[ad_1]

[ad_1]

Source: Visual Generation – Shutterstock

- OMFIF presents a report on blockchain technology and the benefits of Ripple products as an alternative to SWIFT.

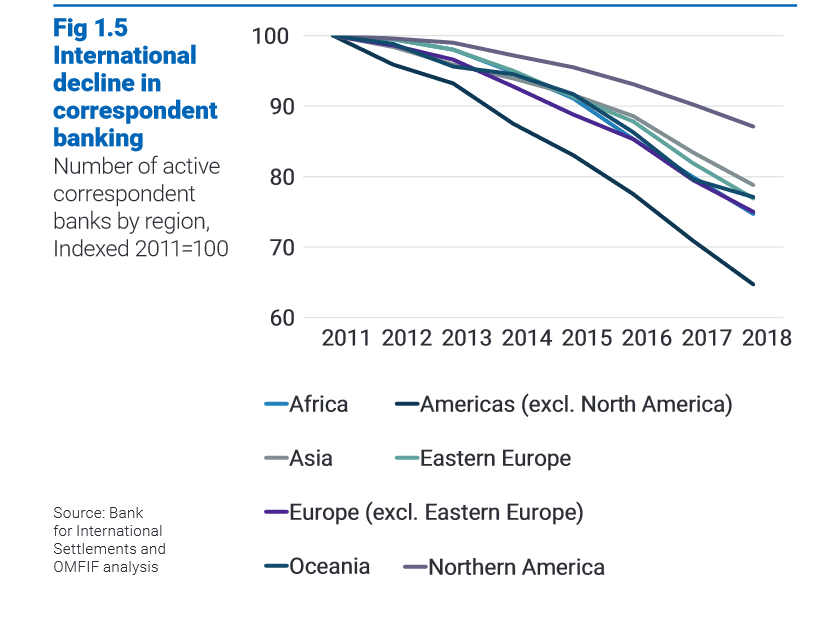

- The report indicates a reduction in correspondent banks around the world which could be an opportunity for XRP and DLT.

A new report presents blockchain technology as a solution for multiple industries. From governance, finance, data access, scalability, the report from the Official Monetary and Financial Institutions Forum (OMFIF), a think tank that focuses on central banks, covers different types of blockchains: private, public and consortium. Ripple products are part of the solutions presented.

According to the report, blockchain technology is appropriate for enhancing several key banking system functions such as payments, settlement and transaction validation. The report points out that the DLT technology on which XRP operates, for example, can bring improvements in 5 key points: security, speed, transparency, traceability, cost and risk management.

Implementing an XRPL-based system could reduce vulnerability in the traditional banking system and its single points of failure. The report gives the following example:

The centralized nature of legacy financial systems makes them vulnerable to single points of failure. For example, a single attack on an intermediary responsible for payments, clearing or settlement could suspend services to the entire system, leading to widespread disruptions between payment services. By creating a distributed network, a DLT-based system could eliminate these single points.

Additionally, distributed general ledger technology could improve the delivery and payment functionality required by some banking services. Therefore, XRP could be applied to eliminate an intermediary in a transaction and remove credit risk. In this way, transactions recorded by a banking institution could be “cheaper”, according to the report.

XRP and its advantages for the traditional financial system

The report examines several banking institutions that agree on the drawbacks of the SWIFT network for making transactions. These are expensive, have a lot of obstacles, and involve a lot of parts to complete. Furthermore, a representative of a banking institution interviewed said that the SWIFT network is not appropriate for companies:

(SWIFT) It’s actually just a bank-to-bank message, so once again it’s not up to par. The contraction and consolidation of the number of corresponding banking channels have reinforced the higher costs associated with cross-border payments as institutions seek to reduce their risk exposures (…). Circumvention of this costly system is widely regarded as the primary motivation for applying DLT to cross-border payments, as there are real efficiencies to be achieved.

Source: https://www.omfif.org/wp-content/uploads/2020/05/The-role-of-blockchain-in-banking.pdf

Highlighting the benefits of Ripple products using XRP, such as On-Demand Liquidity, the report notes that a bank can eliminate the complicated process required by SWIFT and replace it with an XRP pool. This way, a bank can allocate less liquidity as part of a service and still get the same amount of transaction volume in global payments:

The bank only needs to hold its home currency and maintain an account with XRP, with only enough XRP to meet its largest anticipated payment obligation. The process minimizes the number of brokers and their spread markup.

[ad_2]Source link