[ad_1]

[ad_1]

To sum up, XRP is bearish against the USD, despite being a bitcoin hedge. Against the main cryptocurrency, Ripple seems bullish and has recently overtaken Ethereum as the second largest crypt.

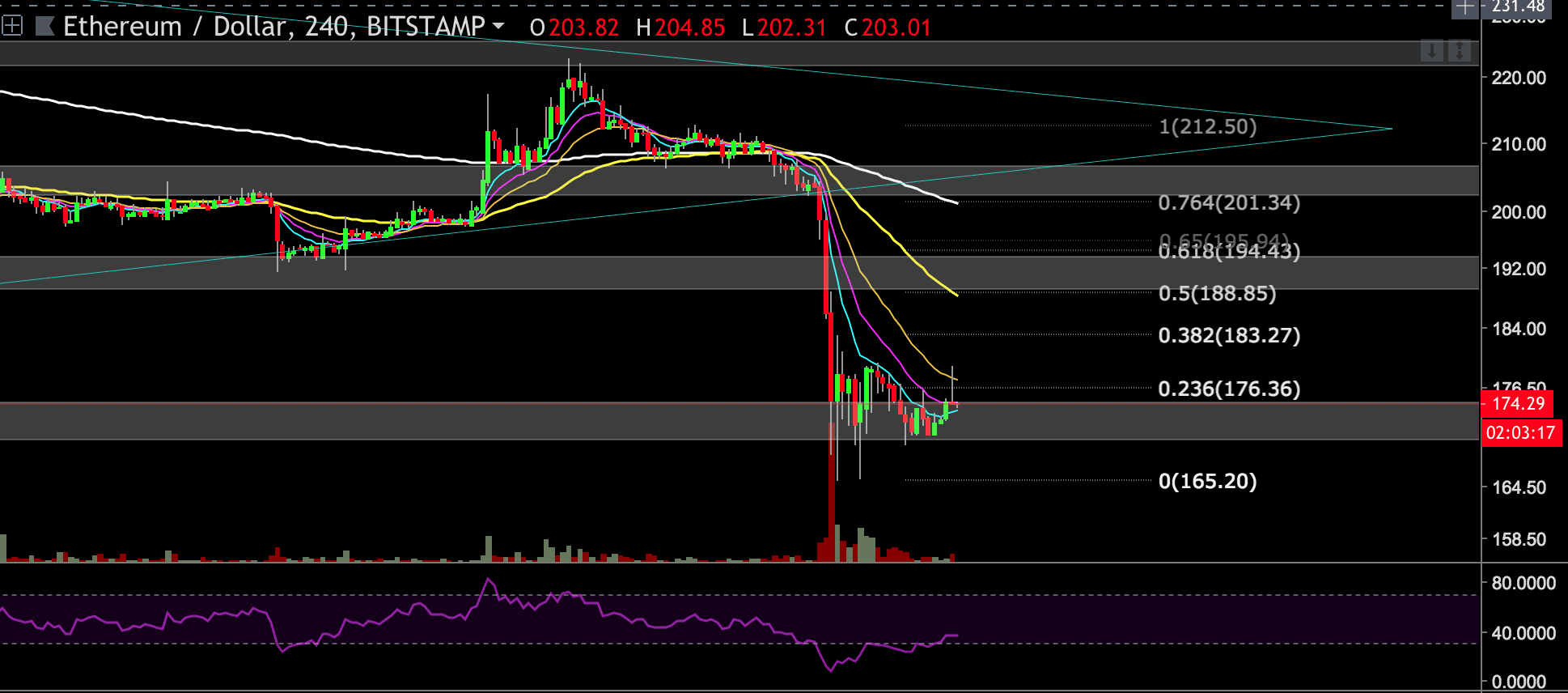

XRP-USD market

The XRP market is moving downwards following the volume of the high seller. A breakout above the resistance level of $ 0.55 may occur if buyers react strongly with a demand strength. This crypt will remain in a bearish trend, but a bullish run could save the market from bears

The last twelve days have seen a decline in the value of Ripple in USD. This is the result of the selling pressure that follows the tendency to bearish encryption.

Looking at the long-term trend, it seems that the price is reaching for the significant support level of $ 0.45 (1). A break in the previous level and the next target may be the support level $ 0.40 (2) in which the lowest trend line is found. On the bullish side, the next major resistance is $ 0.53.

Furthermore, the Relative Strength Index (RSI) 14 indicates the low level of (40) indicating that the market is close to the oversold zone. At the same time, the moving averages 50 and 100 are equally capable of reaching a tilt direction to signal a clear bearish tendency.

