[ad_1]

[ad_1]

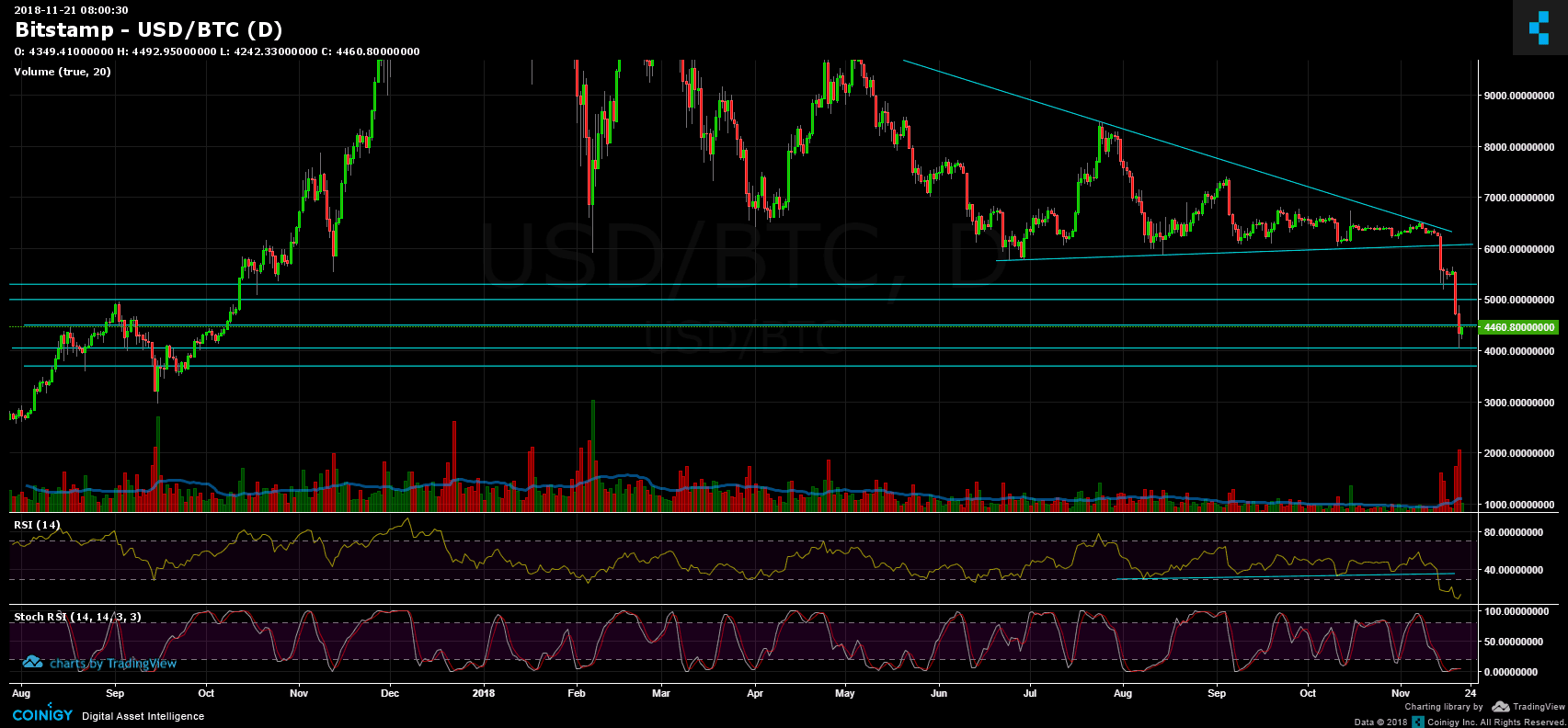

Having reached a maximum of 10,500 Satoshi this week, the Ripple-Bitcoin market has been unstable and trading has shrunk between 9800 – 9500 Satoshi in the medium term.

As against the dollar, the price of Ripple is approaching $ 0.38 as its market structure appears in a bearish formation from the beginning of this month and following the market sentiment.

XRP-USD market

On Wednesday, Ripple recorded a high trading volume of over $ 1.5 billion and a market capitalization of over $ 17.5 billion. Today its trading volume is $ 635 million with a market capitalization of approximately $ 16.5 billion. However, it is still positioned as the largest cryptocurrency number two before Ethereum.

Looking at the 4-hour chart, XRP peaked at $ 0.55 on November 6th. The current price is currently swinging at $ 0.38 horizontal support level (1).

A retracement can trigger with a touch of the above support to test the resistance of $ 0.5 before a rebound. Or perhaps a reversal of the above support trend ($ 0.38) as it further increases resistance levels in an upward trend.

The XRP / USD market, however, remains bearish, following the general environment around Bitcoin during the last week.

Key levels

Resistance: $ 0.50, $ 0.55, $ 0.61 | Support: $ 0.38, $ 0.31, $ 0.25

4-hour XRP / Dollar Chart BitFinex

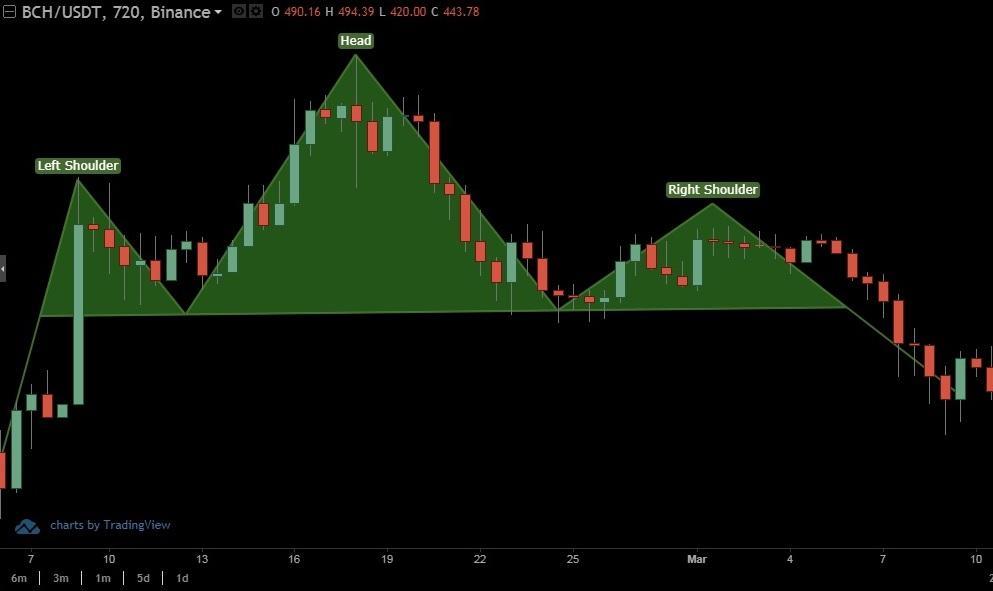

XRP-BTC market

As mentioned before, Ripple did a good job being a cover for the decline of Bitcoins.

Advancing into a lower model, at the peak of 10,500 three days ago. Soon after, a bearish candle that has formed, resulting in consolidation and construction of a sturdy red candle, could send Ripple to a lower level of 8500, 8000 and 7200 levels of SAT support, in the event of a breakdown of the downward trendline at these levels of 9500 Satoshi.

The 4-hour RSI is below the overbought territory: it may signal a decline (a possible trend reversal).

Binance XRP / BTC 4-hour chart

TradingView cryptocurrency charts. Coinigy technical analysis tools.

CryptoPotato video channel

More news for you:

[ad_2]Source link