[ad_1]

[ad_1]

The 21st century will go down as the century of innovation characterized by the emergence of new disruptive technologies. However, even if technology changes lives, in the last forty years the emergence of cross-border and international money transfers has emerged in different jurisdictions with different regulations. For you to easily wrap your head around it, the remittance market is currently estimated at $ 55 trillion. From that huge amount, the charges are $ 31 billion, which is huge and what's even painful is that the whole process takes about three or four days. Ironically, despite the obvious gap, there was no immediate solution that could allow the same day or even the instantaneous settlement of funds.

However, this would not last. In 2004, Ryan Fugger designed the Ripple project. His intention was to create a decentralized monetary system that could effectively empower people and communities to create their own money. This was practically before the official launch of Bitcoin in 2009.

Five years later, Ripple, a remittance company based in San Francisco, was founded by Chris Larsen and Jed McCaleb. This company had ambitious plans. He designed to revolutionize money transfers by reducing the transfer time from a few days to a few seconds. One highlight is that society actually has a longer and more profound history.

The developments did not stop there. In 2011, Jed McCaleb began developing a digital exchange system in which transactions were verified through consensus among network members. A year later, Jed McCaleb invited Chris Larsen. The two tried to face Ryan Fugger with their concept of digital currency. However, a couple of months later, Ryan Fugger abandoned the rescue, leaving Jed McCaleb and Chris Larsen to create OpenCoin.

