[ad_1]

[ad_1]

In the letter

- In early October Sam Bankman-Fried, CEO of FTX, which runs the decentralized cryptocurrency exchange Serum, predicted that an increase in trading volume on Ethereum-based DEXs wouldn’t last.

- Volume dropped sharply on DEXs in October.

- On the Decrypt podcast, he explained how he identified what he calls “fake volume”.

A LA Blockchain Summit in early October, Sam Bankman-Fried, CEO of crypto exchange FTX, said a summer surge in Ethereum-based DEX volume was “bullshit”: a few bullish months, he said, were no guarantee of a bullish future.

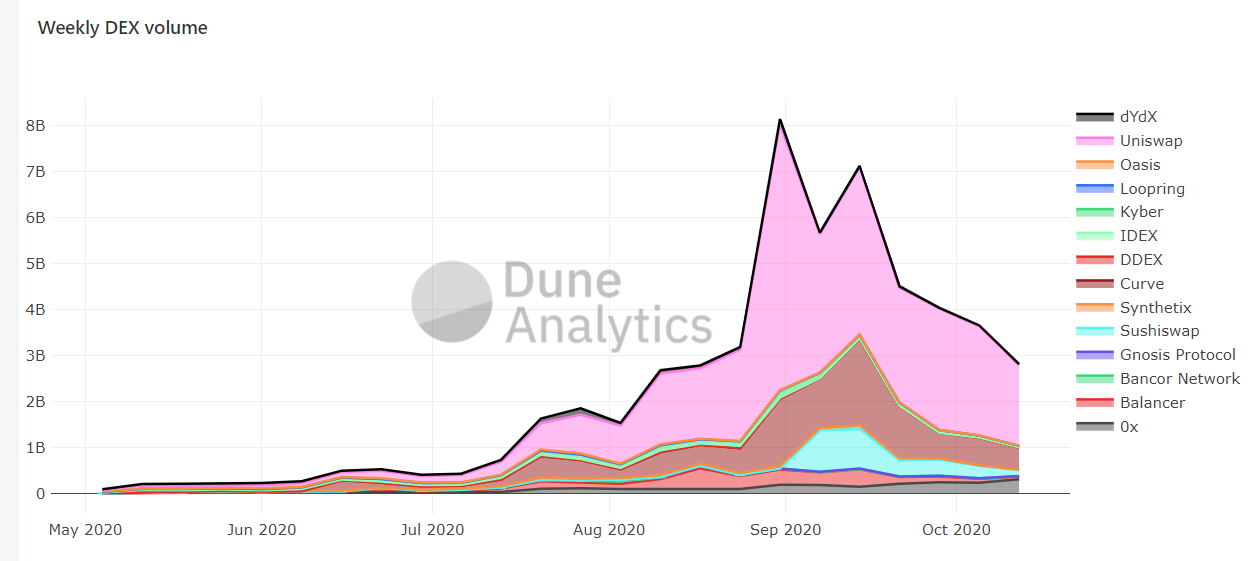

It turns out that Bankman-Fried, whose company, FTX, also runs a DEX called Serum, was right. According to the crypto data company Dune Analytics, trading volume on Ethereum-based DEXs fell abruptly throughout the month of October. The volume has decreased by 45% in the past 30 days.

Decentralized exchanges are different Coinbase is Binance, the so-called centralized exchanges. While centralized exchanges keep safekeeping on your cryptocurrencies, ofcentralized exchanges do not. The most popular is Uniswap.

Weekly trading volume on these exchanges exploded over the summer, peaking at over $ 8 billion in late August, thanks in large part to decentralized finance protocols offering new incentives with the potential for huge returns.

On Decrypt’s podcast this week, Bankman-Fried went into detail on how it came to its conclusion.

What was happening on the DEX, he said, was more or less analogous to “trans-mining” or transaction extraction. Centralized exchanges sometimes reward traders with native tokens: Binance Coin, Huobi Token and so on, to use the platform.

Transminers attempt to trade against themselves just to earn these tokens, which they can sell for a profit. “The significant volume of these exchanges has been very limited,” Bankman-Fried explained.

“The reason you ask how much volume a trade has is to answer questions like: how important is it? How much liquidity does it have? How important is it for prices? Where should someone be advised to trade? How big is their future? money is earning? ”

None of these questions, Bankman-Fried said, were answered with the kind of “fake” volume numbers that come with trans mining, and which he claimed to be roughly the same as what happened with DEX this summer. , thanks to those new incentives.

Even up Uniswap, the most popular decentralized exchange, the numbers confirm this. Daily trading volume at the time of writing it is just over $ 100 million, down from nearly $ 1 billion in September.

“One time [exchanges] stopped paying people to fake the volume, “Bankman-Fried said of the trans-mining phenomenon,” all the volume went away. ”

Later in the podcast, he made the link to decentralized exchanges explicit, with a caveat. “This isn’t true for all DEXs,” he admitted. “But that’s true for the most part.”

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment or other advice.