[ad_1]

[ad_1]

Red path confirmed

Summary:

I'm going to keep this as short as Bitcoin and Ethereum have both followed their respective red counts, though not as a triangle for 4. This is academic though. What is fundamental now is that we maintain a lower one, which should be 5 of V of C in both counts. While I continue to count the $ 3320 support in Bitcoin and $ 94 in Ethereum, these counts are more than "full". And, if we see corrective actions from these levels this week, I assume that there will be a break in support, at least for trading. By this I mean that risk management will be more important than trying to reach a low level, at least up to five up to the extension of .382 and .618.

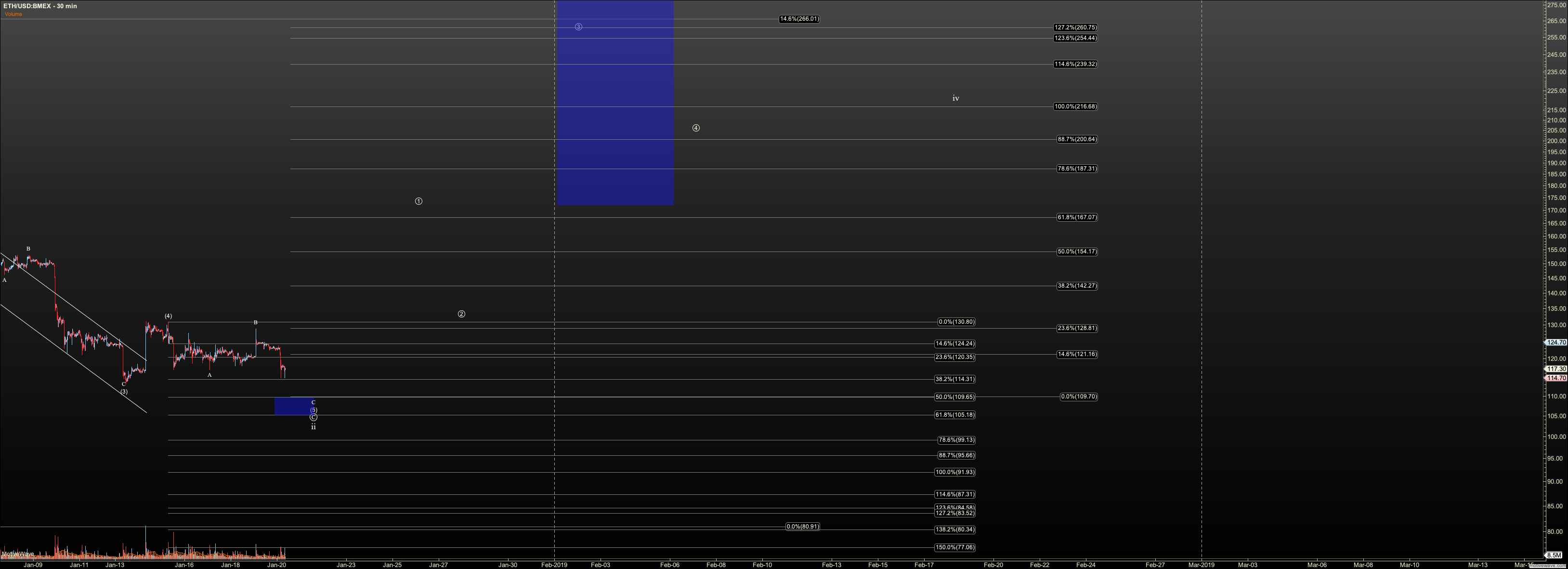

Bitcoin

At the moment I have $ 3368- $ 3400 as a probable zone for a fund, and strong over $ 3575 suggests that this little wave 5 is complete. We saw a nominal resistance break for 4, but only a peak that did not follow. Obviously, then we came back.

