[ad_1]

[ad_1]

Opinion: XRP, the second largest cryptocurrency by market capitalization, has faced a lot of speculation since the start, and the stories have re-emerged after the SEC has renewed their search for fraudulent ICOs to help investors to lose funds.

The origin of Ripple and XRP has always been unclear, as the facts available say one thing, but company officials say one more.

Although Ripple's CEO, Chris Larsen, and market strategist boss, Cory Johnson, have made it quite clear in recent days from their media tours that XRP is not actually published and created by Ripple, they still have many explanations to make respect to the skeletons of the past that crawl out of the closet.

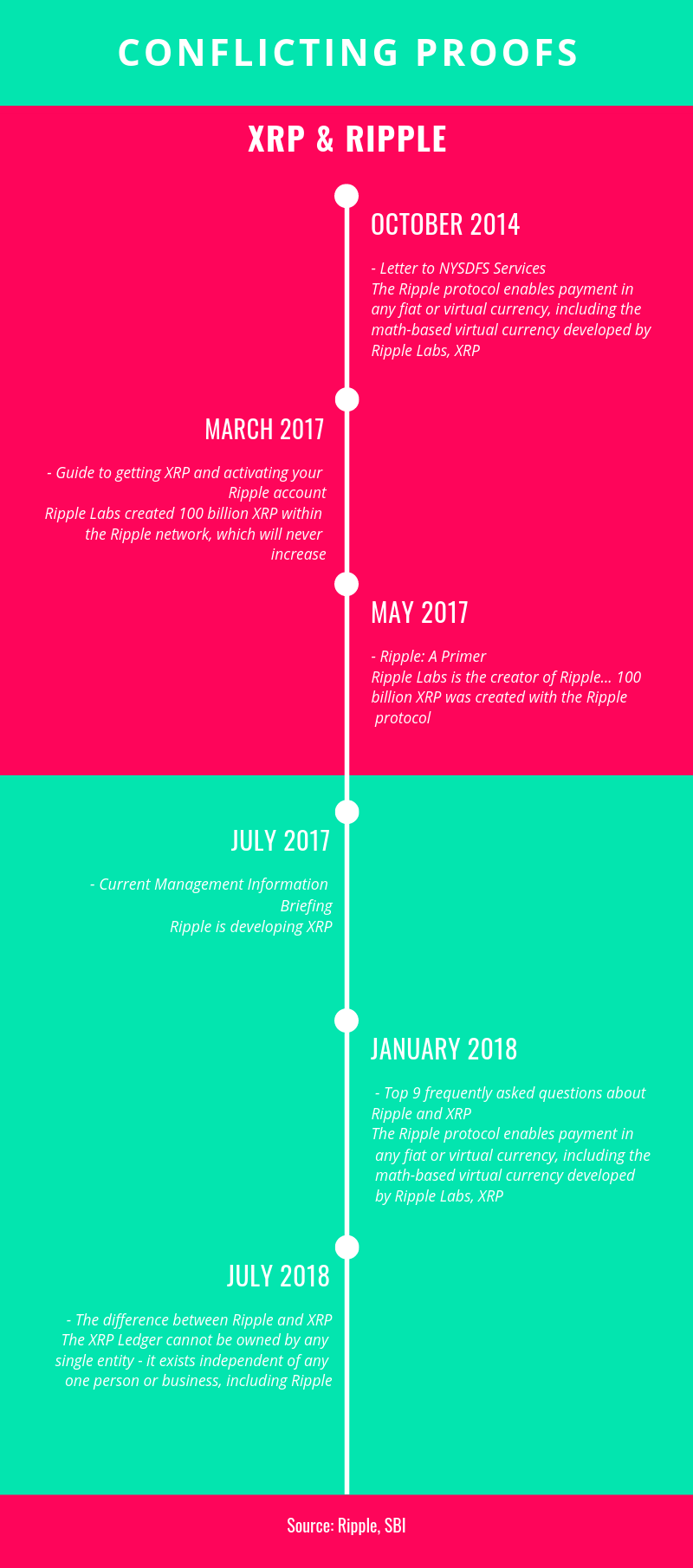

The infographic below shows evidence of conflicting ideas on Ripple and XRP.

To avoid further confusion in the community, Jed McCaleb and Cory Johnson took a media tour to clarify that XRP is not a security and that it was not created by Ripple.

One such example is the letter from Ripple's CEO, Brad Garlinghouse, which lists the reasons why XRP is not a security.

1. "If Ripple, the company, were to shut down tomorrow, the XRP register will continue to operate.It is an open source and decentralized technology that exists independently of Ripple."

