[ad_1]

[ad_1]

Ripple investors (XRP) are known to be much more optimistic than others for a long time. However, whales are beginning to identify such waves of interest in cryptocurrency and could play a long game to trap overly optimistic investors. On the surface, everything looks good as far as XRP / USD or XRP / BTC are concerned. These tables tell us what the average investor is thinking, but the XRPUSDLongs chart tells us what the average trader thinks. Investors of Ripple (XRP) are mostly hodlers who do not bother to buy the dip and accumulate everything they can. Over the months, this scheme has become more obvious to whales. If Ripple investors (XRP) are not careful, they may fall prey to mischievous schemes and projects of these greedy whales.

This is not a theory. We have seen this happen in the past when the price of XRP / USD was manipulated in 2018 around the Swell Conference. The retail interest in Ripple (XRP) was one of the highest at that point and the price was trading just above $ 0.18. Everyone was talking about Ripple (XRP) as the next big thing. During the conference, Ben Bernanke and Tim Berners Lee were the keynote speakers. The whole event was a great success, but the price of Ripple (XRP) continued to make the tank before, during and even after the conference. Most XRP / USD investors had no idea why the price would have been accumulated before, during and after such a successful event. If this had been another coin, we would have said that people were just buying the item and selling the news.

Ripple (XRP) on the other hand is mostly supported by average investors. Coinbase has not yet listed Ripple (XRP) on its platform to date, but it has however become the second largest currency by market capitalization. This continues to show the level of interest in XRP / USD. However, where all this optimism joins, the bad players who want to take advantage of this exuberance also enter the scene. This is what happened during the penultimate Swell Conference and this will most likely happen again. Ripple (XRP) has a large availability and not all investors have to buy coins in the stock exchange. This means that they can buy without affecting the price of Ripple (XRP) but they can sell on exchanges to manipulate the price to their advantage.

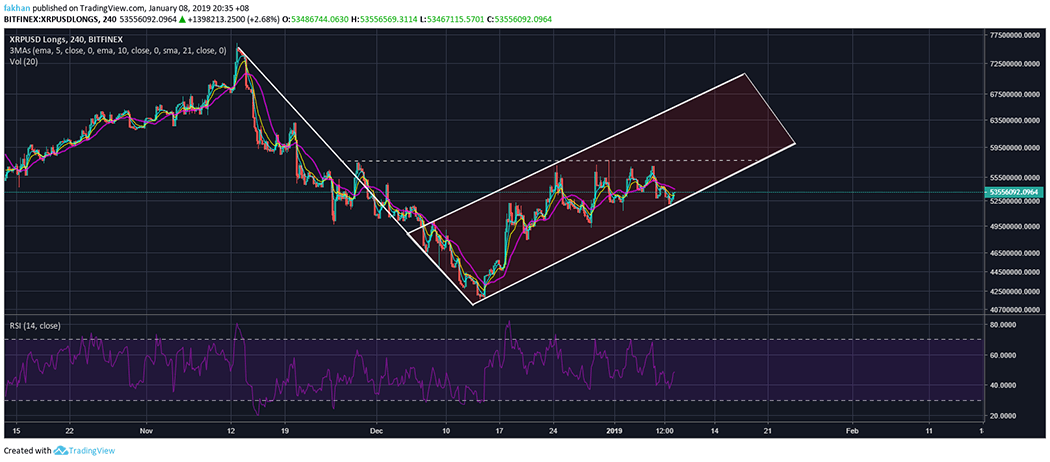

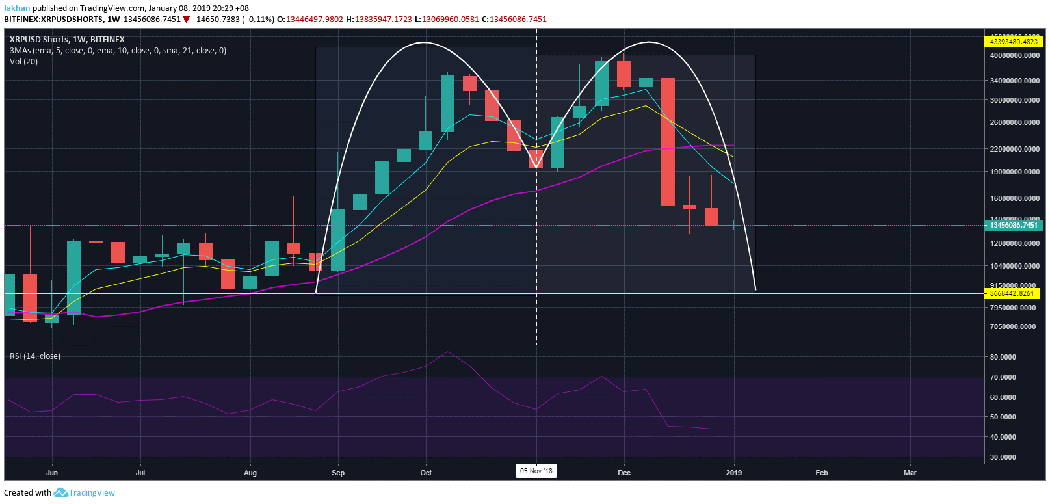

The bear flag on the first chart for XRPUSDLongs shows us what is possible and the price action on the XRPUSDShorts chart shows us what's happening right now. The number of short circuits has already decreased significantly and is about to complete the correction. This means that Ripple (XRP) will be ready for a new wave of sales pressure in the coming months. Whether or not it is able to withstand that pressure is another debate, but these are the risk factors that investors in XRP / USD must be wary of in order to better protect themselves against the moves of bad players in the market.