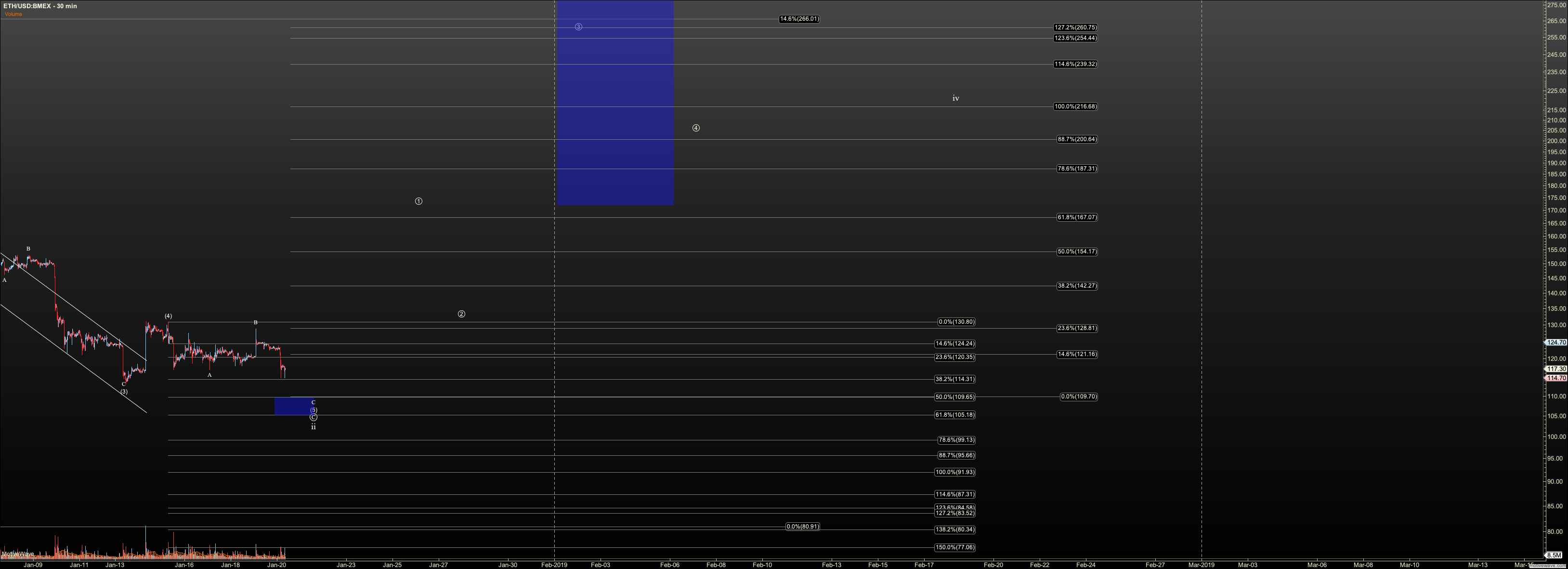

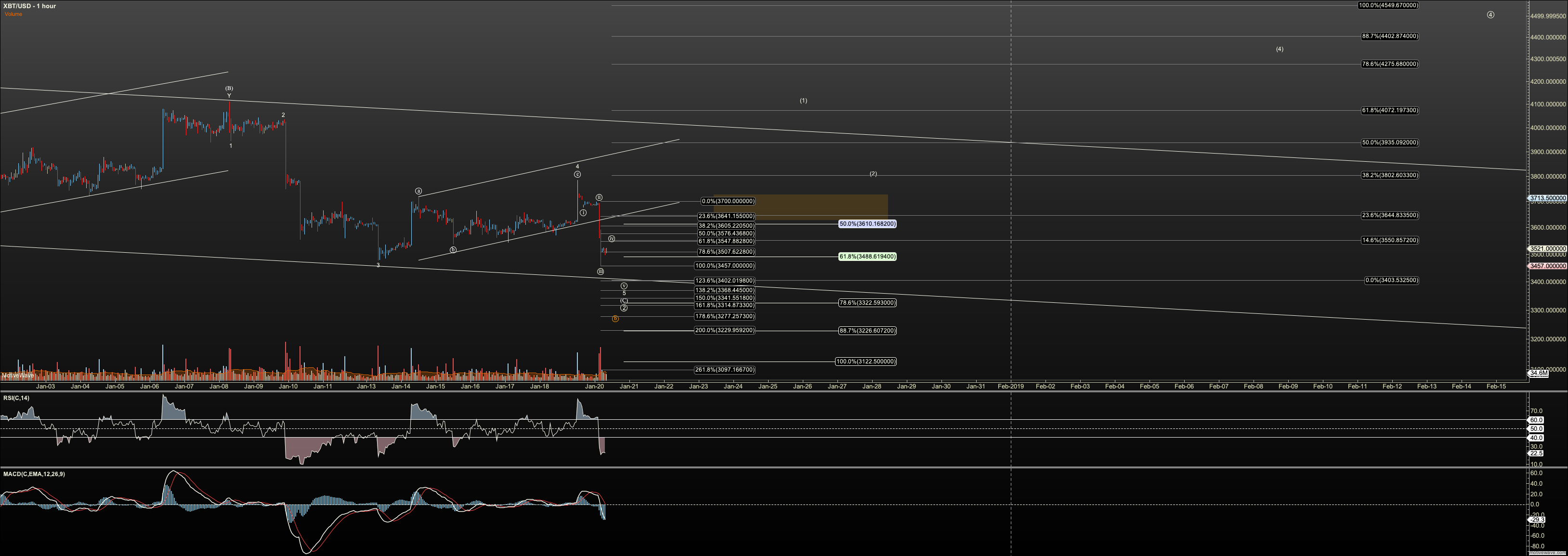

Ethereum

At the moment I have $ 105 to $ 109 as a probable zone for a fund, and strong over $ 121 suggests that this little wave 5 is complete.

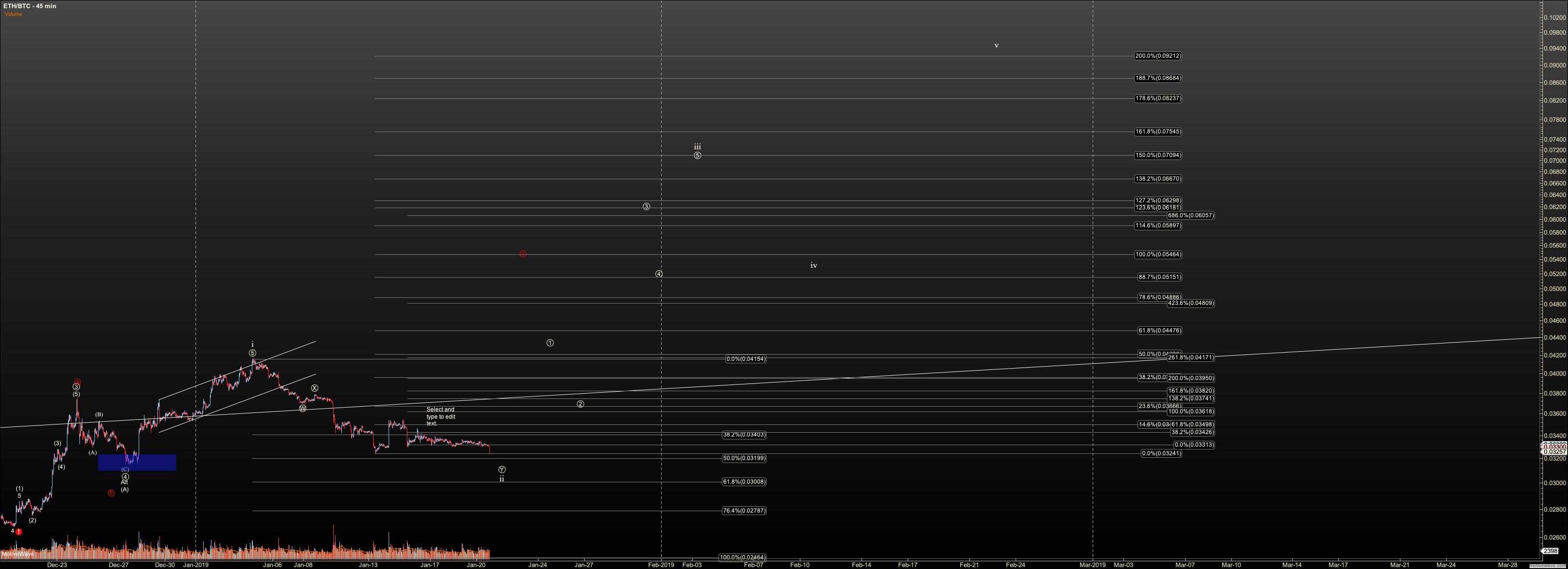

I have ETHBTC wrapping a WXY while holding down .03

No changes to GBTC right now, and still quite unclear.

ETHUSD – Primary Analysis – 20 January 2038 PM (30 min)

XBTUSD – Primary analysis – 20 January 2037 PM (1 hour)

ETHBTC – Primary Analysis – 20 January 2039 PM (45 min)