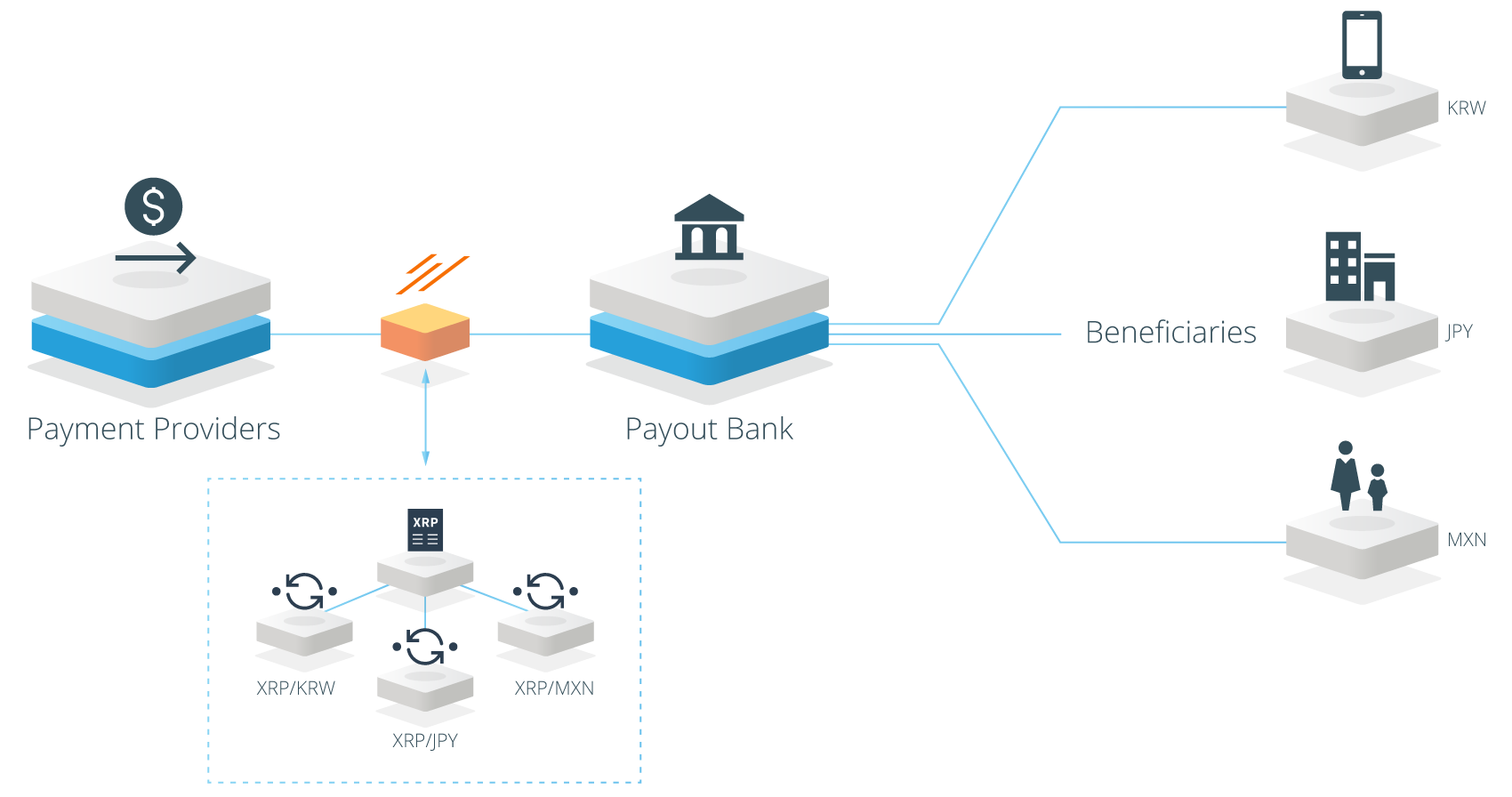

Since then, the progress made by Ripple is nothing short of explosive. For example, last year the Ripple team developed three products: XCurrent, XRapid and XVia. The XCurrent product is currently used by over 100 companies worldwide. Among all the products, XRapid stands out, implicitly using the XRP digital asset. In addition to speed and scalability, the use of XRP as a bridge currency in cross-border transactions allows for the elimination of our accounts.

XRapid, uses XRP and in return XRP is a fiat on demand corridor for XRP / EUR, XRP / USD, XRP / JPY, XRP / MXN, eliminating the need for our accounts. This alone allows an instant settling that effectively disorganizes the need for latency prevalent in the classic money transfer system. There are a couple of companies that pilot the project as they try to incorporate XRapid's efficiency.

So far the product has proved useful after successful USD / MXN conversions of Cuallix's test in 2018. The conversion made use of XRP as a liquidity tool by converting USD in XRP through US trade supported and subsequently XRP in MXN through Mexican exchanges with settlement completed in seconds.

This year, several companies are testing Xrapid. Some of these include: MoneyGram, Currencies Direct, Mercury FX, Western Union, IDT, Cambridge Global Payments, Viamericas. Insti- tutions that pilot Xrapid by Cuallix are Zip Remit and, although not motivated, SBI plans to use Xrapid's efficiency.

The question that is on everyone's lips: Will Ripple replace SWIFT?

I am convinced that this is not the right question to deal with this situation. Also, I think Ripple is not yet mature to replace SWIFT, but I see a room where they will coexist within the same market segment. What we should ask ourselves is: Will Ripple succeed in the next few years, will it become a leader in the cross-border money transfer market and will guarantee a 50% market share in the future?

Currently, SWIFT is a monopoly in the remittance market. History shows that a market leader is difficult to remove. Encouragingly, Ripple may have the muscle to overcome and become a winner in this battle of supremacy against SWIFT.

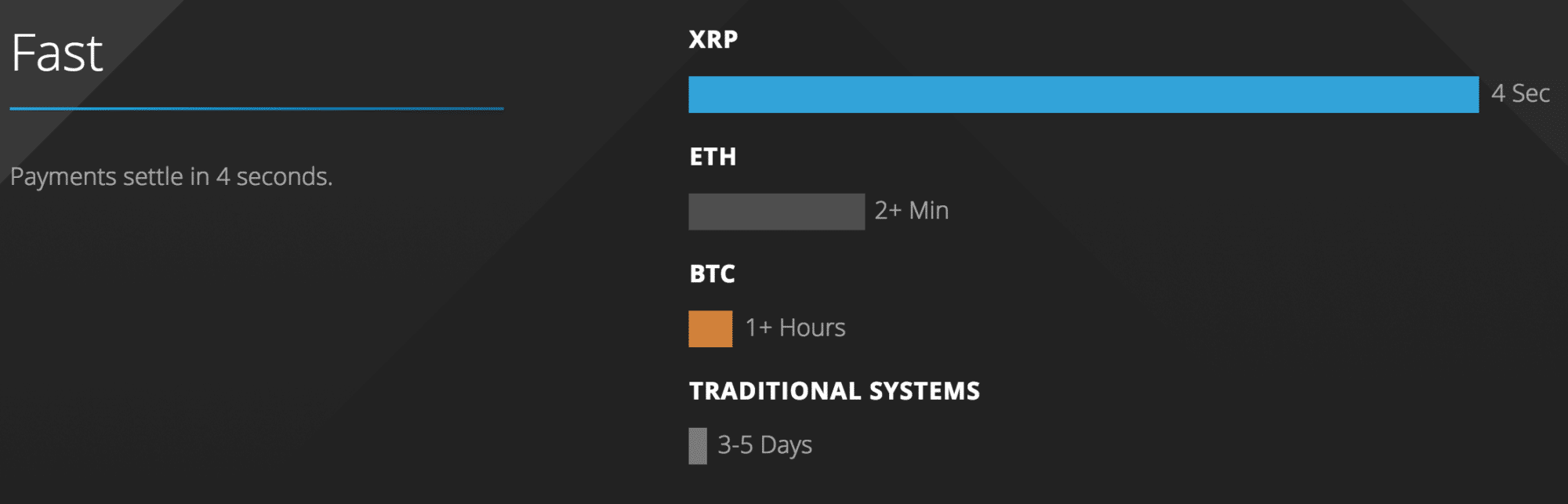

Speed

What are the arguments that make me think that Ripple will succeed? First, we can talk about transfer speed or fund regulation. Through SWIFT, it will take at least four days for moving funds between different continents. A transfer made via XRapid is resolved within 4 seconds at most. This year, the financial institutions that pilot XRapid have reported savings of up to 70%, another blow to the expensive SWIFT.