Main levels:

Resistance levels: $ 0.53, $ 0.57, $ 0.61 | Support levels: $ 0.45, $ 0.40, $ 0.38

4-hour XRP / Dollar Chart BitFinex

XRP / Dollar BitFinex 1 hour chart

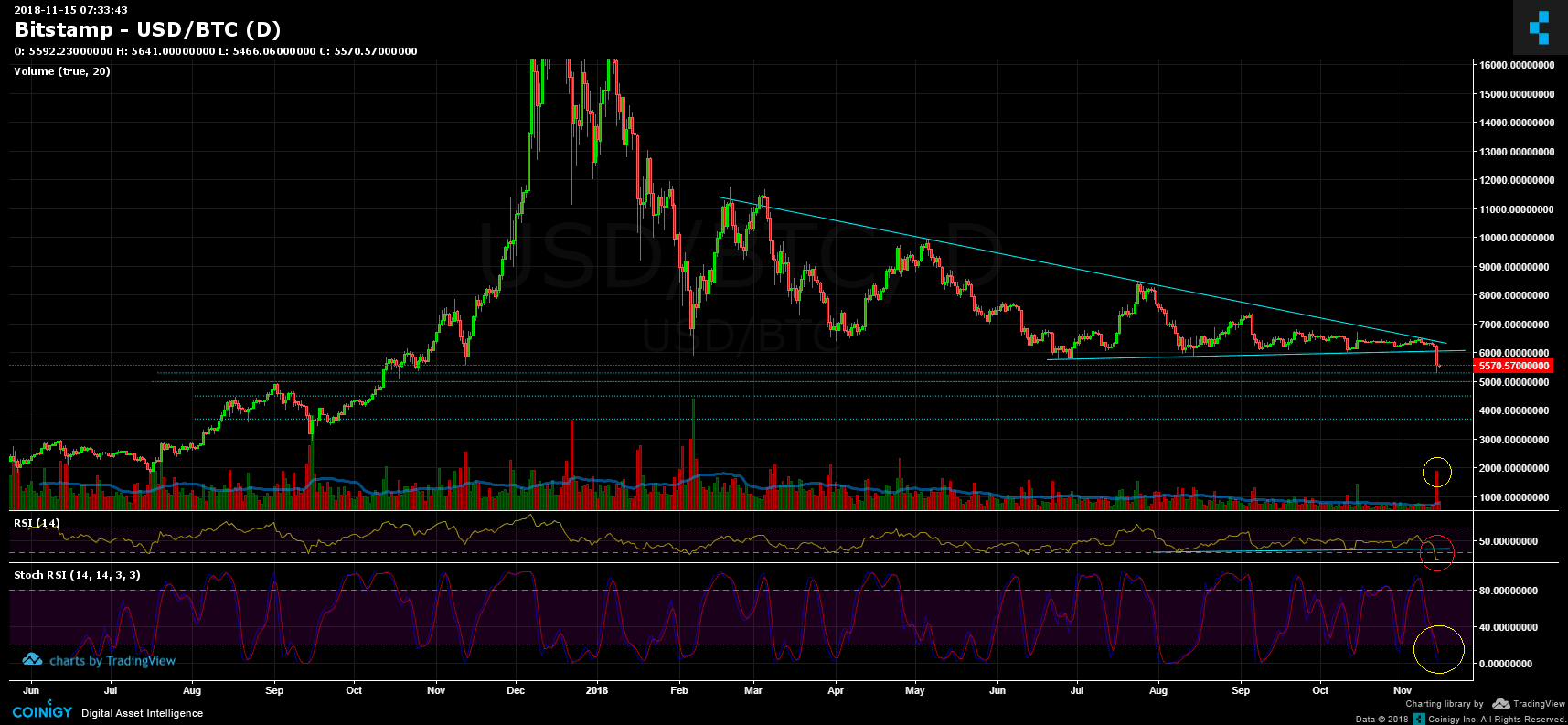

XRP-BTC market

Against Bitcoin, the story is completely different. During this current bear market, Ripple seems to be the gold to protect Bitcoin.

Ripple looks bullish against BTC. In the following table of 1 day below, we can see that Ripple had met resistance yesterday (9400 Satoshi). The next significant support is found at 8760 Satoshi, along with the ascending trendline (which supports the chart around 8300 Satoshi right now).

The RSI looks bullish in an upward trend line, while the stochastic RSI approaches the overbought zone.

Chart 1-day Binance XRP / BTC

TradingView cryptocurrency charts. Coinigy technical analysis tools.

Be the first to know about our price analysis, crypto news and trading tips: follow us on Telegram or subscribe to our weekly newsletter.

More news for you:

[ad_2]Source link