[ad_1]

[ad_1]

The halving was to be Litecoin's bullish catalyst; it wasn't the height of the hype. However, the analysis of the graph shows potential. | Source: Shutterstock

The halving was to be Litecoin's bullish catalyst; it wasn't the height of the hype. However, the analysis of the graph shows potential. | Source: Shutterstock

From the CCN markets: the action on Litecoin's prices has been less than stellar in recent times. After publishing a 2019 high of $ 146 on June 21, the cryptocurrency gave in to strong selling pressure. Today, August 22, Litecoin dropped to $ 70 for a leap of more than 50 percent in two months.

The halving, which was to be the bullish catalyst of the coin, was not at the height of the hype. With no other catalyst in sight, the perspectives of the cryptographic token seem sad. Some traders are already asking for Litecoin to move to even lower levels.

Be careful if $ LTCUSD closes below $ 68, in which case we could see a return to $ 40. We are in a gold pocket right now, which would be an epic bonus zone but still, on average if interested $ LTC. This would be related to my decline $ BTC thesis …#Litecoin pic.twitter.com/6FwtAS1G6A

– Brezcasni (@ludikawboy) 21 August 2019

However, we have taken a closer look at the Litecoin chart and are optimistic about its short-term prospects. We are already seeing signs of what could be a strong bullish insurgency.

Litecoin Trading in key support areas while oversold readings are agitated

A play that worked very well for us is to choose a market from below while trading near a key support area and oversold conditions. The expected relief of selling by oversold signals, in addition to the support level demand often leads to a buying frenzy.

We are witnessing the preparation of these conditions in Litecoin.

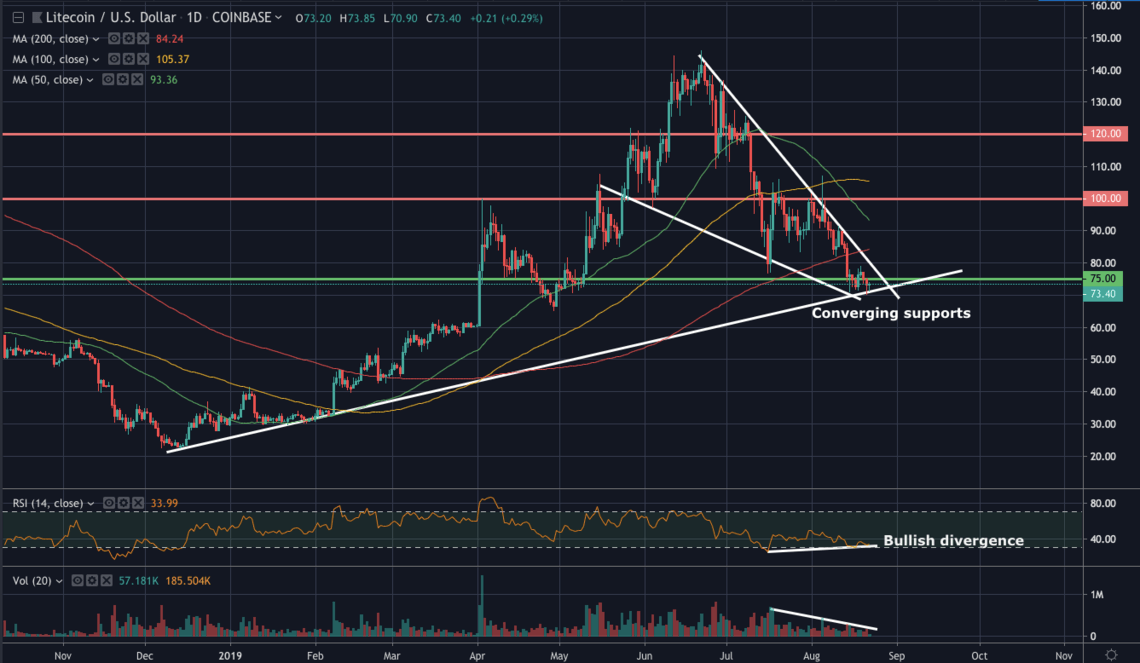

A quick look at the daily chart shows that the price is supported by more media between $ 70- $ 75 as the currency approaches the apex of a falling wedge. Moreover, the momentum is also oscillating on the side of the bulls. The daily RSI is recording a bullish divergence as it trades near the oversold territory. These signals tell us that bears are exhausted while losing interest in selling at current levels.

This position is supported by the decreasing volume. The small volume of recent weeks suggests that sellers are losing ammunition.

Max, also known as Bitcoin Jack, is the main analyst of BravadoTrading. It supports our opinion that Litecoin is due to a rebound.

Max told CCN:

"The decent fall of the wedge with the correct volume scheme with the green support offers a decent long opportunity. The installation I would prefer is the loss of liquidity and the closure above. This would mean a long entry. $ 92 and $ 104 would then be targets with $ 111 and $ 117 to completely close any remaining long positions if you can ride the local corrective rebound trend. "

Ideally, we want Litecoin to come out of the wedge and seal $ 75 for support. If our expectations run out, we can probably see Litecoin rise to $ 100 first and then to $ 120.

Disclaimer: This article is intended for informational purposes only and should not be considered as investment advice.

This article is protected by copyright laws and is owned by CCN Markets.

[ad_2]Source link