[ad_1]

[ad_1]

Key Takeaway

- XRP skyrocketed by more than 200% after breaking a multi-year resistance barrier.

- Despite the massive gains recorded, a particular technical index suggests a correction is underway.

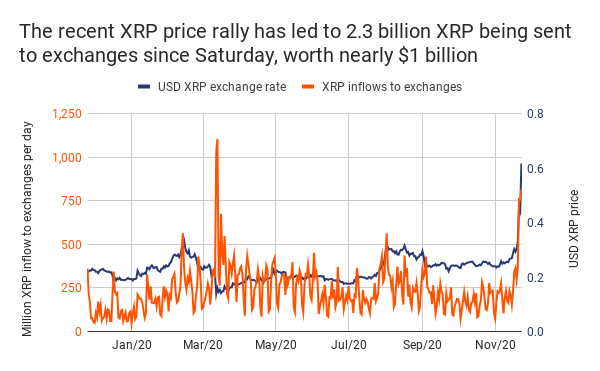

- The bearish thesis holds when looking at the number of tokens sent to exchanges in the past few days.

Share this article

Like few other altcoins, XRP has benefited from Bitcoin’s impressive rally in recent times.

The cross-border remittance token has risen more than 200% in the past two weeks, but several technical and on-chain metrics suggest that prices may retrace before higher highs.

Break the multi-year resistance

XRP’s price action has been contained by the $ 0.32 resistance level since mid-August 2019. But on November 20, the cross-border remittance token was able to overcome this major hurdle and climb nearly 140% .

The bullish momentum has allowed prices to reach a high of $ 0.78, the highest level seen since the end of September 2018.

From a technical standpoint, Ripple’s native token appears to have come out of a huge ascending triangle that has developed within its daily chart over the past eight months. A horizontal resistance wall was formed along with the swing highs, while an ascending trendline was created along with the swing lows.

The distance between the widest point of the triangle anticipated a rally to $ 0.84.

However, this goal can be considered complete due to the rapid bullish price action XRP has seen in the past few days.

In fact, the TD sequential indicator suggests that the altcoin may be trading in overbought territory. This technical index presented sell signals in the form of nine green candlesticks on the 12 and 4 hour charts of XRP.

Bearish formations estimate a correction of one to four candles before the bullish trend resumes.

While the TD forecast has yet to be validated by a spike in sell orders, it appears some investors are preparing to cash out.

XRP Hodlers prepare to make profits

That was over 2.3 billion XRP tokens sent to more cryptocurrency exchanges since prices started to take off. This represents a 330% increase in daily trade inflow, worth nearly $ 1 billion.

Considering the number of investors who have moved from underwater positions to profitable positions, such a spike in foreign exchange inflow could lead to growing selling pressure.

“30-day investors have grown an average of + 159% in the past month alone. And when an asset earns over 5% returns per day for an entire month, history says there will be a period that will allow traders to catch their breath at their best and kick themselves for not selling in the worst case. ” said Brian Quinlivan, Director of Marketing and Social Media at Santiment.

In the event of a correction, the most significant support level below XRP is $ 0.32. But before prices can drop to this point, there are two more demand areas this cryptocurrency needs to break.

These areas are found at $ 0.54 and $ 0.45 respectively.

On the flip side, the bearish outlook will be invalidated by a daily candle close above $ 0.78. If the XRP bulls manage to push prices above this supply wall, further advance to $ 0.84 or even $ 1 is almost guaranteed.

Share this article

Ripple made Gram rich, but what about XRP holders?

The partnership between Ripple and MoneyGram continues to raise eyebrows as the cryptocurrency company pumps millions of dollars into the remittance company. Even though there appears to be only one beneficiary …

Ripple changes PayID brand after 13 banks sued for copyright infringement

San Francisco-based crypto company Ripple has registered a new brand for a product called PayString at the USPTO (US Patent and Trademark Office). Based on court documents, however, the rebrand …

[ad_2]Source link