2. "People who buy XRP do not think about buying Ripple shares.There is a company called Ripple, we are a private company, we have investors … but buying XRP does not give you ownership of Ripple, it does not give you access to dividends or profits that come from Ripple. "

3. "XRP is solving a problem.There is no use in a security."

The refutation

In response to Mike Dudas's Tweet, Dr. T [XRPTrump] he denied Ripple's proof that he created XRP and claimed that it was created long before the Ripple company and also provides proof with a GitHub repository that shows that 100 billion XRPs were actually created in May 2012 and that Ripple was created in September 2012.

In addition to the GitHub repository, Dr. T also refers to The Founder & # 39; s Agreement created by Jed McCaleb, Chris Larsen and Arthur Britto, which sheds light on how the XRP was created and distributed among the founders.

David Schwartz, CTO of Ripple, was in agreement with Dr. T and said:

"It's a very bizarre series of superficially apparent contradictions presented as if they were a great mystery and there was no way of saying what is true." Many of them can be readily clarified just by looking at the project's public github story. "

He continued:

"It is not surprising that when discussing things where the distinction is not relevant (such as the mechanics of the XRP offering) it does not distinguish between what Ripple has made the company and what the people who have become founders and employees have done before the establishment of the company ".

XRP The Standard [XRP Community]

As reported in the XRP community blog, Hodor, an impassioned XRP enthusiast, said that "the share of ownership of the company [Ripple] it is only known to insiders ", while he also stated that the company is still" private ".

"… we can assume that as soon as the investor is, the greater the potential share, in general, however, the considerable amount of money infused in successive turns could have determined a significant share of the company's property; at work they really know for sure. "

The blog also said that the founders of Ripple and XRP assigned a portion of XRP to themselves, while they donated most to the Ripple company [previously called OpenCoin].

OpenCoin received 80 billion XRP while Jed McCaleb and Chris Larsen received $ 9 billion and $ 7 billion respectively. Jesse Powell, who was also on the board of Ripple, has published a letter asking why Jed McCaleb and Chris Larsen have assigned themselves to XRP. Powell said:

"In my opinion, the two stole the company assets when they hired XRP without the approval of the first investors and without sharing the allocation among the other shareholders".

But then again, it was just a sight, and as Hodor says "only the insiders know for sure".

Securities and Exchange Commission [SEC]

During the Consensus Invest 2018, Jay Clayton of the SEC was asked several times about how and when XRP will be classified, to which he replied:

"We are open to people who come to see us with their particular situation and, I will tell you, some of these questions take time."

The Howey test is open to interpretation and stating the facts and emphasizing that XRP is a security does not make it. Only time can tell what the SEC will decide, and if it decides to classify it as security, what the implications for XRP and the community could be.

implications:

XRP is a security

If the XRP is classified as security, the first thing that will happen is that there will be a massive FUD in the community and the price may fall sharply, but the case of use for XRP will remain the same.

Clayton's "no comment" response on XRP could mean that the resource is under investigation, and Bakkt has recently shown interest in enumerating cryptocurrencies other than Bitcoin, knowing that Bakkt is supported by the ICE parent company and conveniently owns the New York Stock Exchange . If we put two and two together, it could mean that the SEC could be awaiting the launch of Bakkt. But then again, this is pure speculation and above all, this is a great if.

Moreover, according to the SEC rules, XRP will be removed from all cryptocurrency exchanges and the legal framework governing the securities would mean that Ripple should meet the fiduciary obligations towards their so-called shareholder. Significantly, a security classification would be a disaster for Ripple because, as per US SEC security laws, XRP hobbing would have a property right, income, dividends, interest, etc.

Although the above situation seems sad, it could also be a safe haven for XRP and Ripple as they will now be supported by the SEC and therefore create a favorable climate of trust around the asset, which could trigger investments by major institutions that otherwise do not they would invest in cryptocurrencies.

XRP is not a security

If the SEC rules that XRP is not a security and only one other utility, XRP's operation would not change, and all the FUD surrounding XRP and Ripple and the creation of XRP would be done once and for all.

The advantage of not being classified as security could cause ripples [pun intended] in the XRP community and cause a price spike, thus pushing the mass adoption of XRP and more partnerships with Ripple.

Institutional investors will invest in it regardless of its classification, and instead of buying it from stock exchange they would buy it from stock exchanges like Binance, Coinbase or OTC.

Furthermore, it would reduce regulatory uncertainty in space and lead to greater capital investment.

Subscribe to the AMBCrypto newsletter