[ad_1]

[ad_1]

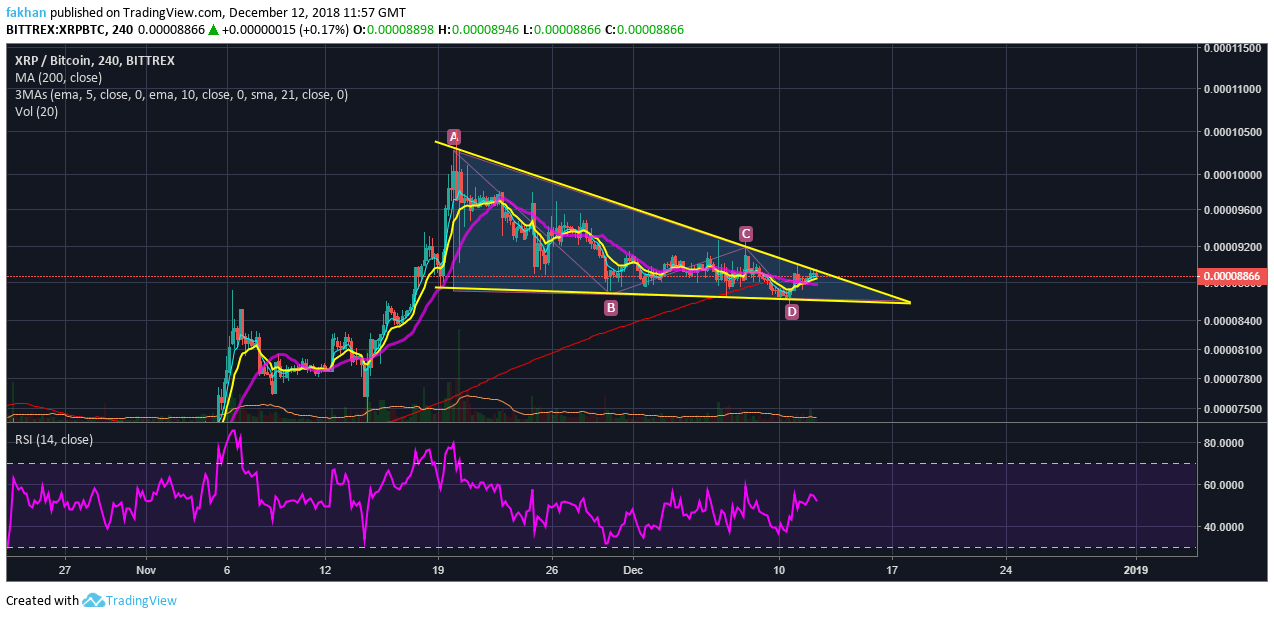

Ripple (XRP) seemed to have escaped his fix against Bitcoin (BTC) for a while, but that situation has changed completely in the last days. From the beginning of this month, Ripple (XRP) showed signs of commercial weakness against Bitcoin (BTC). The 4H chart for XRP / BTC shows that Ripple (XRP) is now exchanging a descending triangle against Bitcoin (BTC). This triangle has a strong chance of breaking down. RSI for XRP / BTC is already in overbought territory and has room for further disadvantages. Price action seems very vulnerable and as soon as XRP / BTC falls below the 21st EMA, it is likely to fall aggressively.

In addition to the 21 EMA, Ripple (XRP) has now dropped below 200 MA on the 4H card, which means there is plenty of room to get off. While the rest of the market is preparing to recover from Bitcoin (BTC), Ripple (XRP) is likely to undergo a correction for the next few weeks. That said, Ripple (XRP) is known to be unpredictable, especially when it comes to making independent moves in a declining market. The RSI could be in overbought territory, but that does not mean that the price should go down in the near future. However, as long as the price remains below both the 21 EMA and the 200 MA, it will be very difficult to recover the price.

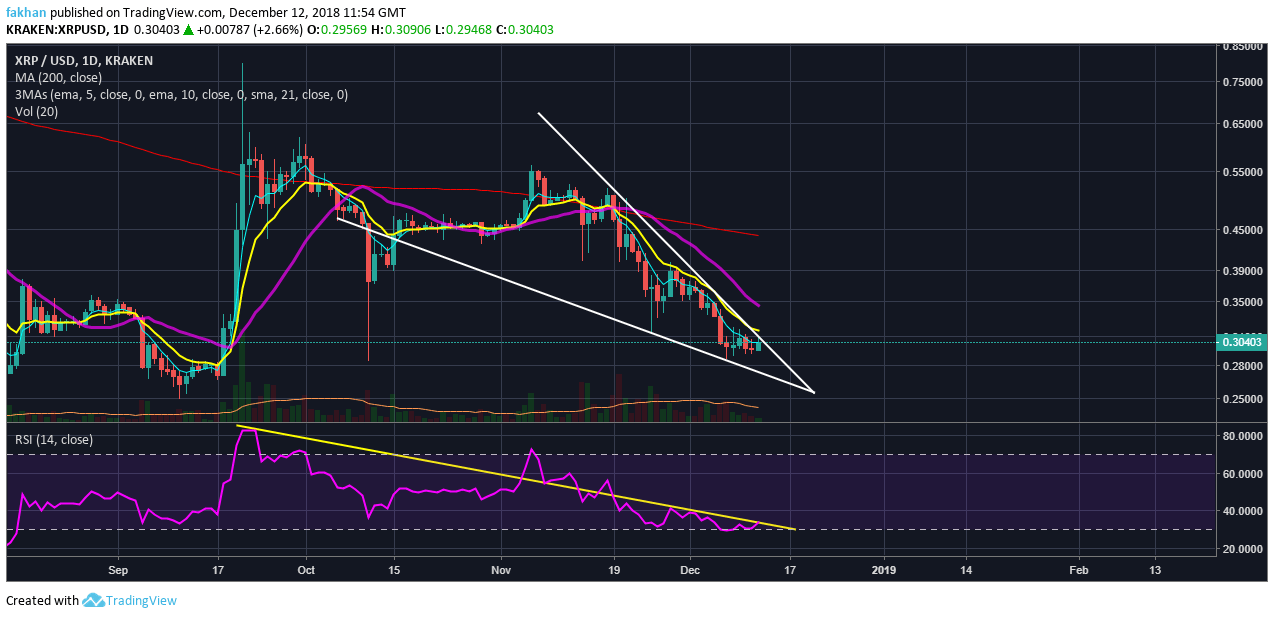

Ripple (XRP) has held firm against the US dollar (USD) in recent days. The price defended against a decline of less than $ 0.20. A lot of speculators have observed $ 0.18 as a potential level for an inversion, but so far the price has not fallen to that level. Also the number of shorts for XRP is constantly increasing and the sentiment at this moment is excessively bearish. That said, long-term XRP hodlers are buying dives as usual even if the price continues to fall further. This explains why Ripple (XRP) is doing better than most other coins at the moment. The daily chart for XRP / USD shows the price trade in a falling wedge. There is room for a decline to $ 0.18, but the odds are a fall below $ 0.20 will be a rapid one that leads to a quick recovery.

There are a lot of purchase orders around $ 0.18 on the major stock exchanges and the price is unlikely to remain at that level for long. Also the RSI in the daily time frame is in oversold conditions and is due to an upward correction. That said, it may still fall further towards the end of the week to pave the way for the last wave before the recovery can begin. Ripple (XRP) is currently up by more than 2% for the day, but has suffered a 5-day EMA and has already suffered a strong rejection. The price is unlikely to remain at current levels for a long time and will soon fall to a new annual low along with the rest of the market.