[ad_1]

[ad_1]

Following the recent news on Ripple and XRP, its management is tightening ties with the Bank of America for a business blockchain to facilitate cross-border transaction (Money Gram and Western Union) among the enthusiasts of the encryption. Asian Bank (CIMB) also shows interest in the adoption of Ripple-economy while preparing its customers to position themselves for a peer-to-peer payment system. However, it is believed that this may have influenced the price increase of Ripple yesterday. Or Ripple (and Stellar) could be a cover for Bitcoin.

XRP-USD market

A few days ago, Ripple exceeded Ethereum's position on market capitalization as the second digital currency; currently trading with a volume of over $ 1.5 billion and a market capitalization of over $ 17.5 billion.

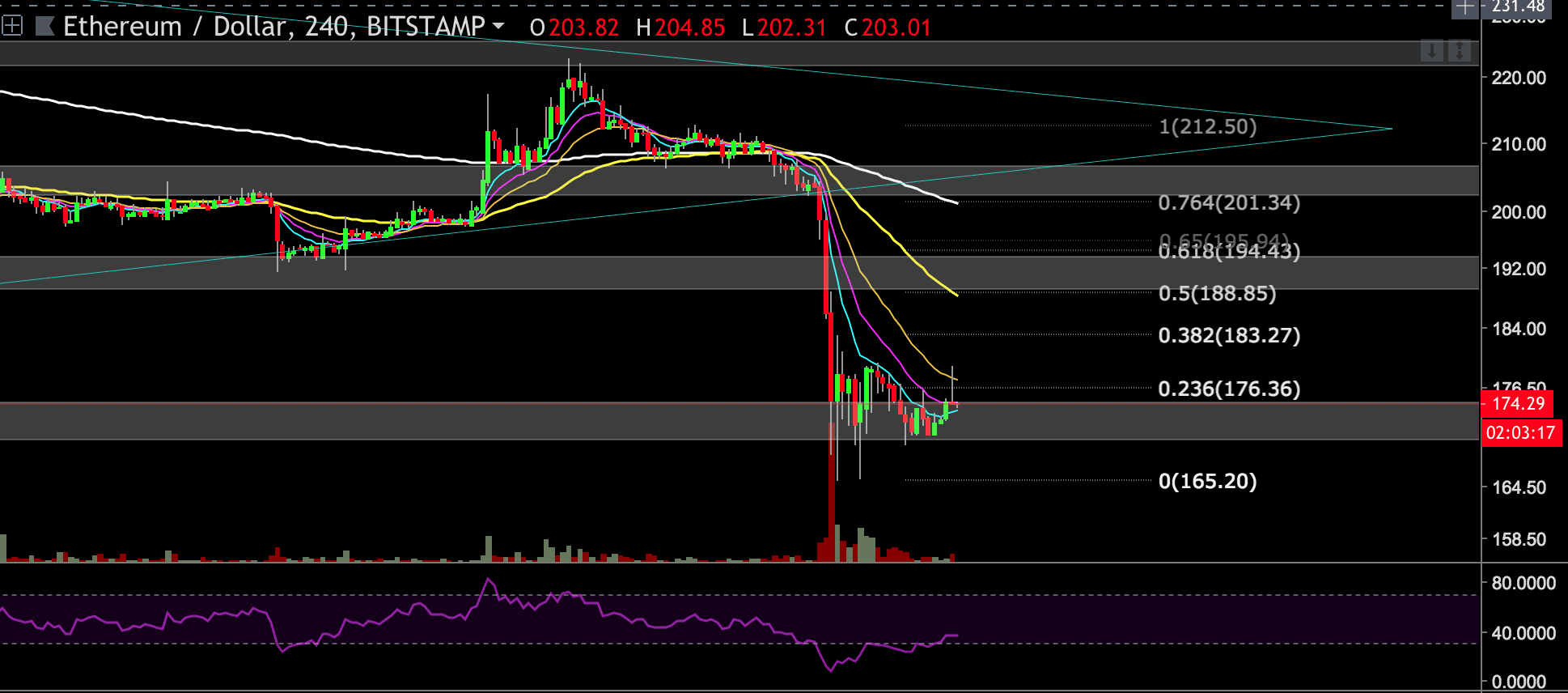

However, the four-hour chart shows trading frequently between the levels of $ 0.53 and $ 0.40, while the general movement is falling. As the price approaches support level 1 ($ 0.40), a retracement can be expected. The correction area is the resistance level 1 ($ 0.49). But in the event that the price breaks the aforementioned support, the next support stands at $ 0.38.

The XRP / USD market, however, remains bearish, following the general environment around Bitcoin during the last week.

Key levels

Resistance levels: $ 0.49, $ 0.52, $ 0.55 | Support levels: $ 0.40, $ 0.38, $ 0.35

4-hour XRP / Dollar Chart BitFinex

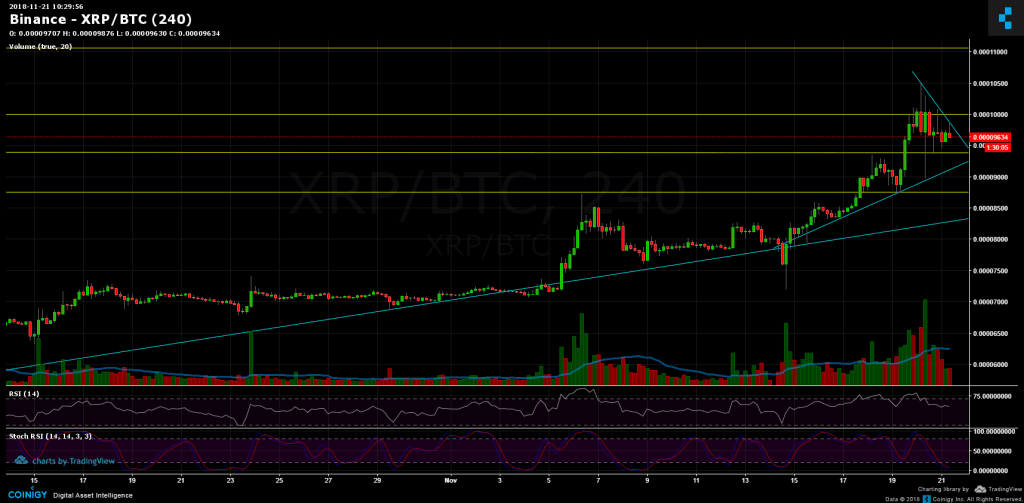

XRP-BTC market

Over the past two days, Ripple has shown that it is currently the best substitute to protect against the free fall of Bitcoin. At its daily peak, it had reached 10,500 brands of Satoshi and quickly retraced the Bitcoin correction.

Looking at the following chart, From above Ripple has a downward trend line to be overcome to remain bullish, ahead of the resistance level of 10,000 Satoshi. Behind it is 11,000 SAT resistance.

From the bear side, Strong support level to 9370 SAT, along with the upward trend line. Breaking the above will send Ripple to test the Satoshi 8760 and 8300 support levels again.

The stochastic RSI is at its lowest levels: it could indicate that the market is oversold (a short-term uptrend sign).

Binance XRP / BTC 4-hour chart

TradingView cryptocurrency charts. Coinigy technical analysis tools.

CryptoPotato video channel

More news for you:

[ad_2]Source link