[ad_1]

[ad_1]

- Litecoin lost ground above $ 90, adding credibility to the potential free fall at $ 80.

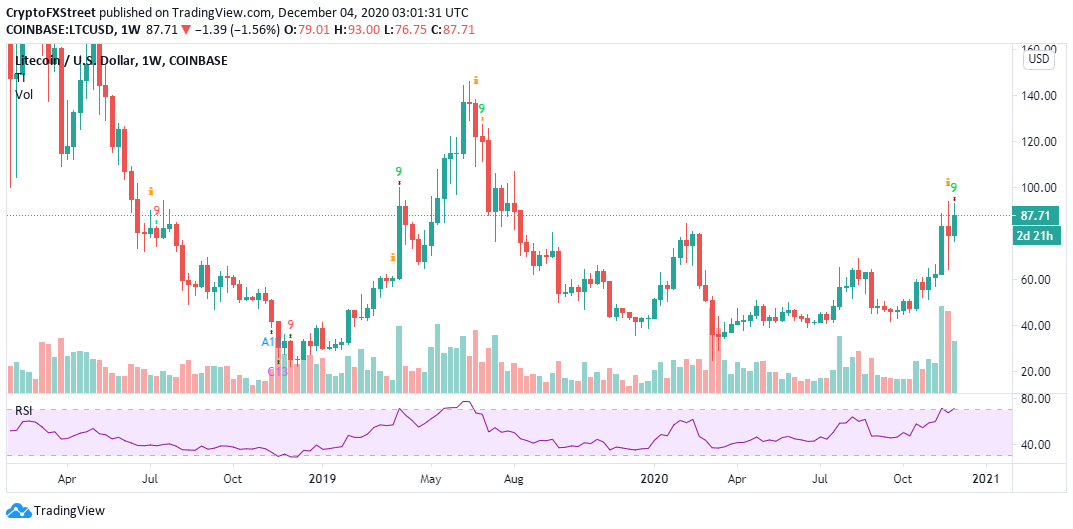

- A sell signal on the weekly chart suggests that correction is almost inevitable before LTC rebounds significantly.

Litecoin refreshed the highs above $ 90 but left the $ 100 unchanged. The inability to sustain the uptrend has led to a drop below $ 90. LTC / USD fluctuates at $ 88 amid bearish signals in favor of losses seeing $ 80.

Litecoin prints a huge bearish picture

LTC dived below the parallel ascending channel on the 4-hour chart. The bearish narrative appears to have been validated by the Relative Strength Index after reaching higher levels within the overbought region, followed by a series of lower highs. This bearish divergence suggests a decrease in the purchase volume and, therefore, the price to fall further.

If Litecoin ended the day below the channel’s lower limit support, sell orders are likely to be triggered, adding weight to the downswing. As a guideline, buyers will try to hold the price at $ 85, but if the bearish pressure increases significantly, the losses could extend below the 100 SMA. Meanwhile, the 50 SMA at $ 80 appears to be the strongest anchor zone. formidable.

%20(14)-637426483450568053.png)

LTC / USD 4-hour chart

The TD sequential indicator presented a sell signal on the weekly chart. The call to sell manifested itself in a green nine candlestick. If validated, Litecoin would dip one to four candles per day. Validation is very likely because most of the previous sell signals have materialized. Furthermore, LTC could take a long downtrend, possibly retest the support at $ 64.

LTC / USD weekly chart

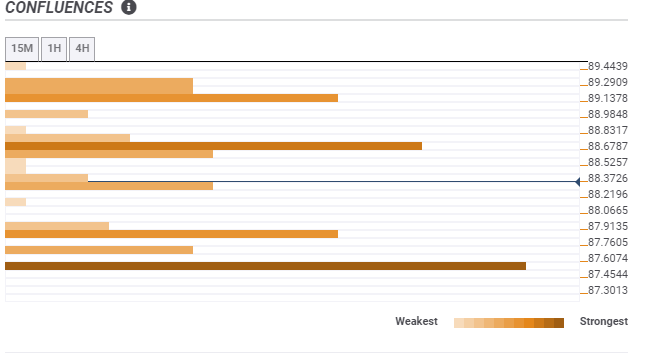

Confluence Detection Tool reveals a solid support area for the sixth largest cryptoasset. Furthermore, the bulls need to ensure that the anchor at $ 87.6, as evidenced by the one-week pivot point resistance, is protected at all costs to avoid losses at $ 80.

LTC / USD Confluence Chart

n to the upside, the confluence tool shows immense resistance that could delay the recovery. The first hurdle stands at $ 88.6 and is home to the 15-minute SMA 50, the 1-hour central Bollinger Band limit and the 15-minute SMA 10. A second resistance holds the ground at $ 89, as illustrated by one day’s Fibonacci 38.2%.

The bearish outlook would be abandoned if Litecoin recovers its position within the ascending channel. Additionally, closing the day above $ 90 would encourage buyers to re-enter the market from the sidelines. A confirmed breakout to $ 100 is likely to push Litecoin into another magnificent rally.

.[ad_2]Source link