[ad_1]

[ad_1]

As a second article in “The Twain Series” (insight into consumer fintech and cryptography), this article aims to take a closer look at the consumer payments vertical

Since writing the article on why the next engine of mass adoption of cryptocurrencies will come from consumer fintech companies in July of this year, two big news have shown how more traditional fintech players will access crypto payment.

10/8 Square has announced investments of $ 50 million in Bitcoin

21/10 PayPal officially confirmed crypto payment services starting in 2021

The logic of the last article seems to remain intact for now. If you want to review the complete logic, you can find Here.

Background: COVID-19 brings new payment disruptions after ecommerce

Covid-19 highlighted the shortcomings of the current payment solution

In recent years, smartphones, e-commerce and sharing economy have been the key forces that have shifted consumer payment habits from cash transactions to mobile / online payment. In addition to these factors, on the demand side, COVID-19 urged consumers to seek non-cash transaction methods. For the underbanked / unbanked population, the options are even more limited, showing the current shortcomings of payment solutions.

“The migration to digital payments and digital representations of value continues to accelerate, driven by the COVID-19 pandemic and the growing interest in digital currencies by central banks and consumers. “- PayPal

Crypto has officially become the strategy of leading fintech companies

While preparation was underway years earlier, Square and PayPal formally announced their crypto payment adventure in 2020. The rationale behind the strategy discussed last time is supported.

Let’s take a look at the most common payment scenario – shopping and see how crypto payment can work nowadays.

Crypto Payment Today

While more retailers accept cryptocurrencies than before, most crypto payment solutions today don’t require stores to switch infrastructure. This is, innovation occurs more on the side of customer-facing products. The implication is that current solutions are mostly centralized, depending on the Visa / Mastercard platforms or intermediaries. As more and more retailers officially declare cryptocurrencies acceptable, the direction of innovation will change.

How to buy a cup of coffee with your encryption NOW?

POS terminal compatible with cryptocurrencies (for shops)

While there are some coffee shops that install POS terminals that accept cryptocurrencies, Starbucks, along with many large retailers, have not joined the gang so far.

Crypto debit card

Just like with regular fiat-based debit cards, customers need to have a balance in their digital wallet to spend their crypto debit cards. Crypto-native business models also apply here – some companies offer cashback above the market in tokens and additional bonuses obtained through their utility tokens. Take Crypto.com for example, the more tokens you have purchased, the higher the membership level you can get with an additional bonus. The issuance of prepaid Visa cards has also become the strategy of large exchanges such as Coinbase and Binance, which can offer up to 8% of each consumption.

Crypto credit card

For the crypto credit card, Nexo, one of the first crypto lending platforms, is preparing to launch the first crypto credit card that allows customers to get instant credit lines when they swipe their Nexo MasterCard.

The reason crypto credit / debit cards can complete the final stage of payment in the real world is based on the network supported by Visa and Mastercard.

Encrypted gift voucher

Several platforms have accepted cryptocurrencies as one of the payment methods such as Gyft and Alagoria which allows customers to purchase gift cards from over 200 retailers. The process behind it is still centralized, with the platform connecting people who want to sell redundant gift cards with people who pay in cryptocurrency (in Gyft’s case, the platform itself accepts Bitcoin, acting as an intermediary for the gift card transaction). The two main platforms have partnered with Coinbase by requiring users to use Coinbase wallets. Spedn, a crypto payment app backed by the Gemini cryptocurrency exchange, also leverages gift card purchases in the backend to allow customers to pay for their crypto in different stores (yes, including Starbucks).

What’s next? More and more small and medium-sized enterprises (SMEs) accept that cryptography and blockchain-based solutions are on the rise

Most of the current crypto payment solutions discussed above are like transitioning before large retailers accepted crypto. I think it’s also fair to say that their existence stems primarily from consumer incentives to spend cryptocurrencies.

Although through the aforementioned encrypted payment solutions, consumers can pay indirectly in encryption, most big brands like Amazon and Starbucks have not officially declared cryptocurrencies as acceptable currencies (usually due to regulatory / accounting factors). But the tide is turning like ecommerce companies like Shopify that have integrated more than one crypto payment company since last year, including CoinPayments and OpenNode. More SMEs have started accepting cryptocurrency payments with more ready-to-use facilities and on-ramp / off-ramp fiat gateways. The most common on the market currently are POS terminals that accept encrypted or cryptographic payment gateways for e-commerce / offline retailers like BItpay.

Another driving force behind crypto payment is the blockchain-based infrastructure given its unique characteristics vs. digital fiat, including decentralization and posting from a bank account.

What do blockchain-based payment apps have to offer?

A key feature is the intrinsic immutability of blockchain. With the blockchain as the underlying decentralized ledger for recording transactions, merchants can save time and costs in settling chargebacks.

The blockchain-based payment app also reduces the criteria and costs for opening a digital account on crypto wallets. In this category, Libra and Celo have initiated the grand vision from Facebook that stressed financial inclusion, potentially replacing bank accounts with easy-to-access digital wallets.

One of the main key drivers of cryptocurrency payment comes from the continuous innovation within the blockchain / web3 projectS. Lightening Network, which is a protocol that makes P2P transfer on Bitcoin faster and cheaper than ever, has shown great strides in increasing 7 blockchains per second to over 400 blocks per second on Bitcoin. Several startups are taking advantage of the improved Lightening network for cryptographic payment services, such as OpenNode and LastBit.

In addition to progression of regulated stablecoins it can improve the crypto payments industry as people no longer have choices instead of spending volatile crypto assets. In 2020, the European Commission and the G20 officially proposed regulatory initiatives. In October, the People Bank of China (POBC) also started testing its digital yuan by distributing $ 1.5 million to Shenzhen citizens.

