[ad_1]

[ad_1]

Technical analysis is a forecasting method which makes use of an existing market data to predict future market behavior. Technical analysts make use of the forces of supply and demand to make their predictions. This analysis can be done in the form of a chart, makes it possible for experienced players in the market to predict when a particular cryptocurrency value will rise or fall, making them take actions in regard to buying and selling.

To understand technical analysis, you need to understand the following technical analysis:

- Market fluctuations reflect all known information. They have been integrated into the current price.

- Price movement follows a trend. Although there are certain times when prices move randomly, they usually move according to a pattern at a particular period, making it possible to make a chart and predict future behavior. The chart makes it possible to predict when the market will be bullish or bearish. If they are predicted to be correct and properly utilized, they will be invested in the period in which they are expected to have a higher value. The coin value, of course, is controlled by the laws of supply and demand so you know that when the market is bullish, sales will increase This will eventually lead to the market. In the cryptocurrency world, this could happen within an hour or even a few minutes.

- History repeats itself. It is possible for technical analysts to easily predict the market behavior by studying how humans react to the same conditions in the past. Human behaviors are very predictable, and technical analysts use this to their advantage.

Let's look at the technical analysis of cryptocurrency trading and how it can be used to our advantage.

Technical analysis of cryptocurrencies is done by statistical and oscillators.

1. Look for quick results

Technical analysis focuses on a short period of time, as short as a month or a few hours. You should, therefore, act as quickly as possible.

2. Study charts to determine price trend

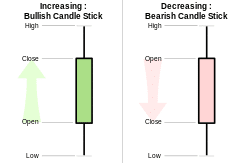

This is done by understanding how the candlestick works. Candlesticks are the green and red bars coming out of them, making them look like a candlestick. The rectangle of the candlestick shows the opening and closing price of the coin for the day. If it is green, the basis of the rectangle appears at the opening price. This is good news because this indicates that your coin value has gone up that period. If the rectangle is red, the top indicates the opening value. This means that the coin went down during that period. The wicks on the rectangles indicated the highest and lowest peak of the coin for that day. The price can be higher or lower than the opening or closing figures.

3. Understand how volume works

If you are interested in buying and selling, you have seen the period of time in the future. If the volume of trade increases as a price, that will be a good time to buy more coins in anticipation that the trend will continue. I know this, if you're thinking of selling, you should think again. But when the volume increases only slightly, then there is not much conviction and prices may start to fall in no time, so you may consider selling during this period.

4. Trading based on the trend

We can learn how to take notes of technical analysis, we should learn how to do we

While doing technical analysis, you need to study the trend over time. As a technical analysis, it is for people who want to make gains within a short time interval, we will use a short-term study of the trend as an example. , Say two weeks ago, and the candlestick at that point is your starting point. If the candlestick is red, which shows a negative point for that day. If the trend is positive. If the trend is positive in this case, the wicks of the succeeding days after the starting day should be low. If this is the case, then there is an upward trend. Otherwise, it's a downward trend.

If a green candlestick is our starting point, we will take note of the peak of its wick. For the succeeding days, the wicks have to be longer than the beginning of the trend to be called an upward trend. Otherwise, the trend is a downward trend.

Understanding this trend tells you the right to take actions. You should look more into buying on the upward trend and selling on the downward trend.

Our timeframe is, however, a very short period to make the best analysis since there will be frequent fluctuations during this short period. Thus, the longer the timeframe, the more accurate the analysis. An analysis taken to make a better decision than one done for a month.

Now that we have a basic knowledge of what is technical, it's about you, and most of all it's important to you. Once you feel you've gained more knowledge, practice. You can not be good with technical analysis if you do not practice.

You can learn more about technical analysis and cryptocurrency on trybe.one.

It is important to note which