[ad_1]

[ad_1]

Bitcoin has stolen the show in recent weeks, skyrocketing across various price ranges, to surpass the all-important $ 17,000 which marked an all-time high for its market capitalization. Now $ 19,000 has gone by and excitement is building as memories of 2017’s spectacular ride unnerves investors and long-term holders. Can its 2017 peak of $ 19,783 be surpassed?

While some bearish analysts are expecting a repeat of the spectacular 2018 crypto crash, the consensus appears to be weighted towards the bullish side of the scale. The situation is different from 3 years ago, because cryptocurrencies are no longer simply a toy for retail and amateur investors. There are some major, high-risk entities on board this time around, and that credibility is attracting more of the same.

Ethereum flies

But it’s not just Bitcoin that is enjoying a price hike. In its shadow lie other major cryptocurrencies that investors would do well to look at. The top of the losers is Ethereum, followed by Ripple’s XRP, Litecoin and Chainlink.

Ethereum, sometimes called Ether, is the second largest cryptocurrency by value. It is a decentralized Blockchain with smart contract functionality. The founder of Ethereum is a young Canadian-Russian programmer named Vitalik Buterin.

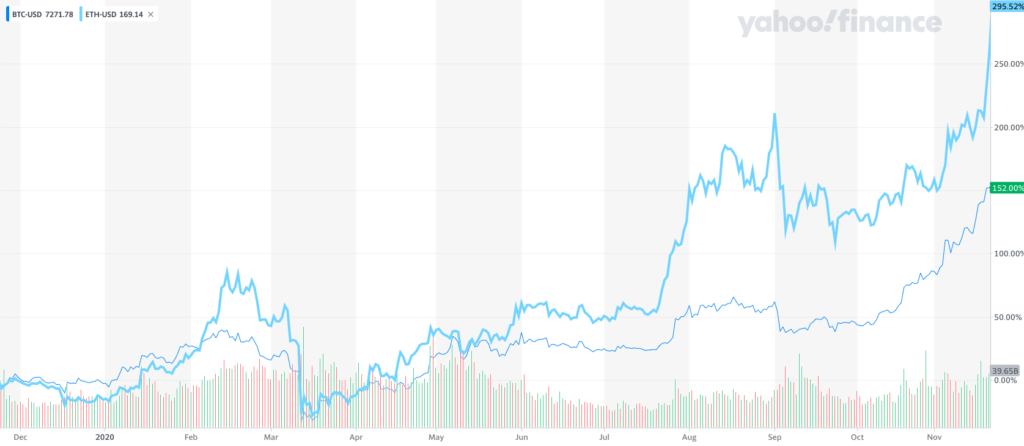

A year ago, Ethereum was trading at $ 144 per coin. It has since risen more than 310% to trade above $ 600 today. By comparison, Bitcoin rose 165% during this period, making Ethereum the current winner of this race. Being a prominent player in the cryptocurrency arena and one of the originals to make it happen, he tends to ride the Bitcoin queues.

Founded in 2013 and launched in 2015, Ethereum’s value lies in its simple yet clever design. It distributes smart contracts and decentralized applications (dapps). This gives the parties involved full transparency avoiding downtime, fraud, control or interference by third parties. This is changing the way many traditional businesses operate. Ultimately, save money, improve credibility, and ensure safety across the board.

A cryptographic revolution

Last year Forbes printed its Blockchain 50 list and 32 of those present had opted for the Ethereum platform. These included JP Morgan (NYSE: JPM), Amazon Web Services (NASDAQ: AMZN), Microsoft Azure (NASDAQ: MSFT), Bnp Paribas (EPA: BNP), BP (LON: BP), Citigroup (NYSE: C), Fidelity is Google (NASDAQ: GOOGL), just to name a few.

With huge companies like these taking it for a ride, this validates blockchain technology and especially Ethereum as a viable network for these projects.

But it’s not just users who give the network more credibility. The reason why cryptocurrency prices are on the rise is the growing interest from institutional investors and private companies. It started earlier this year when MicroStrategy Inc (NASDAQ: MSTR) bought $ 250 million in bitcoin. This was followed by high profile investments from Square Inc (NYSE: SQ) and then PayPal moved to give users the ability to hold cryptocurrencies on its platform. This allows users to pay for goods using encryption without having to convert to the local currency first.

It is being launched in the United States to begin with and will include Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. PayPal uses a cryptocurrency broker-dealer called Paxos’ itBit, which converts cryptocurrencies into fiat. itBit reported a big spike after PayPal launched its crypto options. PayPal’s move clearly resulted in a sharp increase in Bitcoin purchases, most likely Ethereum’s price as well.

Another reason people are getting interested in buying Ethereum is the state of the world. The massive government stimulus continues and people are increasingly concerned about where it might lead. Debt cannot go away on its own and the growing likelihood of inflation is worrying. There is also a growing distrust of authority, reinforced by the various ways governments have dealt with the pandemic, as well as the controversies surrounding the US presidential election.

Can Ethereum Beat Its Previous High?

Ethereum’s highest price came in December 2017, when it hit $ 1433. Today it is hovering around $ 600, so it has a way to go up. However, with the likely volatility continuing to see the year out, it seems increasingly likely that this Ethereum rally will continue into 2021.

Bitcoin’s current market cap of $ 352 billion has surpassed Mastercard’s (NYSE: MA) $ 328 billion. Meanwhile, Ethereum’s market cap is $ 68 billion, which beats General Motors at $ 60 billion.

BlackRock’s Chief Investment Officer said Bitcoin could potentially replace gold. This is a statement, because gold has a market capitalization of around $ 9 trillion.

Meanwhile, ARK Invest’s Cathie Wood also said “If all institutions allotted a similar average-figure allocation to Bitcoin, the cryptocurrency could rise somewhere in the $ 400,000 to $ 500,000 range.”. There will be many very wealthy individuals if Bitcoin reaches $ 500,000 and Ethereum follows in its footsteps!

In five years, Ethereum is rapidly developing into an altcoin with decent investment strength and quality. With more credible investors jumping aboard the cryptocurrency gravy train, the dizzying heights of $ 1500 per coin could be hit by Ethereum. It is an exciting space to invest in and a dramatic investment area to watch.