[ad_1]

[ad_1]

- The parabolic SAR on the 12-hour chart has moved from bullish to bearish.

- The whales are trying to sell their properties.

Litecoin rebounded from $ 53 on November 4th to $ 64.25 on November 7th. However, the price has since been in a downtrend and appears to be on track to chart a series of lower highs and lows. Let’s take a look at doing some technical and on-chain analysis to predict the future price movement of LTC.

Technical data turns bearish

Litecoin fell from $ 64.25 on November 7 to $ 58 on November 10. This decline prompted the parabolic SAR to move from bullish to bearish. While the last candle jumped to $ 59.65, the overall market momentum remains bearish, as indicated by the MACD.

LTC / USD 12-hour chart

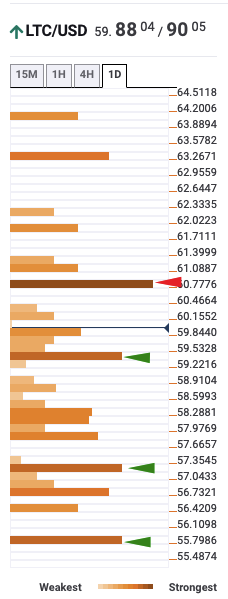

The upside is limited to the $ 61 resistance barrier, which is a solid level as seen in the daily confluence detector. The support walls protect the downside at $ 59.25, $ 57.85 and the 50 bar SMA ($ 55.50). A break below these walls will bring the price up to 200 bar SMA ($ 53.15) and 100 bar SMA ($ 51.20). These levels seem strong enough to absorb any residual selling pressure.

LTC confluence detector

The distribution of the Santiment keepers helps us to see how the whales have behaved. The number of tokens that hold 1,000 to 10,000 tokens dropped from 3,750 on October 5 to 3,649 at the time of writing. Similarly, the number of addresses that hold 10,000 to 100,000 tokens has dropped from 408 to 405 in the past 24 hours.

[07.42.21, 11 Nov, 2020]-637406640385589492.png)

Distribution of LTC holders

Litecoin is currently undergoing major price action. The support walls protect the downside at $ 59.25, $ 57.85 and the 50 bar SMA ($ 55.50). These walls should be strong enough to absorb an enormous amount of sales pressure.

.[ad_2]Source link