Implications for companies in different stages

> Continuous merger of fiat and cryptocurrency into a single product

The PayPal and Square initiative reinforced the trend.

> Crypto exchanges will have more trading customers from “traditional” fintech companies that draw on liquidity

Crypto exchanges are the most direct payee with multiple fintech companies expanding the business in crypto payment. These large fintech clients may be a more important retail market driver for cryptocurrency exchanges. Large companies will have to partner with existing crypto exchanges for liquidity for quite a long time, at least until their buying and selling market becomes large enough. PayPal has partnered with Paxos for liquidity and custodian while Paysafe Group, another leading payment service provider, leveraged Kraken Exchange for cryptocurrency liquidity.

> More peer-to-peer payment

For many decentralized finance (Defi) projects, the target customer base has always been cryptocurrency savvy users. But when it comes to payments that require vast networks of merchants, businesses or startups tapping into the resources of businesses they will have the upper hand. Crypto can further improve peer-to-peer payment (which all existing crypto wallets can do), especially since even in the fiat world, p2p transactions are already on the rise.

> Major fintech companies have partnered with crypto companies offering a large network of merchants

The main advantage of large payment gateways like Visa and Mastercard in this crypto trend is their vast merchant networks. In the past, companies hoping to launch Visa / Mastercard cryptocurrency had to partner with core members, such as PaySafe, Wirecard, and Railsbank, to issue cards. But in 2020, Visa / Master began accepting cryptocurrency companies as core members, showing more openness to cryptocurrencies than before. Coinbase and Wirex each became the top cryptocurrency company among major Visa / Mastercard members respectively this year.

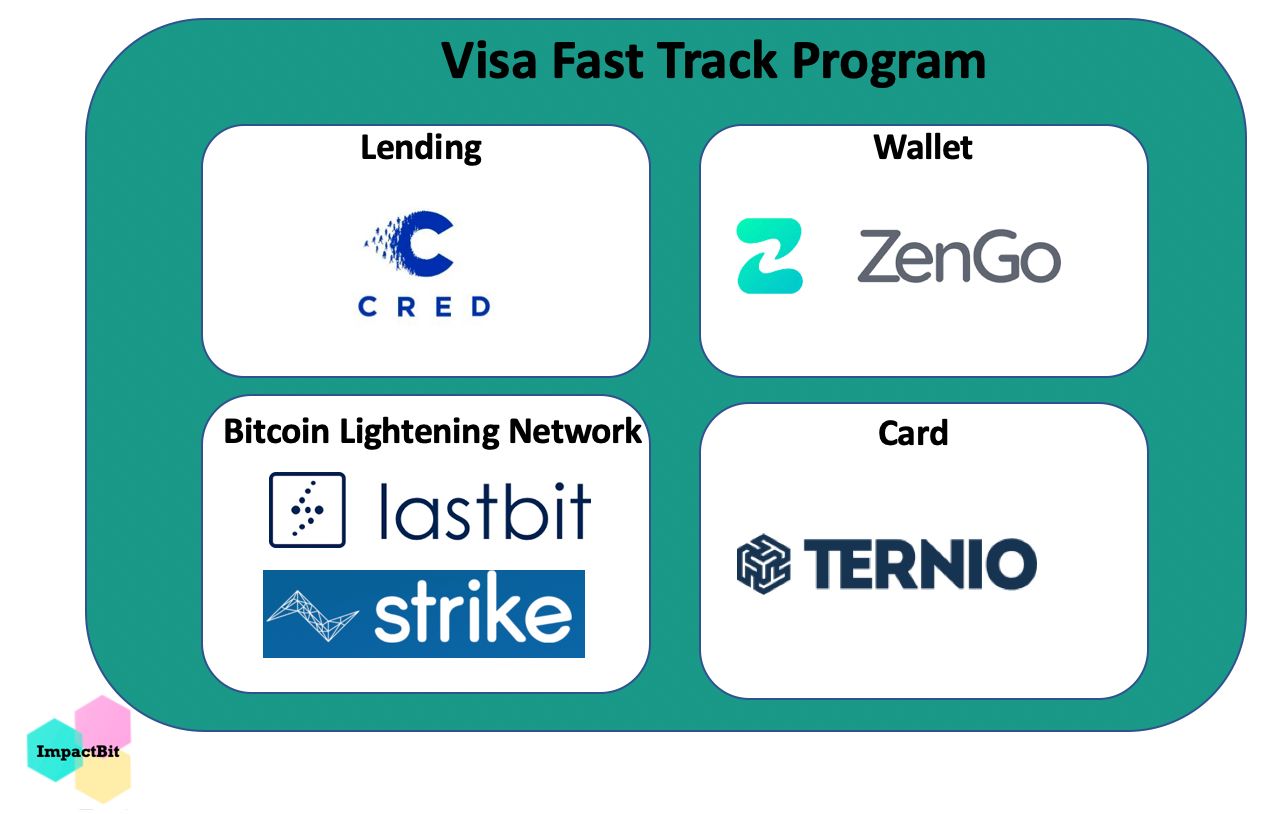

It is worth noting that the Visa Fast Track program has accepted several crypto startups, showing its ambition to tap into crypto startups, including crypto card solutions (Ternio), payment startups leveraging the improved Bitcoin flash network (Strike, LastBit) , digital wallet (Zengo), and crypto loan (Cred). All of these announcements were made in 2020.

Also published on https://medium.com/business-of-crypto-blockchain/the-twain-shall-meet-series-crypto-payment-9f1cdb4f71d

Tag

Create your free account to unlock your personalized reading experience.