[ad_1]

[ad_1]

| After | Price | Modify |

|---|---|---|

| 1 day | $ 0.2981 | 0.06% |

| 1 week | $ 0.2987 | 0.26% |

| 1 month | $ 0.3174 | 6.56% |

| 6 months | $ 0.3613 | 21:30% |

| 1 years | $ 0.7450 | 150.09% |

| 5 years | $ 2,1258 | 613.58% |

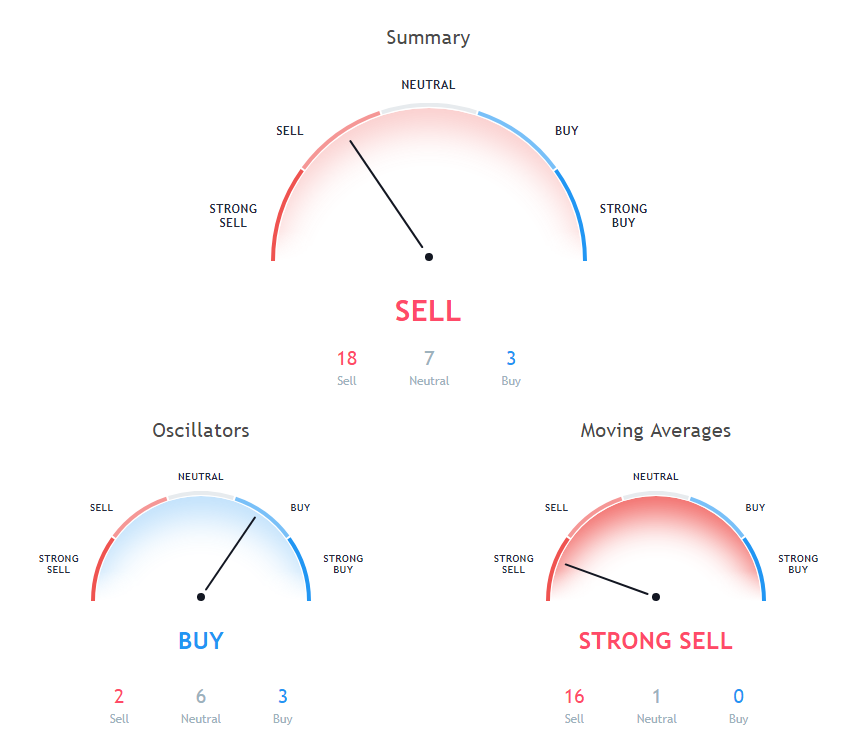

The Commodity Channel Index (CCI) is a momentum oscillator used in technical analysis to measure the deviation of an instrument from its statistical average. Product category index shows the Neutral signal, with value at -144.11131.

The stochastic oscillator is a momentary oscillator. The stochastic oscillator indicates the Neutral action, with a value of 5.19255.

Relative Strength Index (RSI) is an important indicator that measures the speed and change in price movements. Its value ranges from zero to 100. The value around 30 and below is considered oversold region and around 70 and over considered overbought regions. Relative Strength Index indicates the Buy action, with a value of 26.93076.

Moving Average (MA) in simple terms is only the average of any subset of numbers. For example, the simple 50-day moving average is calculated at any point in the chart by adding the 50 days price and dividing it by 50.

Simple 10-day moving average is at 0.3548, showing the sales signal, Ripple is trading below it at $ 0.2979. 100 days Simple Moving Average indicates Sell, as Ripple trades at $ 0.2979, below the MA value of 0.4305. 9 days Ichimoku Cloud Base Line indicates a neutral stock with value at 0.41501, Ripple is trading below it at $ 0.2979.

50 days of simple moving average means a sales share with value at 0.44456, Ripple is trading below it at $ 0.2979. 50 days of exponential moving average is at 0.42099, showing the sales signal, Ripple is trading below it at $ 0.2979. 100 days of exponential moving average is at 0.43742, showing the sales signal, Ripple is trading below it at $ 0.2979.

The 20-day weighted moving average indicates a sales share with a value of 0.40023, Ripple is trading below it at $ 0.2979. 30 days of exponential moving average indicates a sales share with value at 0.40164, Ripple is trading below it at $ 0.2979. 20 days of exponential moving average indicates Sell, as Ripple trades at $ 0.2979, below the MA value of 0.38113.

10 days exponential moving average is at 0.3488, showing the sales signal, Ripple is trading below it at $ 0.2979. 9 days moving average of the hull indicates Sell, since Ripple trades at $ 0.2979, below the MA value of 0.30938. 30 days of simple moving average means Sell, as Ripple trades at $ 0.2979, below the MA value of 0.42636.

The 5-day moving average indicates Sell, as Ripple trades at $ 0.2979, below the MA value of 0.33104. 5 days of exponential moving average indicates Sell, as Ripple trades at $ 0.2979, below the MA value of 0.32709. 200 days of exponential moving average is at 0.47852, showing the sales signal, Ripple is trading below it at $ 0.2979.

Read also: Ultimate Cryptocurrency Exchange Guide

200 days of simple moving average means a sales share with value at 0.45099, Ripple is trading below it at $ 0.2979. 20 days of simple moving average means a sales share with value at 0.38891, Ripple is trading below it at $ 0.2979.

Other technical analysis of prices for today:

The price of Bitcoin (BTC) declines further and trades below $ 3450 – Bitcoin price analysis – 7 Dec 2018

The price of Factom (FCT) becomes bearish, but exceeds $ 12 – Analysis of fractal prices – 7 Dec 2018

Cardano (ADA) The price has declined heavily and broke $ 0.0300 Support Level-Cardano Price Analysis – Dec 7, 2018