[ad_1]

[ad_1]

Last week saw Bitcoin climb new heights with the coin surpassing its $ 18K resistance in an attempt to recreate the historic 2017 rally. At press time, Bitcoin was trading at $ 18,242 with a trading volume of $. 23.1 billion.

Source: CoinStats

In the wake of Bitcoin’s bull run, many altcoins have seen positive gains. However, the upward momentum was not observed uniformly across all altcoins. Coins like LTC have risen more than 34%, however smaller coins like BAT appear to have been stuck in strong side action on prices.

Litecoin [LTC]

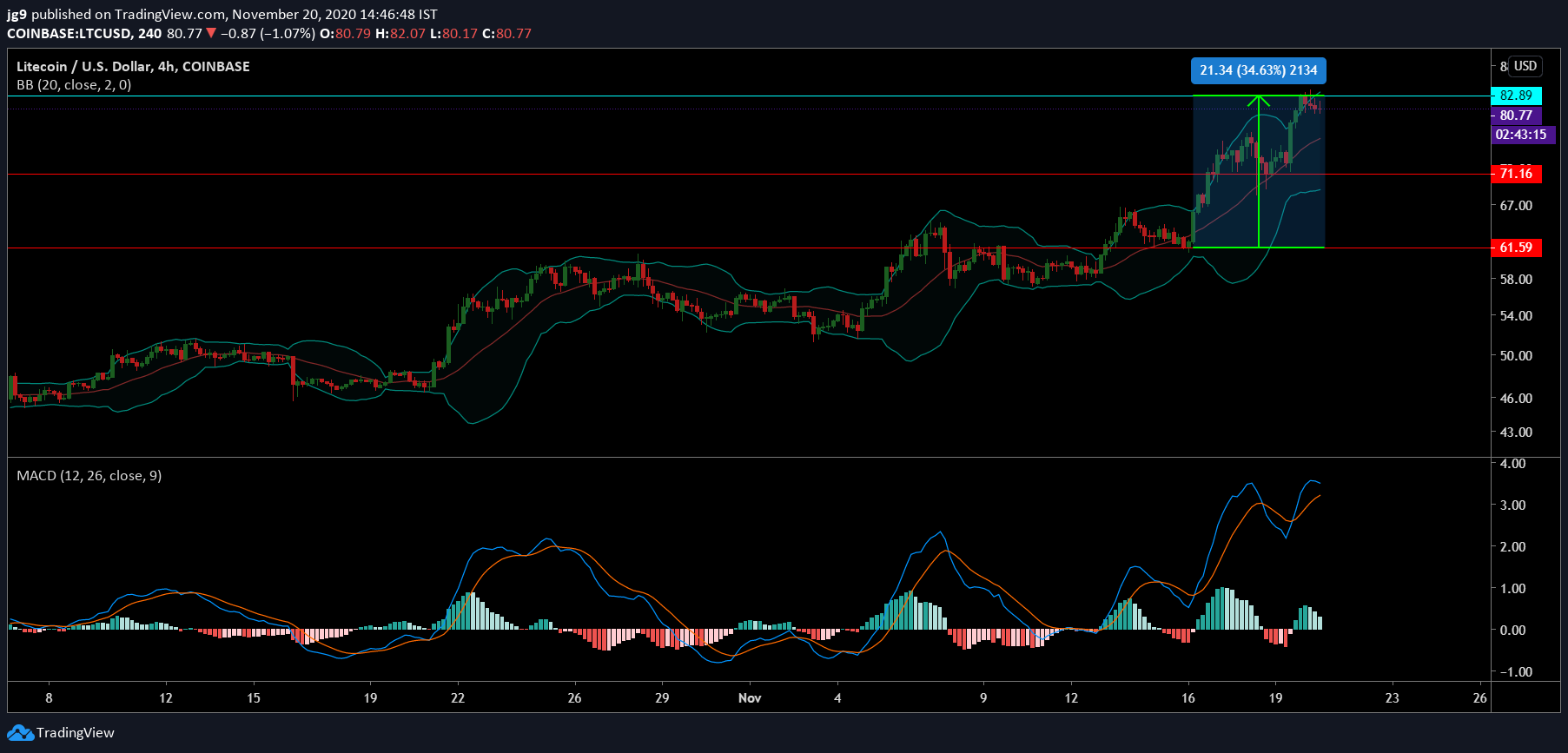

Source: LTC / USD, TradingView

Litecoin ranks sixth in terms of market capitalization, and last week saw its price rise by more than 34%. As of press time, LTC is trading at $ 81.4 with a market cap of $ 5.34 billion. Interestingly, the coin’s price has now made contact with resistance at the $ 82.8 price level. However, should the coin see a decline in the charts then it can rely on the supports at $ 71 and $ 61.5.

The Bollinger bands continue to remain wide enough for the coin, which implies the continued presence of volatility in the coin’s price. The MACD indicator has undergone a bullish crossover and shows no possibility of a short-term reversal.

Currency [XMR]

Source: XMR / USD, TradingView

The price of Monero has risen more than 7% in the past week and is now trading at $ 121.2. The privacy coin now has a market capitalization of $ 2.1 billion, and the price has corrected -1.2% in the past 24 hours. At press time, the coin is close to testing the support at $ 118 and if the bullish momentum continues, it may soon be on its way to trying to break out of the overhead resistance at $ 126.

EMA tapes after stabilizing below the currency’s current trading price are likely to offer support if the coin faces bearish pressure. The MACD indicator has undergone a bearish crossover and signals the likelihood that the correction will continue.

Basic Attention Token [BAT]

Source: BAT / USD, TradingView

BAT is now trading at $ 0.197 with a key resistance level at $ 0.206. The coin is currently testing support at $ 0.195 and has spent the last week consolidating its price between these two levels.

Both the RSI and MACD indicator paint a bearish picture as the former is heading into the oversold zone while the latter has undergone a bearish crossover.