Talented and Focus Team

Another argument in favor of Ripple is the talent and seriousness of the project and the team. Ripple is also very good at lobbying and has key connections that could later strengthen their very existence and / or success. Through their vibrant marketing department, the organization managed to convince personalities like Madonna and Ashton Kutcher to publicize the company. Alongside, this year, the former US president Bill Clinton will hold a keynote at the SWELL 2018 conference. SWELL 2018 is an event initiated by Ripple.

The road Ripple will take to dethrone SWIFT will be hard if not at all impossible to say the least. We plan a slow and gradual process that will undoubtedly require years. In the beginning, Ripple could work hard to cut out 5 to 10 percent of the total remittance service before developing the much needed momentum. Needless to say, the battle for supremacy depends to a large extent on how Ripple deploys XRapid, but above all by how SWIFT has returned to the competition.

Beefed Liquidity

Undoubtedly, liquidity concerns should be a priority for Ripple and the way in which they devise appropriate solutions depends entirely on their strategic approach. The good thing is that I'm at work. This year they have increased their support and XRP is available in different bags on different continents. In fact, traders can deposit or withdraw XRPs for fiat such as USD, GBP, JPY, CAD, MXN or Euro. That's not all, some exchanges and funds are making XRP base thanks to the efficiency and speed that goes.

Successful Decentralization

In addition, Ripple has been on a decentralization record and has so far been successful to say the least. From the reliable data, the number of non-Ripple validators exceeds 50%, which means that Ripple is not responsible and the consultation must take place before the implementation of any chain development.

What is SWIFT available for the Wade Off competition?

I tried to find data on how to improve or modify the SWIFT messaging service for this article, but it was difficult. On the official website, we did not find concrete data on the improvement of the SWIFT messaging service. Although they say there are plans to update their software, there are no specifics about what will improve.

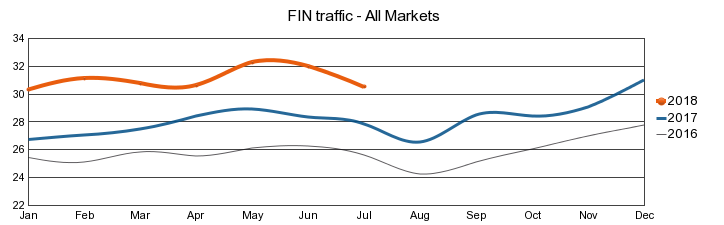

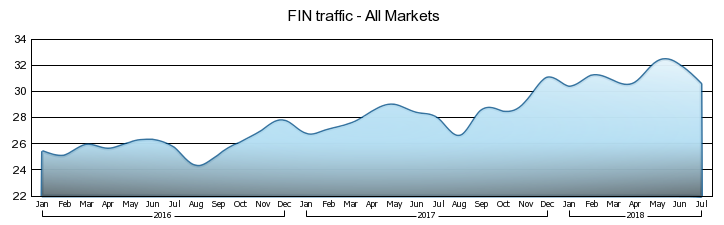

However, I found some interesting information about SWIFT. In July 2018, SWIFT recorded an average of 30.5 million FIN messages per day. Traffic grew by 9.5% compared to July 2017, bringing growth from the beginning of the year to + 11.7%.

(After some research on the Internet, I managed to find the following information about SWIFT in 2018. At the last tests, the duration of a SWIFT transfer was reduced to 11 hours and 3 minutes.)

As you can see, the number of daily messages SWIFT is increased by year in year. This means that the market is constantly expanding.

Conclusions

Some believe that Ripple will deter SWIFT in a few years. I'm not convinced of it. At the moment, Ripple is nascent but SWIFT has matured and is the most dominant fund transfer service and a space for banks. However, it is not a crowded market and Ripple can easily secure a place in cross-border transfer. They can coexist on the same market segment, as Samsung competes with Apple or Intel with AMD. In fact, the competition between two companies on the same market segment is something normal in the global economy. Finally, over the years, Ripple will reach a market share of 40-50% to be able to say that the company is a success.

SWIFT: as long as the speed improves, it remains a messaging service while Ruffle runs on blockchain technology. With this innovative technology at its disposal, SWIFT will never eliminate the need for instant accounts and scaffolding. To succeed, SWIFT should invest and create its own blockchain technology, an expensive task that will take time before it is perfected.

If Ripple distributes XRapid to as many financial entities as possible, we will see a real revolution in the years to come. It will be an intense battle but in such battles technology often reigns supreme. Therefore, unless SWIFT does not modify and innovate, it will be rendered obsolete by Ripple.