While the market plummeted for most of 2018 and the price of coins fell to 90%, Ripple (XRP-USD) continued to add partners, strengthen its economies on coins and push its xRapid product. As we transform the page in 2019, it appears that Ripple will be the first major victory and blockchain interruption – in cross-border payments and remittances.

Just this week, Ripple announced the launch of xRapid with some of its partners. Euro Exim Bank, a financial institution based in the United Kingdom, and SendFriend, an international remittance service, will use both XRP tokens through the xRapid product.

To be sure, these are not the kind of flamboyant partnerships signed by Ripple who have not committed themselves to using XRP. We discussed this in previous articles and in the risk of investing in XRP tokens, which do not serve as the main collaborative vehicle with the largest name banks with which Ripple has announced partnerships. This risk is not new, it exists as long as Ripple is in the cryptocurrency market and carries the risk of "centralization" that many fans complain about Ripple. However, no currency has made Ripple's progress in the last six months and has started to respond to many of the challenges presented.

Let's first take a look at the aforementioned companies. Euro Exim Bank is not a huge British / European bank, but it is certainly growing. His announcement of a partnership with Ripple was to predict the use of xRapid – and XRP by proxy – to feed payments in 80 countries. Obviously, the bank is trying to anticipate its bigger competitors in what could become a way for cross-border payments. Ripple's announcement said that its service saw "40-70 percent savings compared to what foreign brokers normally pay".

SendFriend is a similar story. It is a small startup that seeks to capitalize on market opportunities for monetary remittances between the United States and other countries, starting with the Philippines.

As its Crunchbase page says, "SendFriend is a team from Ex-World Bank and the Ex-MoneyGram staff are passionate about bringing innovation to the masses. Other investors include Techstars, Barclays Bank, Mahindra Finance, MasterCard Foundation and Deloitte (services). "

Both of these organizations are said to start using xRapid in Q1. For now it's small, but it's not a bad idea for Ripple to test his selection product on these smaller beta testers.

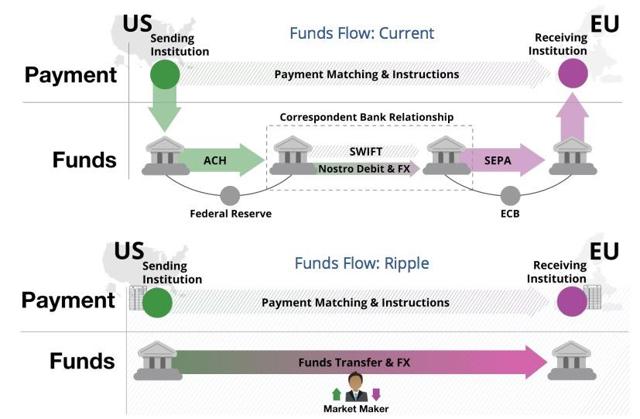

Here is a brief chart of Ripple's competitive field:

Pic Source: GigaOM

Pic Source: GigaOM

And the rest of the story here is huge. And this is the great protagonist of this space, which Ripple has constantly adhered to different types of partnerships throughout 2018.

In December, Ripple announced a partnership with Israel's largest financial services company. Just last week he did the same with Kuwait Finance House, one of the largest banks in the Middle East. And this after the November partnership with CIMB, a Malaysian bank that occupies the fifth place in the ASEAN network.

This makes more than 150 banks and / or financial institutions that now have some sort of association with Ripple – from the certified partner to the network user. And this is only the beginning. No other currency, not Bitcoin (BTC-USD) or Ethereum (ETH-USD), has the type of range in a specific sector as Ripple does here.

Regarding cryptography, Ripple signed an agreement with Bittrex and Bitso to work on monetary transfers made through cryptographic exchanges to automatically convert the fiat into cryptography.

As explained by Ripple's CEO, Brad Garlinghouse, "2019 is the year that the wheat will be separated from the chaff Not many months ago, the media said that nobody would use XRP, which made the headlines skeptical, Today we can not say that people are starting to use XRapid because it's better, faster, and cheaper. "

If Ripple can see his xRapid product able to upset even a small degree in the remittance market, it's an incredible race. The market has grown almost every year since 2000 and Ripple presents one of the biggest innovations in that market. Tokens XRP once exchanged for almost $ 4 – at a price close to $ 0.3 now. The XRP remains an investment with an immensely large increase.

Well, the encrypted mania may have deflated. But it's not a bad thing! In fact, if you still believe in the transformative power of the blockchain, it means that many of these technologies have returned to the first adoption prices. At Coin Agora, our focus is on altcoins – small-cap crypts that have enormous potential to upset corporate ecosystems. Do not miss it: the price craze may return in 2019 and it's your chance to get in now. Let us help you overcome the noise and find the winners – join the Coin Agora community today!

Revelation: We are / are long XRP-USD. I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link