[ad_1]

[ad_1]

Bitcoin’s price recently broke through the critical $ 18000 level and the weekly gain is now 11.44%. However, Bitcoin’s dominance is still 66%. As the price passed $ 17,000 with no further resistance, the top 10 altcoins by market cap have risen. Weekly returns show gains in 9/10.

Litecoin is leading the rally with weekly gains of 30%. Market capitalization reached a 3-month high of $ 4,484,773,919.08. The previous 3-month high of $ 4,484,739,490.84 was observed on August 20, 2020.

Litecoin market capitalization || Source: Glassnode

Bitcoin’s price correction to $ 17400 after reaching $ 18000 earlier on November 18, 2020, may have paved the way for the altcoin rally. Altcoin number one by market cap – Ethereum has had a bullish week so far and the weekly gain is 6.93%.

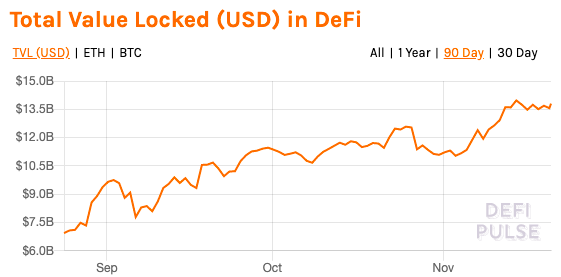

Historically, Ethereum’s correlation with Bitcoin increases during a bullish phase and has subsequently increased. While Bitcoin’s price is going up, Ethereum is making gains. The same goes for DeFi which has a high correlation with Ethereum. Despite its inverse correlation with Bitcoin, major DeFi projects have offered triple-digit gains. Over the past week, AAVE has surpassed 200% earnings, YFI has offered over 83% based on DeFiPusle data. DeFi’s entire TVL has risen 10.6% over the past 30 days.

TVL in DeFi || Source: DeFiPulse

Among the top altcoins, Litecoin has gained momentum since the price hit $ 63. Although considered by many to be the inferior alternative to Bitcoin, Litecoin has enough liquidity and trading volume in spot exchanges to reach the high of $ 138. January 2019. These altcoin gains are reflected in Bitcoin’s market dominance. Analysts in the chain have predicted a correction in Bitcoin’s price as it is currently trading $ 9600 above its fair price. Almost 99% of HODLers are IN profit and booking the profits in tranches can guarantee profits, traders who witnessed the 2017 rally would no longer agree. A small correction in Bitcoin’s price to the current level could further pave the way for Altcoin to climb higher, although the rally may be short-lived.