other large chunk of its revenue comes from deals with banks and financial institutions that use its blockchain technology for money transfers.

Ripple says it now has over 300 financial services clients globally. The company has signed partnership agreements with industry giants ranging from Santander to American Express.

Digital currencies made headlines this year after a brutal sell-off of such assets in 2018, with big companies like Facebook and JP Morgan making moves into space. Facebook in particular has drawn the attention of both investors and regulators, after releasing proposals for its ambitious Libra cryptocurrency project.

.[ad_2]Source link